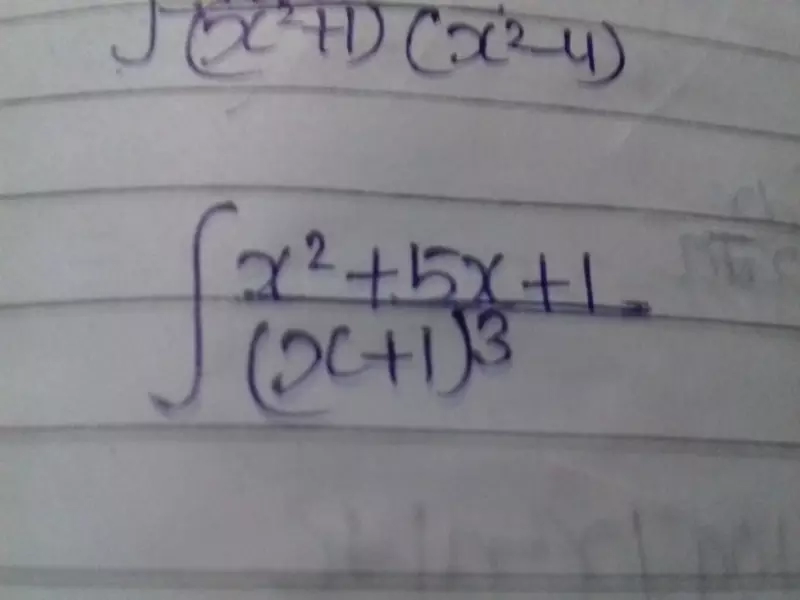

give its solution fast

give its solution fast

Question

Dear Sir,

I provide Professional technical training services across States. I am an Engineer based out of Bangalore in Karnataka.

I travel to my client sites in multiple states for 3-4 days, provide the training and come back to Bangalore.

What type of GST registration should I have, and what type of GST Tax should I pay ?

Thanks & Regards, Vinay

My business is transportation. And i have a 3 branches with diffrent states. Tell me what i do. Can i work with one registration

Sir,

If we purchase vehicle on and EMI is paying. What is the journal entry

Dear sir due to mistake in gstr 3b of July itc (igst input) of Rs.163000/- not filled in gstr 3b and tax liability standing so what I do for this mistake because revise option not show in gstr 3b so please suggest me solution

Metallic sphere s of radius 6 CMS,8cms and 10cms respectively are melted to form a single solid sphere.find the radius of the resulting sphere.

Hi Sir,

Couldyou please let me know what is fixed assets accounting?

Thanks

Ali