Question

Whether the provision of 80TTB amended for the year 2018-19 which allows deduction upto Rs.50,000/- on interest income are applicable on interest earned in Senior Citizen Scheme 2004 and interest earned on RBI Bonds.

Only entry Building A/C Dr 13500000

To Building WIP 13500000

Term Loan for Asset Purchase

Building purchased for 100 lacs.from Ajay Properties on 1 July 2016

Amount spent on further construction =20 lacs

Total Project Cost=120 lacs

ICICI Bank gave loan at 75% of project cost @ 10% p.a

(120 lacs*75%=90 lacs)

Whoie amount repaid after 6 months including interest

Construction was complete by 31 Aug 2016

Pass Entries for Asset Purchased,Loan Taken,EMi and Interest Repaid

Building WIP Dr 10000000

To Ajay Properties A/c 10000000

(Being building purchased.)

Loan from ICICI bank:

Bank A/c Dr 9000000

To ICICI 10% Loan A/c 9000000

( Being loan amount received.)

Building WIP Dr 2000000

To Bank A/c 2000000

(Building construction charges)

Interest on loan from ICICI bank (1 st july to 31 st August 2016)

Building WIP A/c Dr 150000

To ICICI 10% Loan A/c 150000

(Being interest on loan during construction is capitalized.)

Interest on loan from ICICI bank ( 31 stAugust 2016 to 31 st December 2016)

Interest On Loan A/c Dr 300000

To ICICI 10% Loan A/c 300000

(Being interest on loan charged after Construction Completed booked as expense)

Building Dr 13500000

To Building WIP Dr 13500000

(Being construction of building finally completed.)

Repayment of loan:

ICICI 10% Loan A/c Dr 9450000

To Bank A/c 9450000

( Being loan repaid.)

On 1 st july:

Building WIP Dr 10000000

To Ajay Properties A/c 10000000

(Being building purchased.)

Loan from ICICI bank:

Bank A/c Dr 9000000

To ICICI 10% Loan A/c 9000000

( Being loan amount received.)

Building WIP Dr 2000000

To Bank A/c 2000000

(Building construction charges)

Interest on loan from ICICI bank (1 st july to 31 st August 2016)

Building WIP A/c Dr 150000

To ICICI 10% Loan A/c 150000

(Being interest on loan during construction is capitalized.)

Interest on loan from ICICI bank ( 31 stAugust 2016 to 31 st December 2016)

Interest On Loan A/c Dr 300000

To ICICI 10% Loan A/c 300000

(Being interest on loan charged after Construction Completed booked as expense)

Building Dr 13500000

To Building WIP Dr 13500000

(Being construction of building finally completed.)

Repayment of loan:

ICICI 10% Loan A/c Dr 9450000

To Bank A/c 9450000

( Being loan repaid.)

BUILDING WIP DR 13500000

TO BUILDING 13500000 PLEASE EXPLAIN

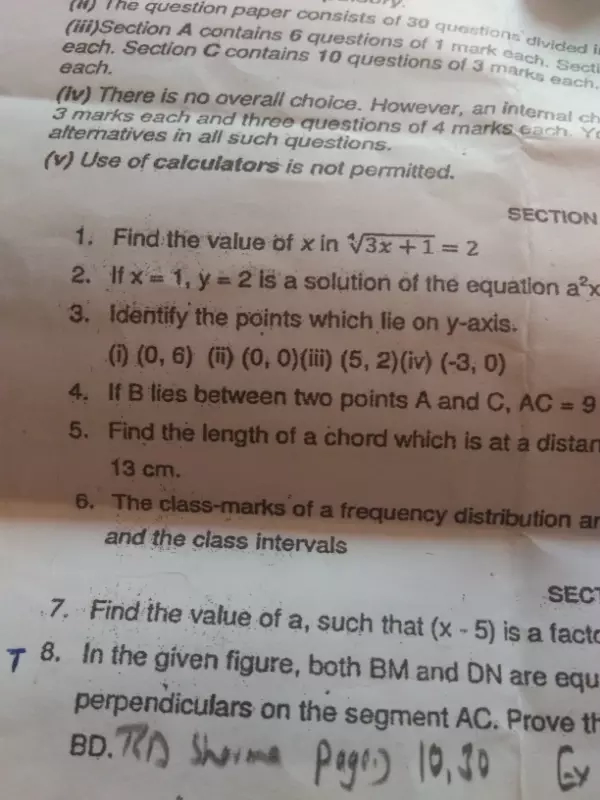

If a company worked with a creditor on regular basis and creditors shows Debit balance then what should we do?

1) creditors shown in current liability.

2) credited for shown in loans and advance

According to second point of this screenshot