Question

Accounts Tax GST

Aug. 4, 2017, 2:59 p.m.

Answer

Aug. 4, 2017, 2:59 p.m.

Answer

HELLO SIR,

what is suspense account what is the proceedure in tally for suspense account ?

how to generate a rent tax invoice for my tenants with invoice number and other details

Sir I don't know anything about taxation, so I want to purchase a book,

Jisme direct aur indirect tax dono ho,

Indirect tax me gst,

And direct tax, tds,income tax and services Tax,

Ye sab Hindi and English language me hona chahiye is there any book.

Jisme direct aur indirect tax dono ho,

Indirect tax me gst,

And direct tax, tds,income tax and services Tax,

Ye sab Hindi and English language me hona chahiye is there any book.

I am running electrical product service center we need to provide invoice to customer for

1 Repair service charges (HSN Code? GST Rate?)

2 Parts charges (HSN Code? GST Rate?)

Please send bill formats for the both

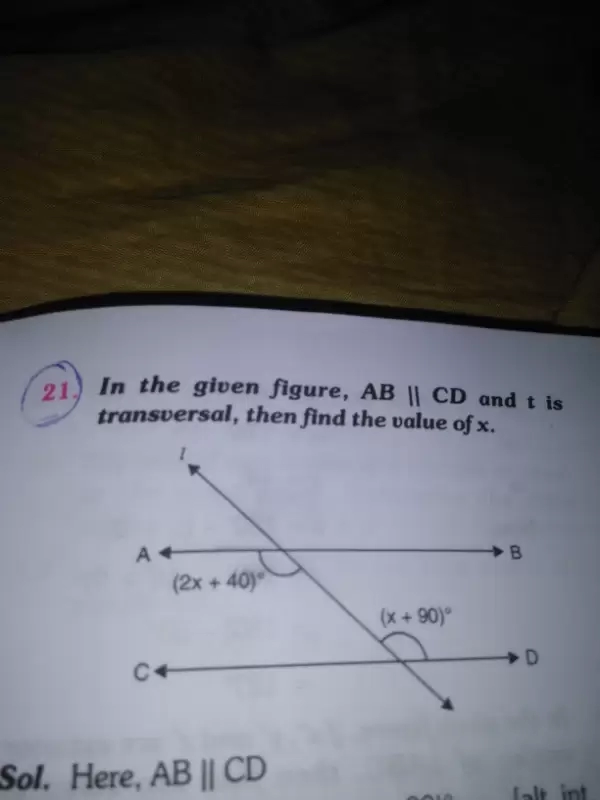

Sir plz solve this sum that was give modules and argument of 1-cosØ +sinØ

Accounts Tax GST

Aug. 3, 2017, 7:25 p.m.

Answer

Aug. 3, 2017, 7:25 p.m.

Answer

How we solve the equation given in solution of exercise 7.5 question 3