Question

Find the equation of that straight line, which passes through (-1,1) and is the equation of line joining 3,1 and -1,2.

What is General Reserve and from which account it deducts , what effect it does in balance sheet what adjustment closing entry will

A company write off depriciation on straith line basic on machinery at 10% on 31december 2011 the position was as under

Cost of purchase to date rs52590

Depriciation wriiten off the date rs25670

Cost of purchase to date rs52590

Depriciation wriiten off the date rs25670

My name sunny choudhary sir me AAP ka pass coaching kerta tha Kya me me AAP ka pass Article ship ker sakta hu sir plz

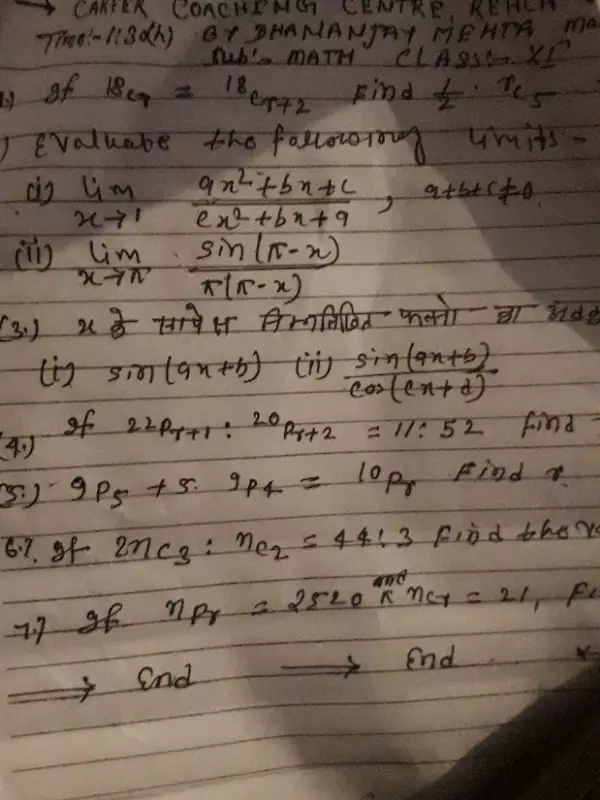

Maths

Dec. 18, 2017, 7:24 p.m.

Answer

Dec. 18, 2017, 7:24 p.m.

Answer

- It ratio of the lengthof a pillar and its shadow is /3:1 thenangle of elevation of sun what?

Maths

Dec. 18, 2017, 6:39 p.m.

Answer

Dec. 18, 2017, 6:39 p.m.

Answer

Please sent me the answer for the 6th question in Ex 14.4 in class 9

Accounts Tax GST

Dec. 18, 2017, 3:57 p.m.

Answer

Dec. 18, 2017, 3:57 p.m.

Answer

Dear Sir/Madam,

I have question about Gst ..

At time of Purchase we want receipt calculation of IGST with reference to Our Surat Consignee, but Maharashtra Shipping Line wrongly charged amount of CGST and SGST with Our Name in Maharashtra..

For The GST benefit we have raise bill with consignee Name and Pay IGST So Please advise how we will get benefit of GST...

And if Any Other Solution For that Please Suggest...