I want to learn

Question

Solve the given system of equations by cross multiplication method 2x-6y+10=0and3x-9y+15=0

- please tell me ex12.2.6 what is major segment

- what is minor segment

- please tell me

Accounts Tax GST

Feb. 13, 2019, 9:32 a.m.

Answer

Feb. 13, 2019, 9:32 a.m.

Answer

Using elementary row operation, find the inverse of the matrix.A=[1 2 2 2]

find the real root of the equation xtanx + 1 =0 using newton raphson method

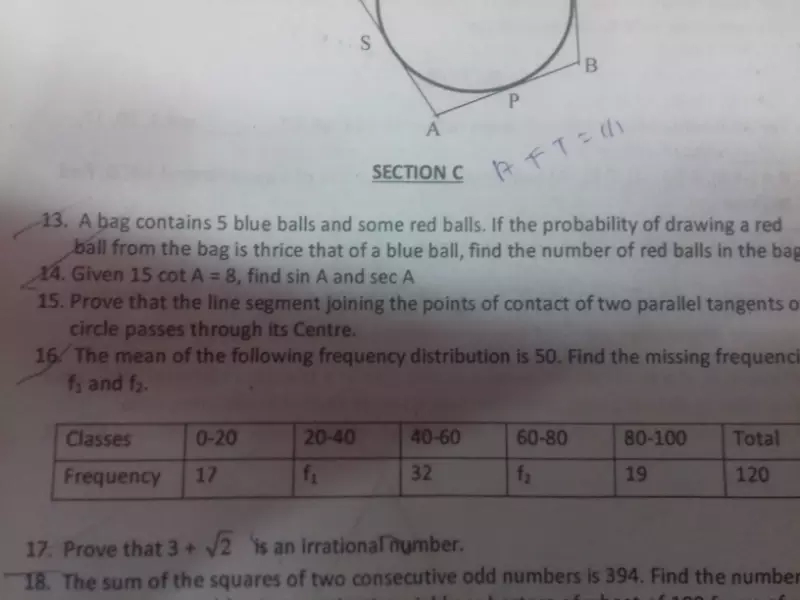

16 questions

16 questions