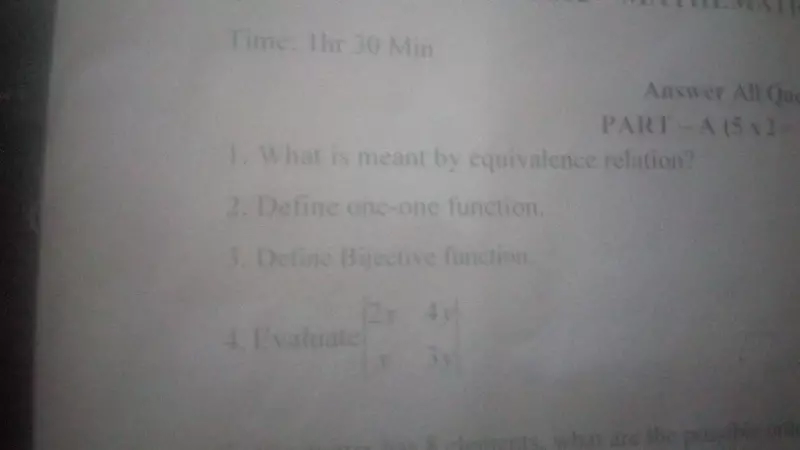

Question

Accounts Tax GST

Dec. 29, 2020, 5:17 p.m.

Answer

Dec. 29, 2020, 5:17 p.m.

Answer

1. ___________ is a sequence of instructions that work based on the inputs provided.

Where will the hand of s clock stop if it starts at 3 and makes 1/4 of a revolution

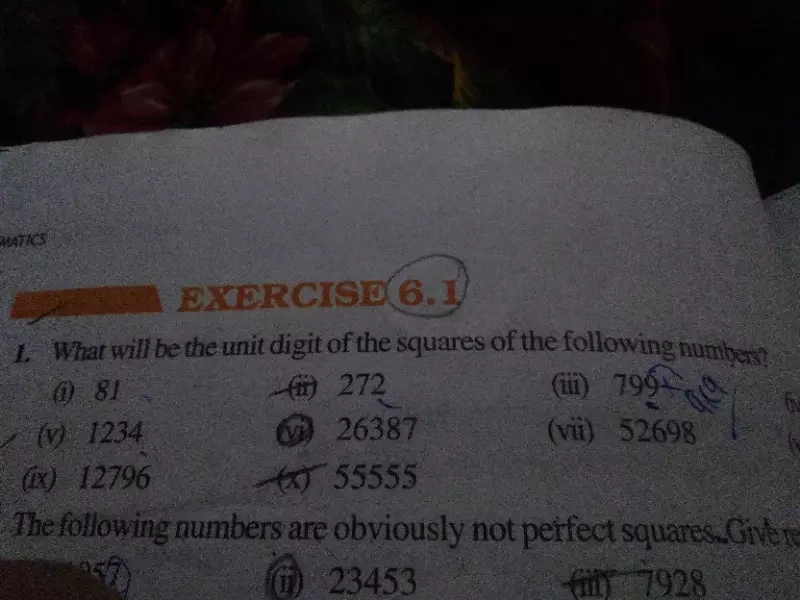

Maths

Dec. 29, 2020, 2:02 p.m.

Answer

Dec. 29, 2020, 2:02 p.m.

Answer

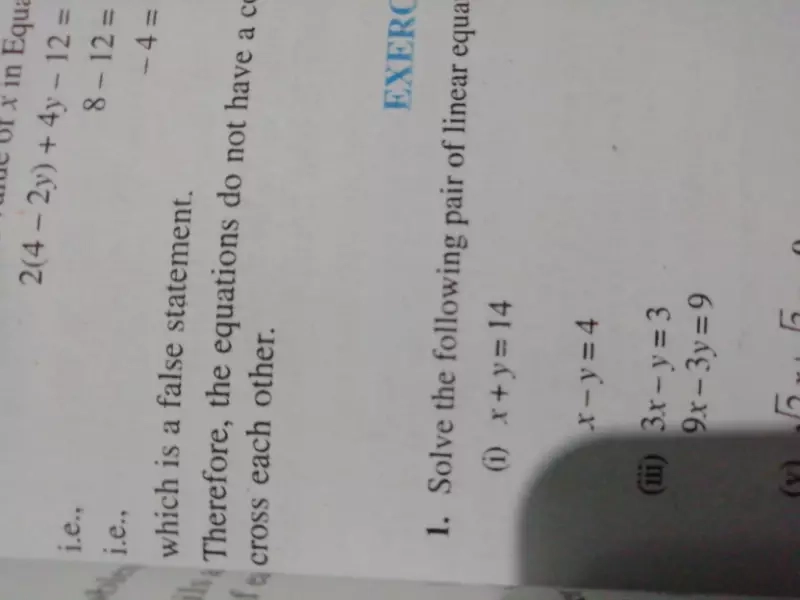

AB is a line segment and line L is its perpendicular bisector. If a point p lines on L ,show that pi's equidistant from A and B