What is the formula of triangle

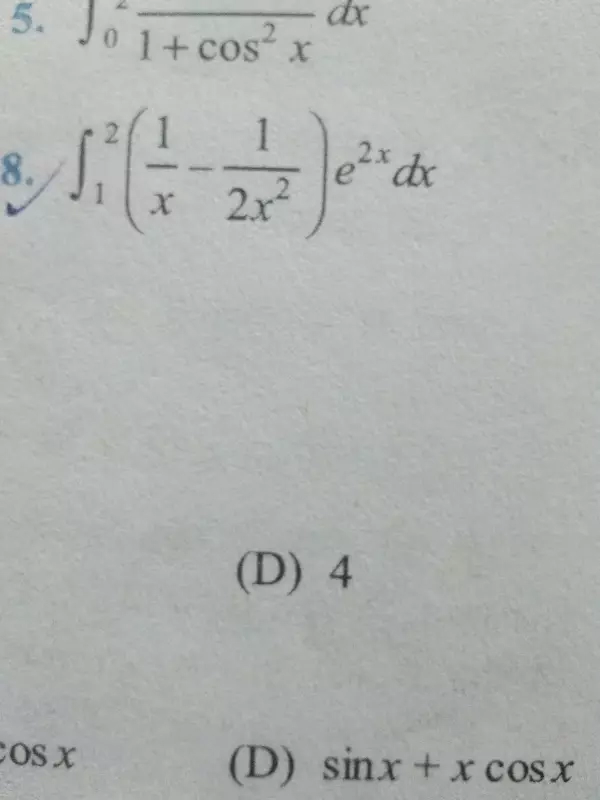

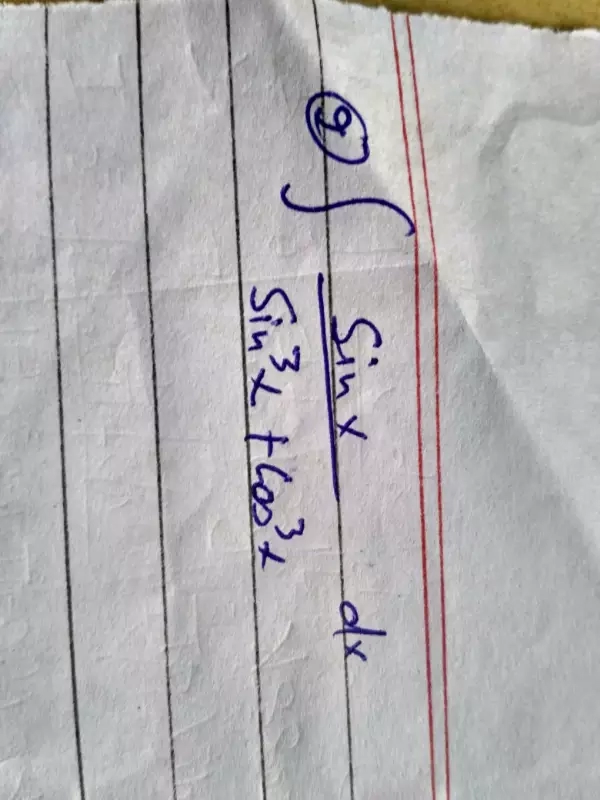

Question

The floor of the rectangular hall has a perimeter 320m, if the height is 12m find the cost of painting its 4 wall at the rate of rs 12 per sq m

In the given figure,AB||CD. The line segments BC and AD intersect at point O. Show that z=x y