Question

i am registered dealer, works contract given to unregistered parties some of them working at their premises and some of them working at my premises. my question is, whether i am entitled to claim refund rcm amount? for leather industries, works contract rate 5% or 18% please advise. my email is [email protected]

vlookup with multiply sheet

according to interview

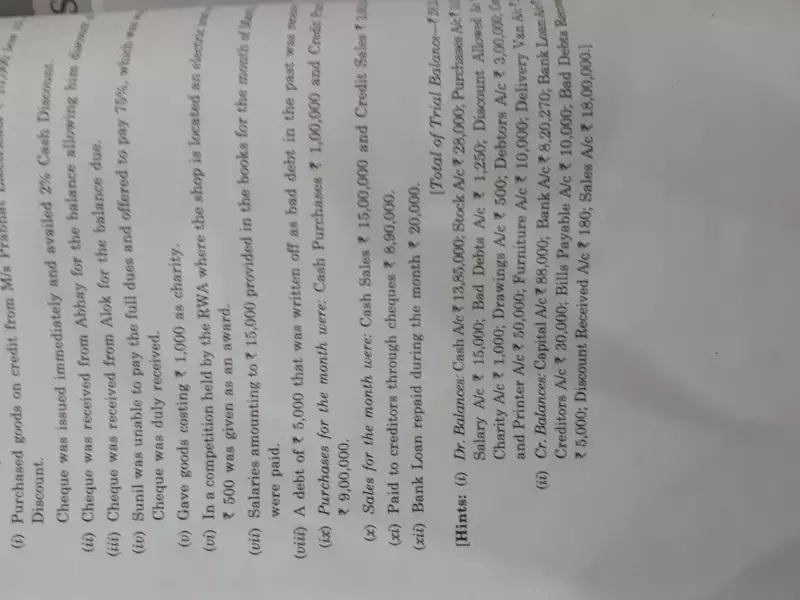

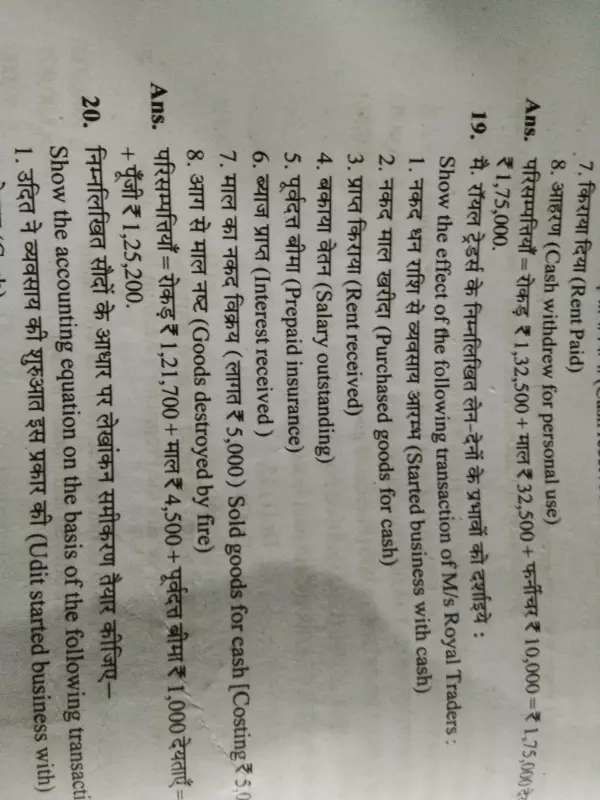

please solve this question sir

how i do this entry in tally

(CASA CHEQ WITHDRAWAL GUDDU 70000 FROM PNB A/C)

Its about supply of tangible goods services. Questions are what is HSN/SAC code and what is IGST rate applicable when i will raise bill to someone else.

Can we alter an error in HSN code no in the enrolment form filled ? If so ,when ?

How to File IT Returns please help me in that ? I need to know about it.

I'm Nagaraju, Amma Homes, Narasannapeta, Srikakulam Dt., Andhra, India,

I'm a builder, we construction group houses, I have GST license,

My doubt : one of my project 90% work completed, registrations stating after GST, so how to pay GST

If r is a fixed positive integer then prove by PMI (r+1)(r+2)(r+3)...(r+n) is divisible by n

I Got a GST Invoice from a proprietorship firm of Rs. 2900000/- + GST @18% for Road Repairing as a contract with material and labour included. I want to know what is the TDS rate and can i deduct WCT TDS also in bill or not after GST.

Please reply as earlist.

- The difference of squares of two numbers is 180. The squares of the smaller no is 8 times the larger no. Find the two numbers by Qudartic formula