Ques no. 32 and 33

Ques no. 32 and 33

Question

Accounts Tax GST

Sept. 13, 2017, 12:20 p.m.

Answer

Sept. 13, 2017, 12:20 p.m.

Answer

For Tally Sales support and customization , you may contact on [email protected]

Hi I want to know if seller has different offices in different states, it is necessary to register for different GSTIN for different states?

Second question: Different return will be filed for each GSTIN?

Third How we will choose different states having different GSTIN for billing purpose in tally?

Second question: Different return will be filed for each GSTIN?

Third How we will choose different states having different GSTIN for billing purpose in tally?

Maths

Sept. 13, 2017, 10:16 a.m.

Answer

Sept. 13, 2017, 10:16 a.m.

Answer

sir my question is what is physical significance of differential equation...?

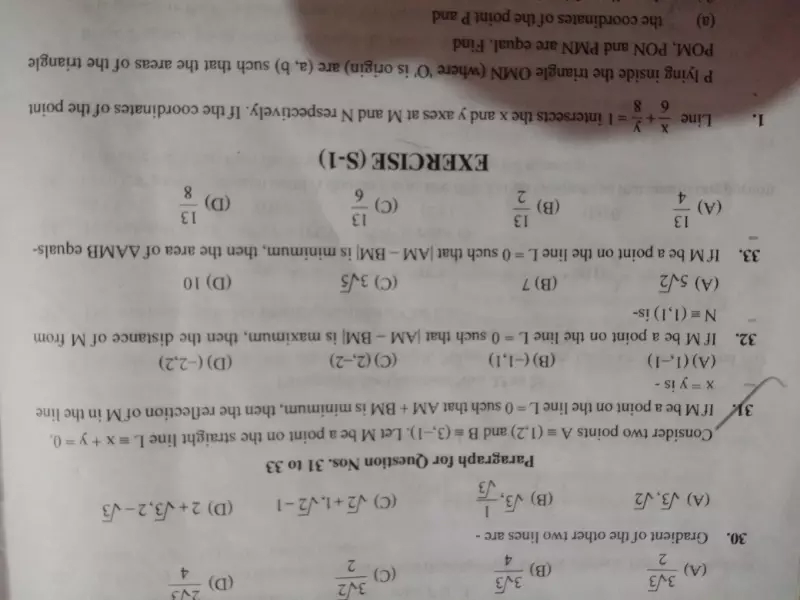

-tanA cotA(90°-A= secA cosec(90°-A) sin2 35° sin2 55°/tan10° tan20° tan30° tan70° tan80°