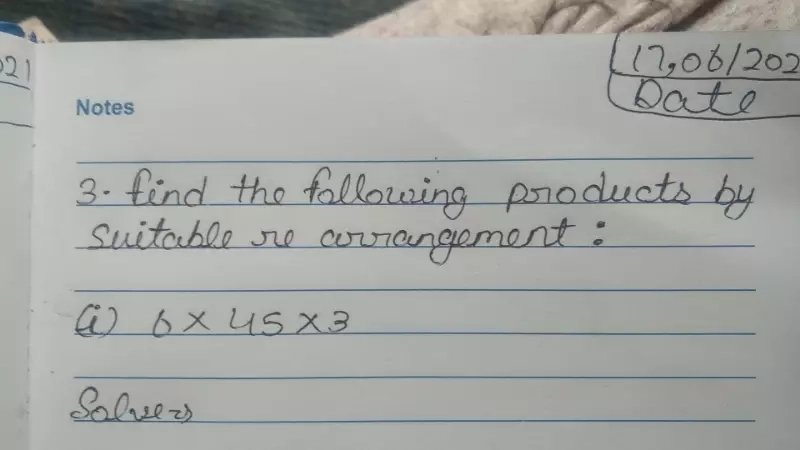

Question

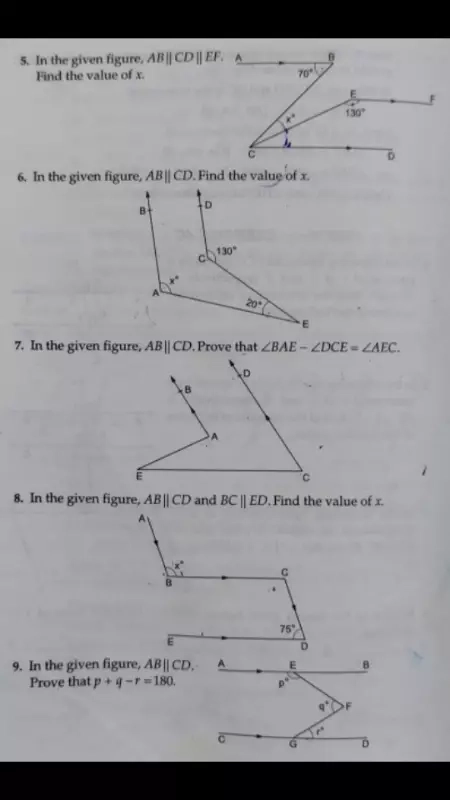

Maths

June 16, 2021, 11:40 p.m.

Answer

June 16, 2021, 11:40 p.m.

Answer

Derive a formula to find the perpendicular distance of a point

P( x , y ) 1 1

from the line

Ax By C 0 .

P( x , y ) 1 1

from the line

Ax By C 0 .

Maths

June 16, 2021, 10:13 p.m.

Answer

June 16, 2021, 10:13 p.m.

Answer

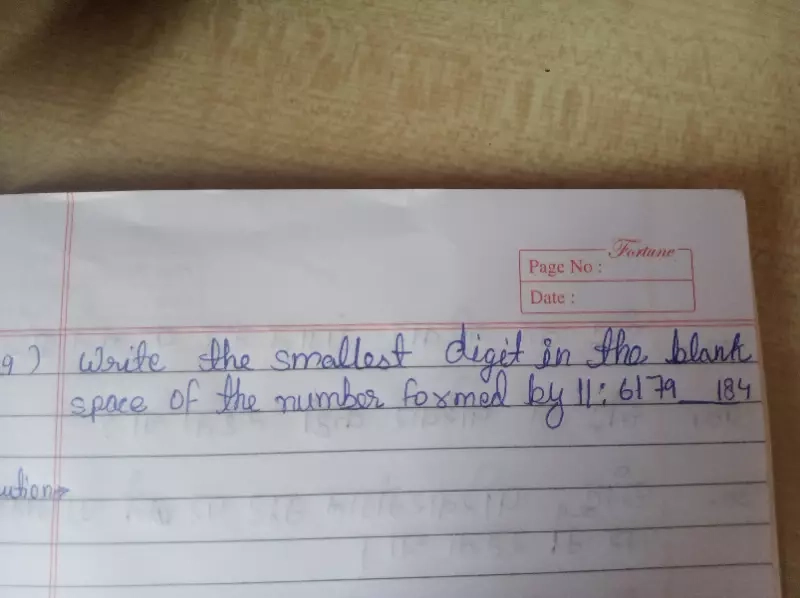

Write the smallest digit in the blank space of the number formed 11divided6179______184

If if if x is equal to under root 2 + 1 find the value of x + 1 over x