two positive integers a and b can be written as a minus x cube y square and equals to x y cube x y a prime number find LCM ab

Question

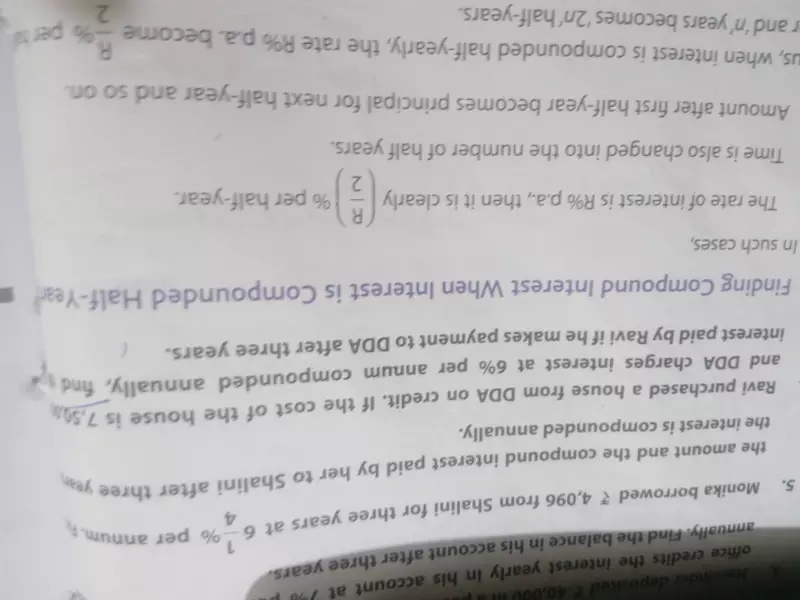

Accounts Tax GST

March 1, 2020, 8:57 p.m.

Answer

March 1, 2020, 8:57 p.m.

Answer

An article was purchased for Rs 5400 including 8%. Find the prize of the article