Question

Hello, Could you please add free Service Tax & TDS filling procedures topics on your website. Thanks

would you like to tell me, where the amount will add either in the time of creation ledger or the creation of accounting vouchers ?

MY SALARY COMING UNDER 2,50,000/- WHEATHER I AM BOUND TO PAY INCOME TAX OR NOT?

Hello Sir,

Would request you to please provide a complete example on WCT i.e. 1. Service Tax Treatment and the amount on which it should be deducted 2. TDS -IT & TDS-VAT treatment and the amount on which it should be deducted 3. VAT (Input & Output)

Thank you for your help sir !

Hello sir

In the above question --for writing off the excess provisions

provision for expenses must be debited instead of Apsara building and Delhi jal Board as per my thinking. i might be wrong as i am not very good at accounts.. kindly advise

Hello

In the above example consultation exp are 100500. i might be wrong but it must be 100000 and swachh bharat cess 500.

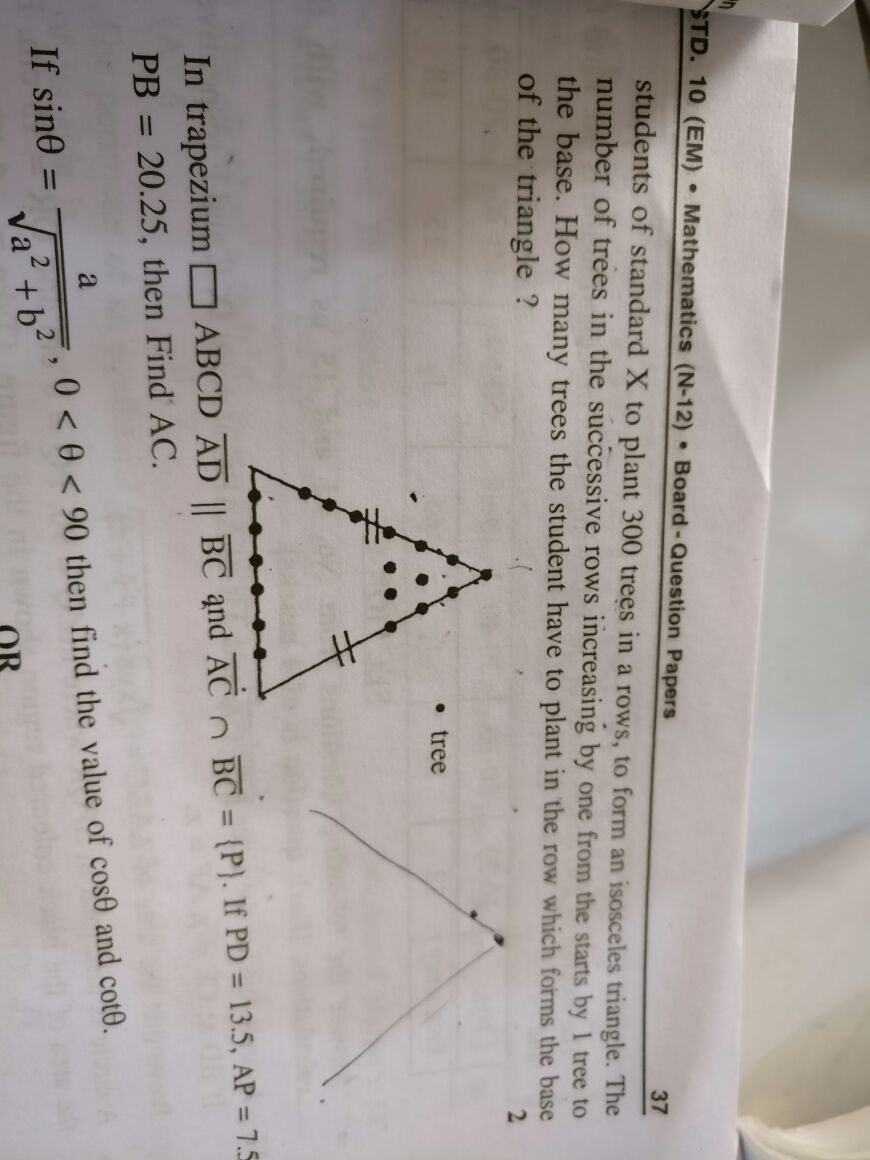

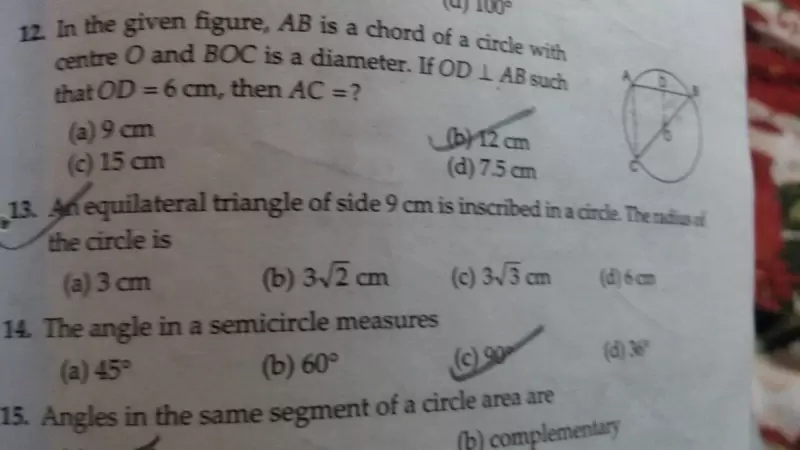

Please solve question no13

Please solve question no13