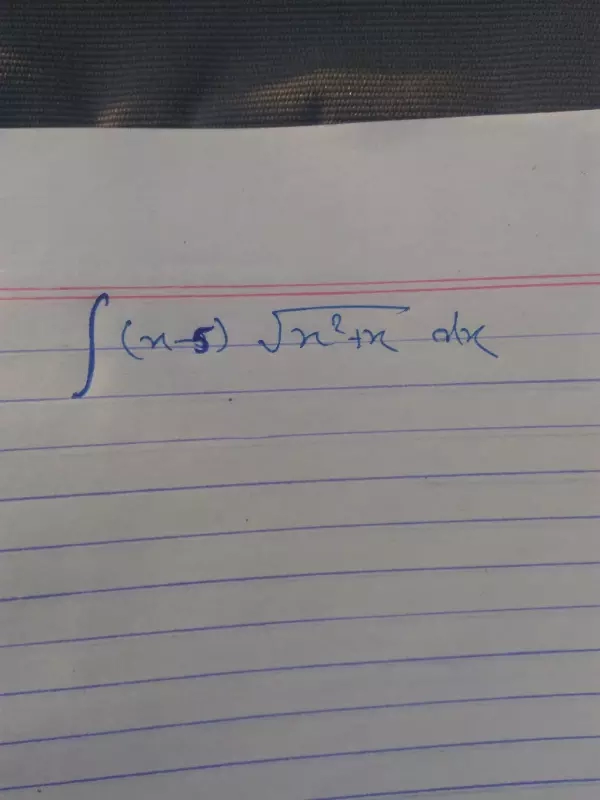

Integration (1+sinx)/sinx (1+cosx)

Question

A pole 6 m high casts the shadow 2√3m long on the ground . then find the sun's elevation.

Why does Cassius object to allowing Antony to speak at Caesars funeral?

Davneet uncle you are too good here but the text are too big not mobile friendly so this app is worst now always ads

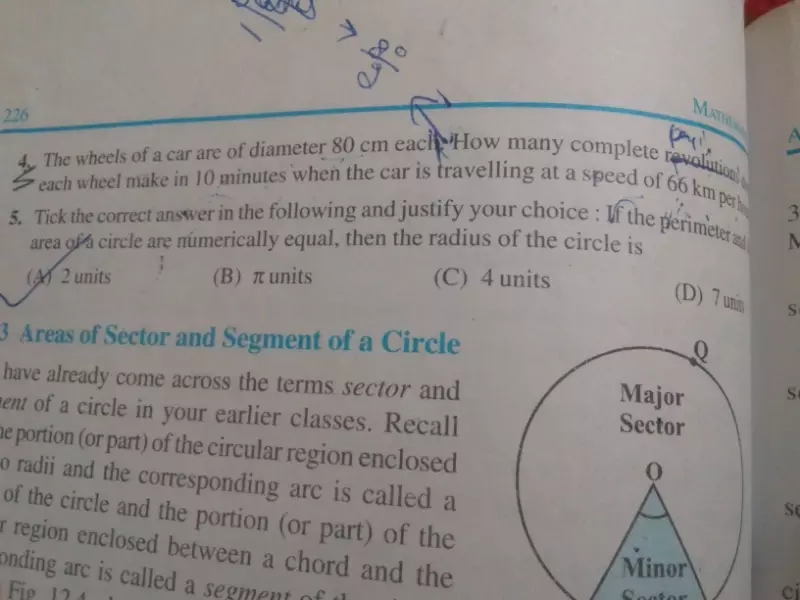

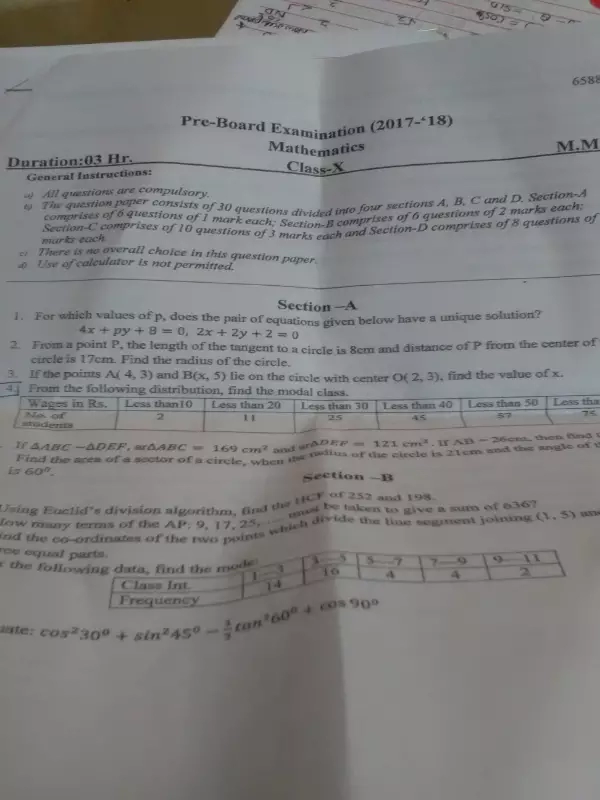

question 4

question 4