Express the matrix 3 2 5 as the sum of symmetri

4 1 3

0 6 7

Question

Maths

May 4, 2021, 6:51 p.m.

Answer

May 4, 2021, 6:51 p.m.

Answer

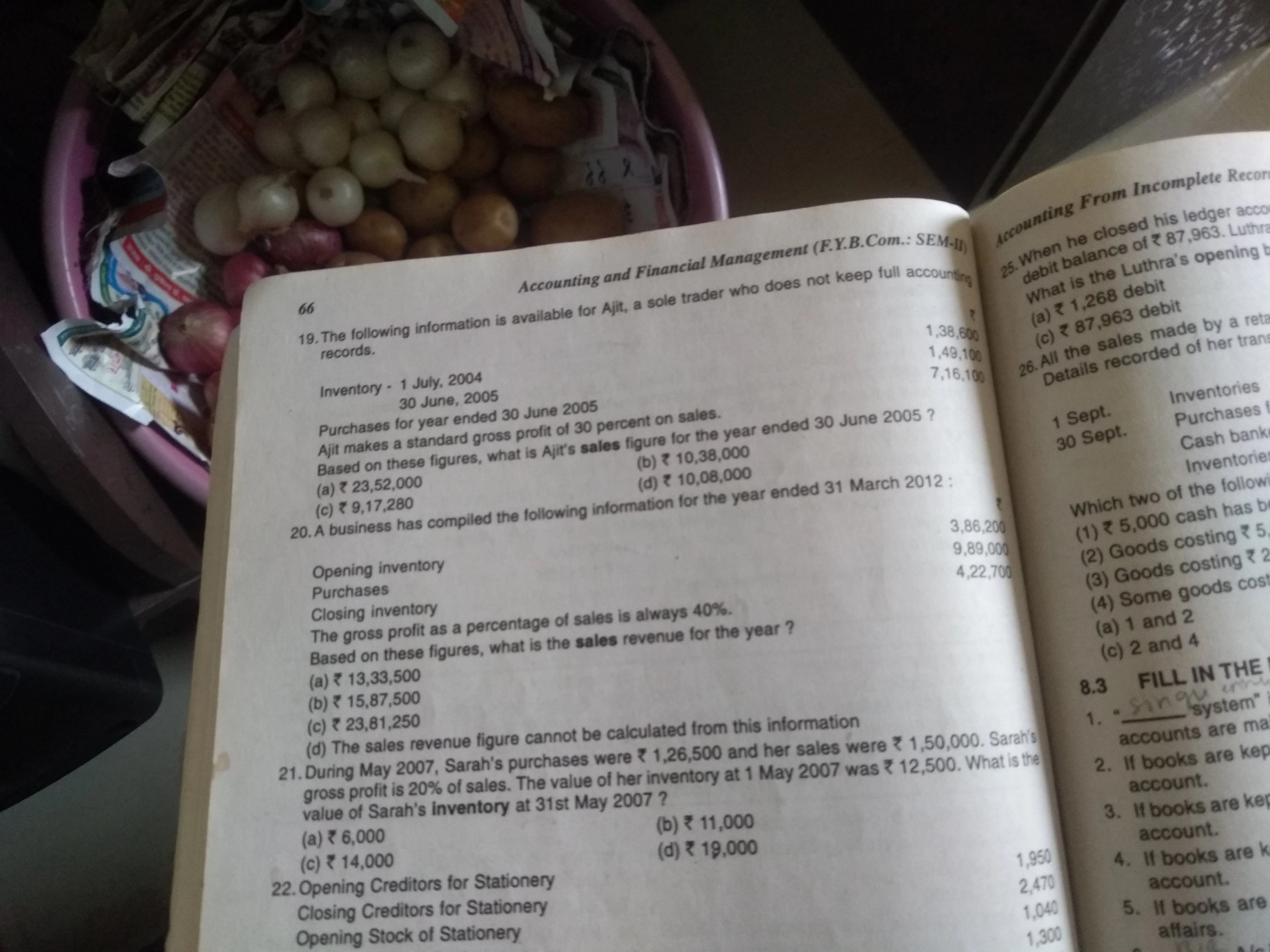

Express the following in the form of p by q where p and q are integers not to equal to zero

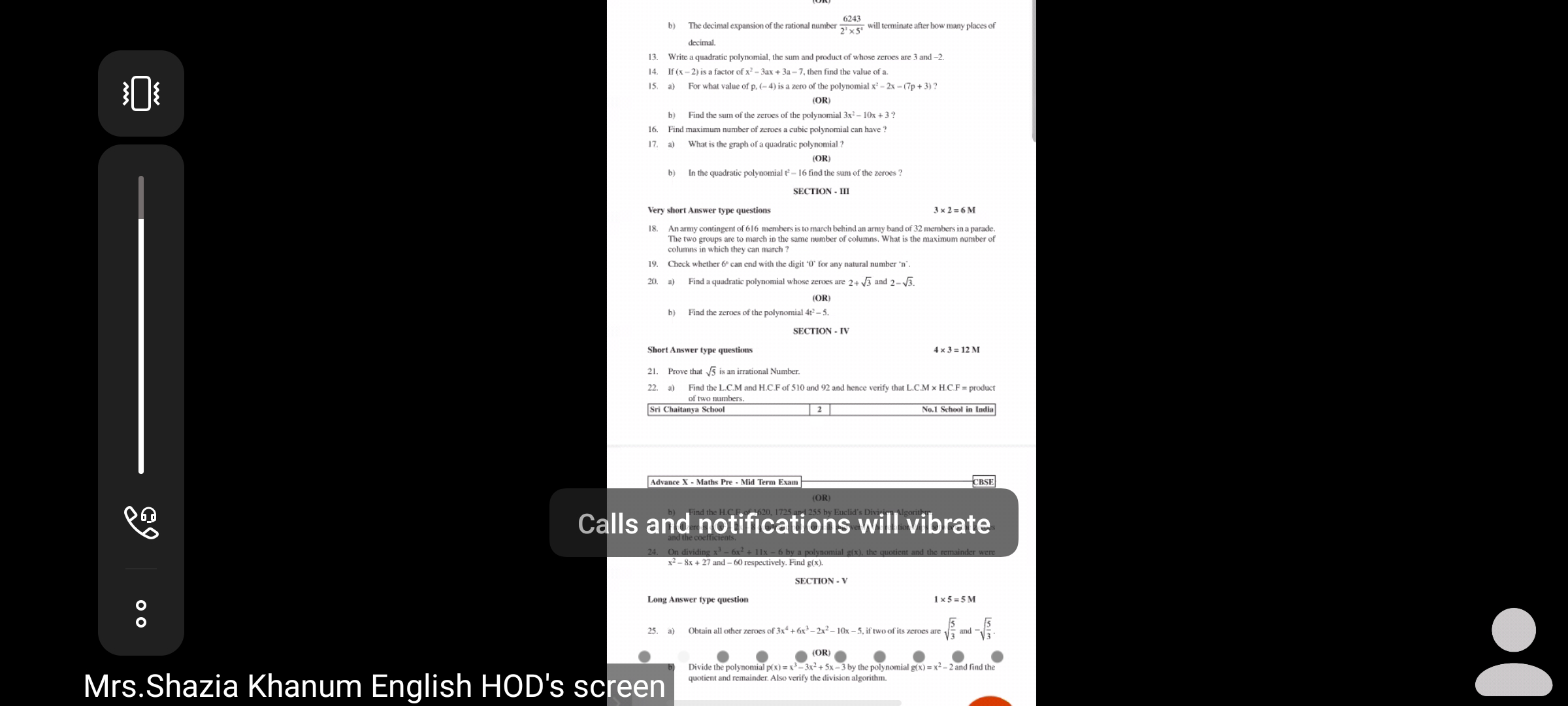

Please solve: Find all the zeroes of x4-3x3-x2+9x-6, if you know that two zeroes are -root3 and root3