please solve 3&4 questions

please solve 3&4 questions

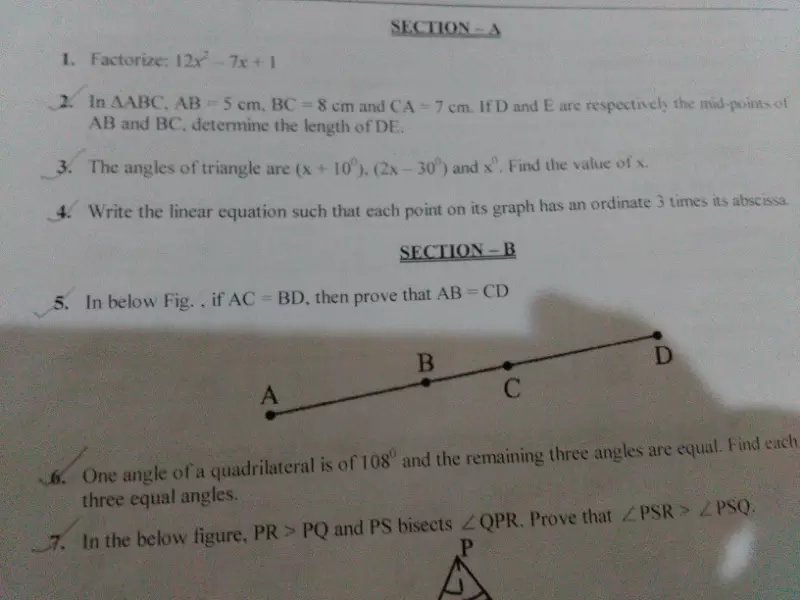

Question

Want the extra q/a of the prose keeping it from Harold ,a prose cane class9

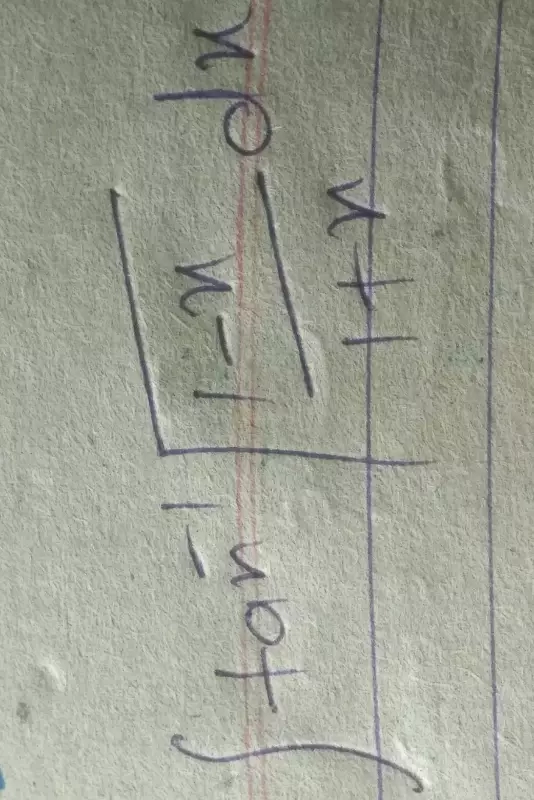

Find the summation of the first n term 1+(1+4)+(1+4+7)+(1+4+7+10)+....

in the figure, ba perpendicular to ac, de perpendicular to df such that ba = de and bf = ec. show that triangle abc is congruent to triangle def.

Maths

Oct. 3, 2017, 10:53 p.m.

Answer

Oct. 3, 2017, 10:53 p.m.

Answer

Can you also provide such another subject app? I like it very much .It gives perfect answer for all questions