HOW TO CHANGE VEHICLE NO IN E WAY BILL 01

Question

Dear Sir,

- If we want to take credit for office expenses(registered under gst), how can we claim ITC and is there any limit for expenses on which we claim ITC??

- Or sir jo office expenses hote h like salary, rent, printing n stationery etc. ye to hm annual basis p record krte h fr hm in expenses pr ITC kaise claim kre or kb claim kre GTR-1,GSTR-2, GSTR-3 m ya annual return m??

- Or sir in expenses ka invoice kiske naam p raise krenge?

Thank You

Accounts Tax GST

Sept. 14, 2017, 10:31 a.m.

Answer

Sept. 14, 2017, 10:31 a.m.

Answer

Sir jab ham vat tax lagate to vat ka voucher entry me tax nahi kat ta hai sir

Regards

Vinay kumar

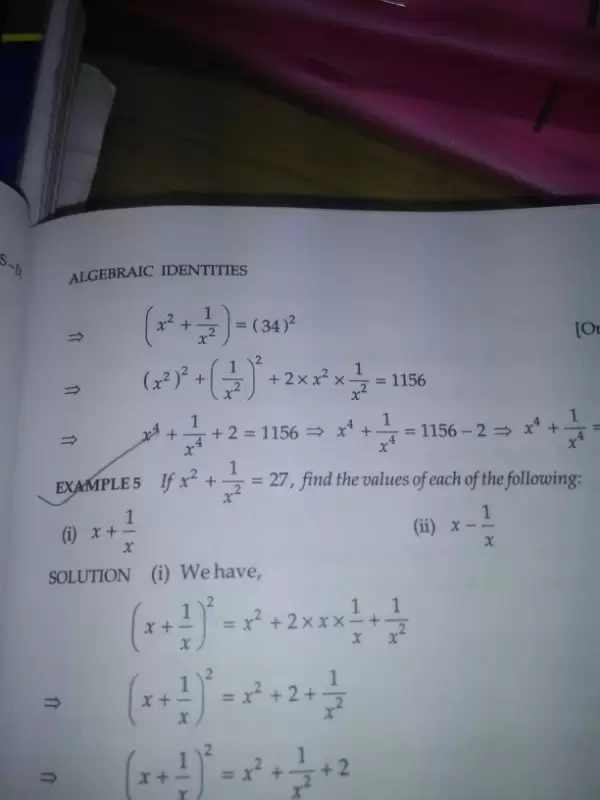

If the remainder on division of x3 + 2x2 + kx + 3 by x – 3 is 21, find the quotient and the value of k. Hence, find the zeroes of the cubic polynomial x3 + 2x2 + kx – 18

iam having input tax of igst shall i that tax amount in cgst and sgst

If sum of two no. is 28 then find the no. If second is double of the first no.

What is allows tally to import data from other software as well as export data from Tally?

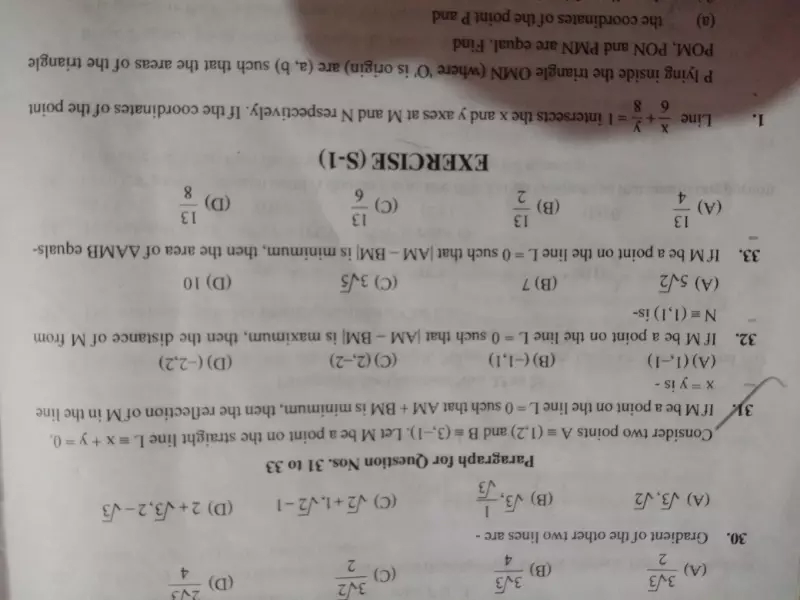

Ques no. 32 and 33

Ques no. 32 and 33