find the value of k if the three points (k,2-2k),(-k+1,2k),(-4-k,6-2k) are collinear

Question

there is a box containing 30 bulbs of which 5 are defective.if2 bulbs are chosen at random from the box in succession without replacing the first, what is the probability that both the bulbs are defective?

A point on D is on the side BC of an equilateral triangle ABC such that DC=1/4 BC . prove that AD²=13 BC²

Dear sir,

Please help me ,

I am a online exporter,

need to know is there any IGST ON,

SELLING ONLINE EXPORTS,

ON COMMISSION LISTING CHARGES TO A PLATFORM WHICH IS BASED ABROAD,

ALSO IS THERE ANY IGST WHEN WE PAY TO PAYPAL FOR THERE VARIOUS SERVICES,

THANKS FOR YOUR HELP

if the two vertices of an equilateral triangle be (0,0)&(3,√3) find the third vertices

Maths

Aug. 28, 2017, 3:34 p.m.

Answer

Aug. 28, 2017, 3:34 p.m.

Answer

Hey tell me how 1=Cot^2 A Cosec^2 A

Plz answer fast tomorrow is my exams

Plz answer fast tomorrow is my exams

Dear sir,

1. How to prepare the MIS of a Sweet shop.

2. Guidelines for ERP Implementation.

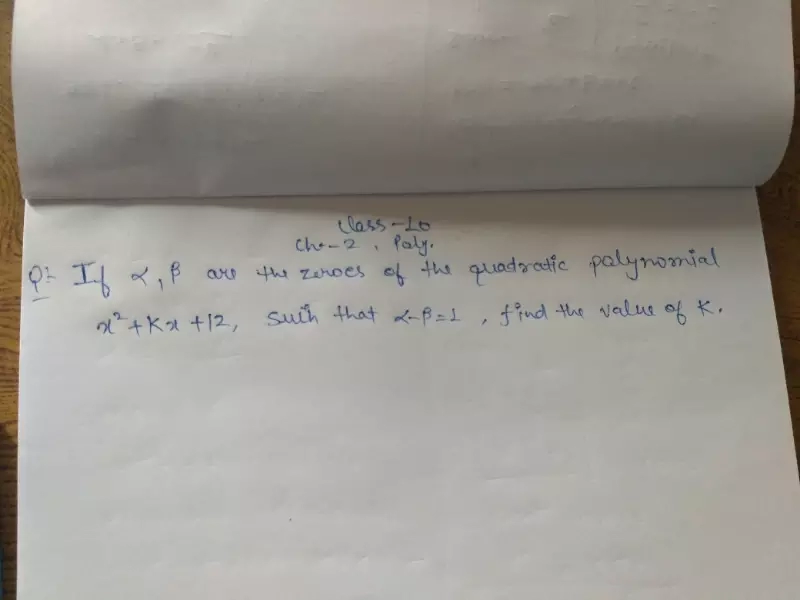

sir how to find the value of k?

sir how to find the value of k?