Its about supply of tangible goods services. Questions are what is HSN/SAC code and what is IGST rate applicable when i will raise bill to someone else.

Question

Can we alter an error in HSN code no in the enrolment form filled ? If so ,when ?

How to File IT Returns please help me in that ? I need to know about it.

I'm Nagaraju, Amma Homes, Narasannapeta, Srikakulam Dt., Andhra, India,

I'm a builder, we construction group houses, I have GST license,

My doubt : one of my project 90% work completed, registrations stating after GST, so how to pay GST

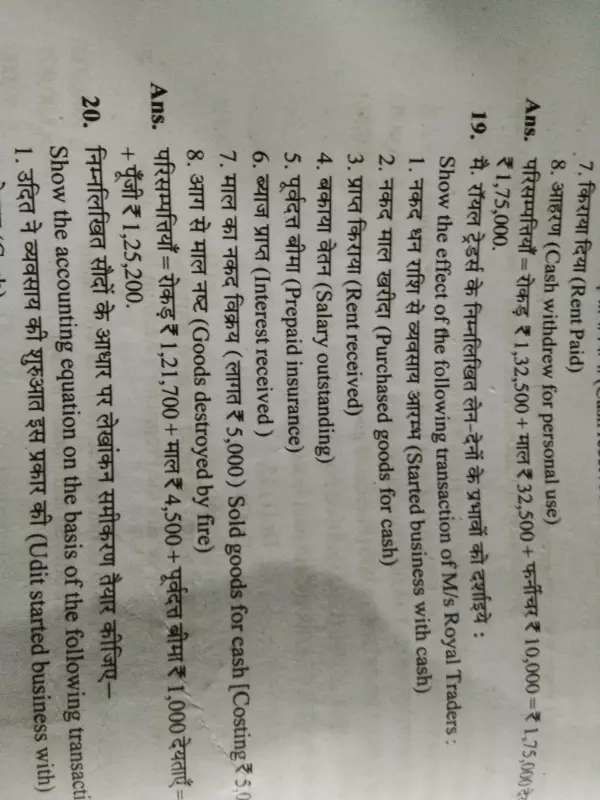

Maths

Aug. 2, 2017, 10:28 p.m.

Answer

Aug. 2, 2017, 10:28 p.m.

Answer

If r is a fixed positive integer then prove by PMI (r+1)(r+2)(r+3)...(r+n) is divisible by n

I Got a GST Invoice from a proprietorship firm of Rs. 2900000/- + GST @18% for Road Repairing as a contract with material and labour included. I want to know what is the TDS rate and can i deduct WCT TDS also in bill or not after GST.

Please reply as earlist.

Maths

Aug. 2, 2017, 8:19 p.m.

Answer

Aug. 2, 2017, 8:19 p.m.

Answer

- The difference of squares of two numbers is 180. The squares of the smaller no is 8 times the larger no. Find the two numbers by Qudartic formula

- Line segments AB is parallel to another line segments CD.O is the mid-point of AD.SHOW that

in the expansion of (x^2 1/x)^n , the coefficient of the 4 ton is equal to the coefficient of the 9 term find in and the 6 term of the expansion

We are a coal trading firm.we are being levied get compensation cess and the same is forwarded to our clients. One of the client being tiles maker, rejected our invoice with GST cess and asking without it as he is not able to claim it. Is it right?