Tirbhu kiya hai

Question

Two pillars of equal height are on either side of a road, which is 100 m wide. The angles of elevation of the top of the pillars are

What are the legal provisions governing depreciation, and what is the duty of an auditor in relation thereto?

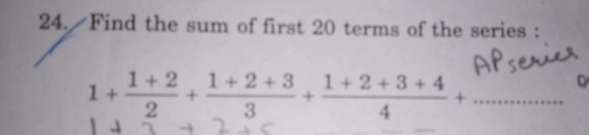

The sum of n terms of a series for all value of n is n^2+3n. Find the first 3 terms of the series?

40th and 50th(b)

40th and 50th(b)

Plz solve fastly i need that at any cost with in 1hour

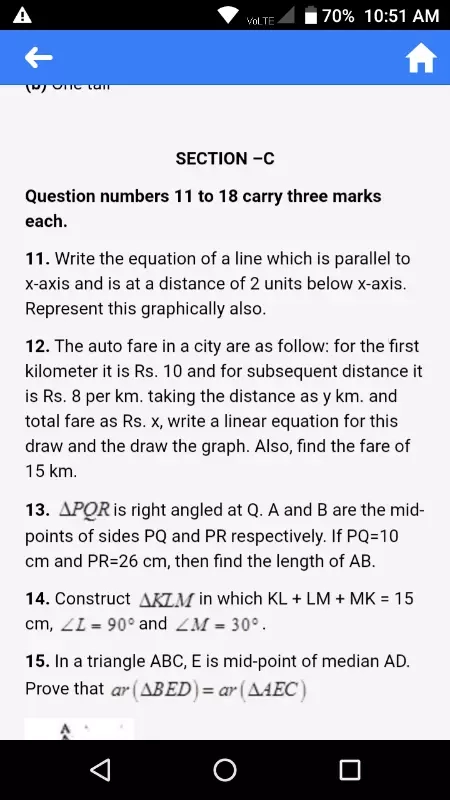

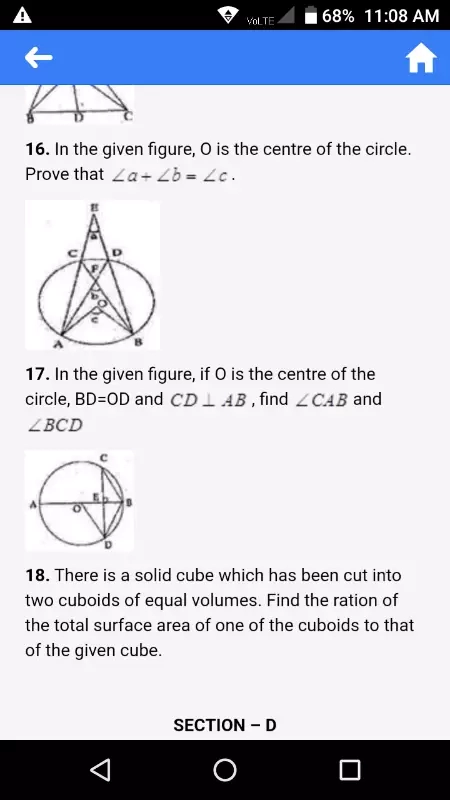

Q.17and18

Q.17and18