Question

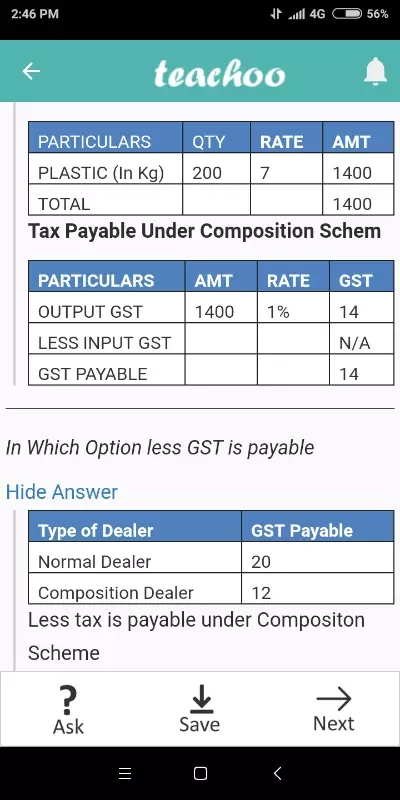

Accounts Tax GST

May 27, 2018, 1:12 p.m.

Answer

May 27, 2018, 1:12 p.m.

Answer

HSN Code for Events, Exhibitions, Conventions And Trade Shows Organisation And Assistance Services

An Ap consist 50 terms of which is 12 and the last term is 106 find the 29th term

GST paid is Rs 14 why have u taken Rs 12 as GST paid

GST paid is Rs 14 why have u taken Rs 12 as GST paid number line

number line