How to the journal entry

Question

whether Bihar Industrial Area Development Authority(Artificial Judicial person) have to take 2 types of registration under Reg 1 & Reg 7 (Tax Deductor) also or registration as Reg 7 only. Please advice

I am small MUTUAL FUNDS AGENT my commission recovery IGST,15.5% ,so it is refund & not refund please send me reply

Harry up plz help me first

Ek class me 60%student study Hindi class me 40% boys aur20% girl not study Hindi how many students study hindi

Sir I want to know I Have completed b.com.and now m pursuing m.com after completing it i wil join a job for part tym so I m thnkng to do distance learning MBA sir that's why I want to knw .Is it beneficial for me or not if I do?????plz suggest me sir cz some people says distance learning is nt valuable for MBA candidate..I m confuse between distance learning MBA and regular MBA.

Pls let me know what is the HSN code for job worker(job work related to dyeing) for carpet.

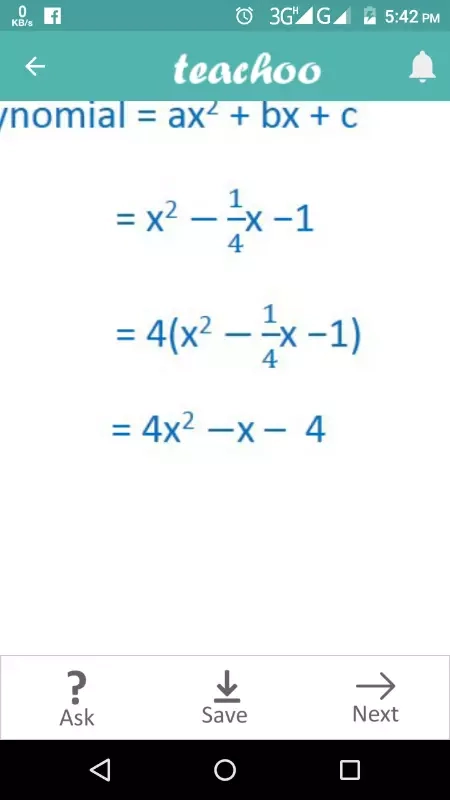

isme 4 se multiply kyu kiye hain???

isme 4 se multiply kyu kiye hain???