in figure AB||DC ,AD=4cm,BE perpendicular to DF ,be=3cm ,then area of triangle ABC is

Question

Without performing division ,state whether the following rational numbers will have a terminating decimal form or a non terminating, repeating decimal form.11/12,9/15,36/100.

If P is any point equidistant from the end points of given line segment then prove that P is on perpendicular bisector of that line segment

Median of an ungrouped data 13,10,12,18,17,p is observed as 14. Find p by giving reasons

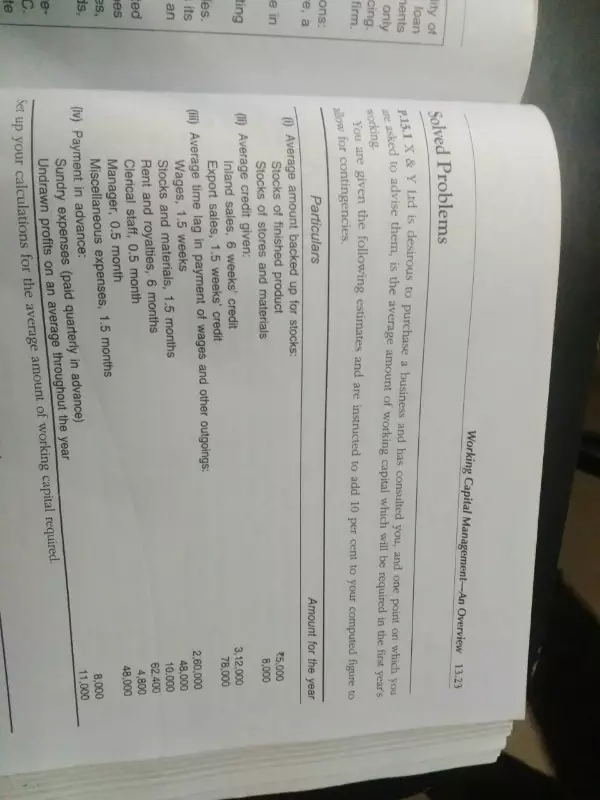

The plan for a new housing development call for the construction of a large number of residential homes. A marketing expert tells the owner that because of the poor location of development, 20 of the houses which are sold will be sold at a loss. A financial consultant asserts 10% of the houses will be sold at a loss. The building contractor states that only 5%of the houses will be sold at a loss.

a. If the owner feels that the market consultant is 5 times as reliable as the building contractor and the financial consultant is 4 times as reliable as the building contractor, what prior probabilities should the owner assign to this Percentages?

b. If 8 houses are actually built and sold, and 2 of the houses are sold at a loss, what prosterior probabilities should the owner assign to the 3 Percentages?