I DO PAYMENT OF SALARIES UNDER A LABOUR CONTRACTOR OF DIFFERENT CONTRACTS HANDLED, PLEASE GUIDE ME HOW I DO ENTRIES IN TALLY ERP 9 FOR THE SAME AS PER D BANK STATEMENTS.

Question

What is used to criterion of consistency I.e for consistent performance

TWO COMPUTERS A AND B TO BE MARKETED . A SALESMAN WHO IS ASSINED THE JOB TO FIND CUSTOMERS FOR THEM HAS 60% AND 40% CHANCES RESPECTIVELY OF SUCCEEDING IN CASE OF COMPUTER IN CASE OF COMPUTER A AND B.THE COMPUTERS CAN BE SOLD INDEPENDENTLY .GIVEN THAT HE WAS ABLE TO SELL AT LEAST ONE COMPUTER ,WHAT IS THE PROBABILITY THAT COMPUTER A HAS BEEN SOLD?

How can exporter purchase goods without paying GST, as in VAT goods where purchased against Form H

If there is sale from business to retail customer who is not having GST no, what type of bill will be issued and what is the maximum limit for cash bill for unregistered customer

How to cross verify bills of other party and our party bills and find out differnce

Sir, government ke niyamanusar 20 lakh se upar turn over pe gst lagega,

Housing society k maintenance charges pe government ne Kaha h ki 5000per month maintenance charges pe koi gst nahi lekin,

5000, k upar pe gst 18% applicable hoga,

Mai ek housing society me Accountant post pe kaam Kar raha hun confuse ho gaya hun ki Agar government k first niyamanusar gst return dena hoga wahi Dusra niyam k mutabik hamara turn over 1 crore 20 lakh ka h.

Aur maintenance charges 2500per month.

Housing society k maintenance charges pe government ne Kaha h ki 5000per month maintenance charges pe koi gst nahi lekin,

5000, k upar pe gst 18% applicable hoga,

Mai ek housing society me Accountant post pe kaam Kar raha hun confuse ho gaya hun ki Agar government k first niyamanusar gst return dena hoga wahi Dusra niyam k mutabik hamara turn over 1 crore 20 lakh ka h.

Aur maintenance charges 2500per month.

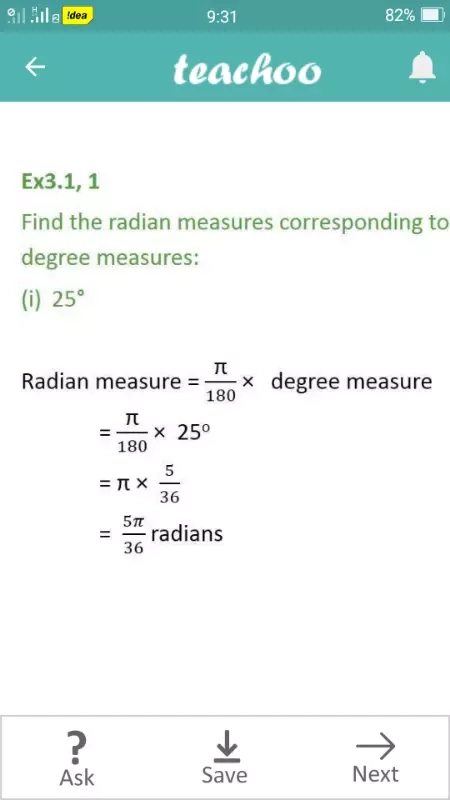

π\180.25degree how it's become π.5/36

π\180.25degree how it's become π.5/36