What are the coefficients of x in the following expressions?

4x – 3y, 8 – x + y, y 2 x – y, 2z – 5xz

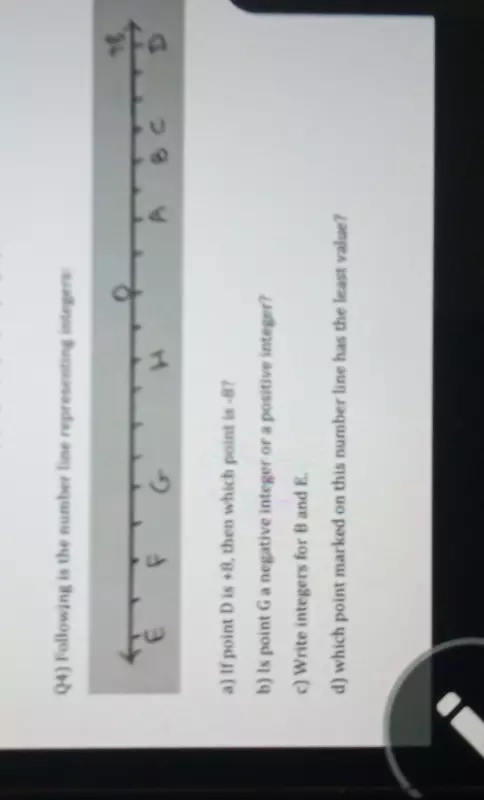

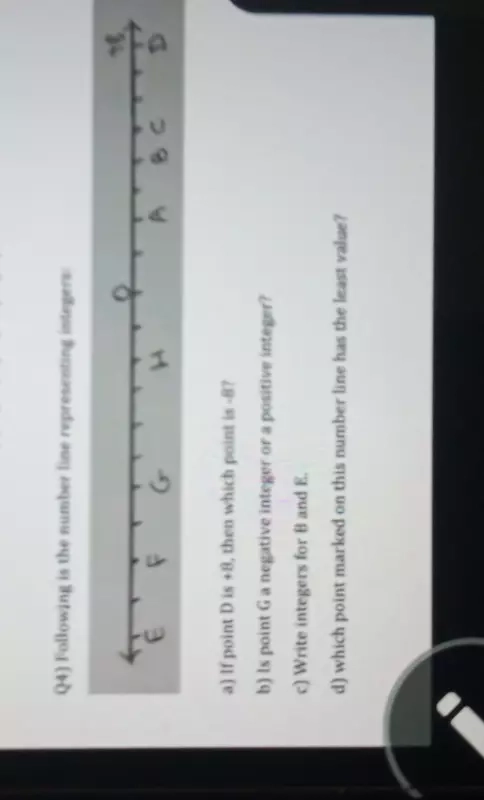

Question

Maths

July 9, 2021, 2:32 p.m.

Answer

July 9, 2021, 2:32 p.m.

Answer

If A and G are A.p. and G.p. respectively of the number 4 and 16 then what is A-G

Accounts Tax GST

July 9, 2021, 2:05 p.m.

Answer

July 9, 2021, 2:05 p.m.

Answer

From the following particulars prepare a bank reconciliation statement on 31/3/2021

- Bank balance as per cash book ₹9100

- Cheque issued but not presented for payment₹800

- Cheque paid into bank for collection but not credited by the bank ₹500

- Bank charges debited in the pass book, but not entered in the cash book ₹100

- Interest on investment credited in the pass book but not entered in the cash book ₹400

- Cheque received and paid into bank but not entered in the cash book₹900

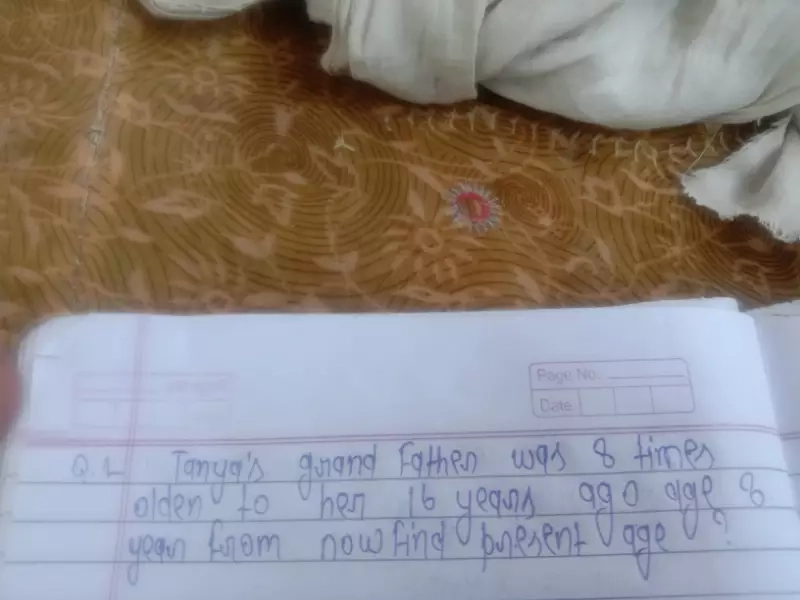

Maths

July 9, 2021, 11:22 a.m.

Answer

July 9, 2021, 11:22 a.m.

Answer

mamta bought 15 sarees and gave 3/5 of these to her mother - in-law. how many sareess are left with her?

The age of Ramu and Sonu are in the ratio 5:7 sum of their age is 84 find their prasent ages