find the cartesian and vector equation of line that passes through the points (3,-2,-5)and (3,-2,6)

Question

Accounts Tax GST

Sept. 21, 2017, 12:52 p.m.

Answer

Sept. 21, 2017, 12:52 p.m.

Answer

How to update advance payment against new bills generated after payment received in Tally.

Accounts Tax GST

Sept. 21, 2017, 12:05 p.m.

Answer

Sept. 21, 2017, 12:05 p.m.

Answer

Recieved capital by Cash Rs 20000.

Cash deposited in bank Rs 50000.

I am new in Tally.

How can I feed these entries in Tally please explain me step by step.

Show the cube of any positive integer is of the former 7m or 7m+1 or 7m+6

I m running a coaching centree is there any chance for join with you and earn some commissio by your courses..

Sovle the Questin 17(b) with full calcule

Send my by whats app 9012569937

Accounts Tax GST

Sept. 21, 2017, 12:45 a.m.

Answer

Sept. 21, 2017, 12:45 a.m.

Answer

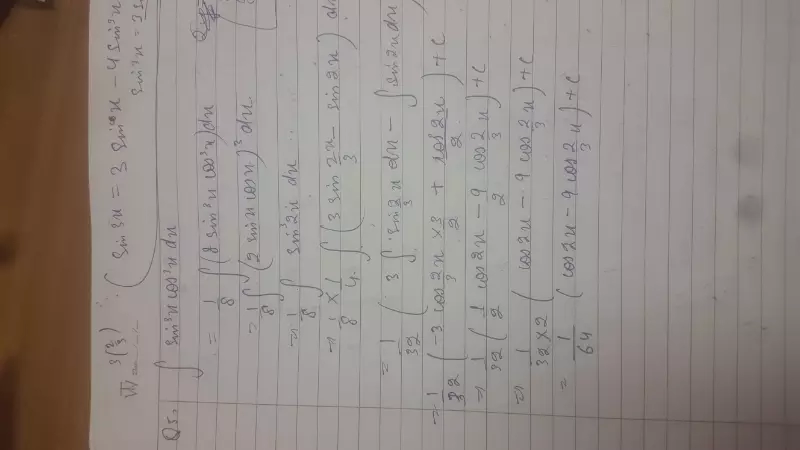

If I solve it this way...powers of cosx such as 4 and 6 are not involved...so can answers vary when we use different methods??..

Cgst sgst=igst he Kya bus ye antar he ki out of state purchese Kiya to igst nhi to s c(gst) lagega purchser ko same rate Dena hoga bus alag alag divide Kiya gya he taki smajh me aye ki kha see purchese hua