Differentiate the following w.r.t x

X^3e^xcosx

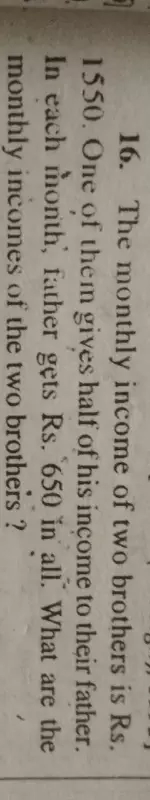

Question

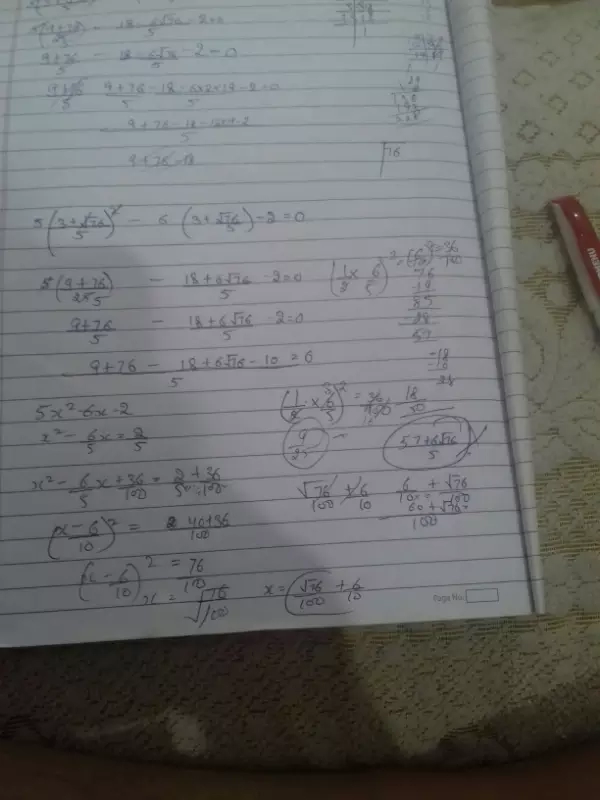

In athematic progressions chapter

If a9=-35 40.0. -35 40×3

=. -.

3. 3

How 3 comes to the numerator

If a9=-35 40.0. -35 40×3

How 3 comes to the numerator

Maths

May 30, 2018, 5:47 a.m.

Answer

May 30, 2018, 5:47 a.m.

Answer

Prove that the sum of the two interior opposite angles of a triangle is equal to the exterior angles

Accounts Tax GST

May 29, 2018, 5:34 p.m.

Answer

May 29, 2018, 5:34 p.m.

Answer

Capital account me Kiya jata h or Kiya nhi or kidar jata h ( dr. Said Kiya or cr. Said Kiya )

- Help me yrrrrrro

Maths

May 29, 2018, 1:19 p.m.

Answer

May 29, 2018, 1:19 p.m.

Answer

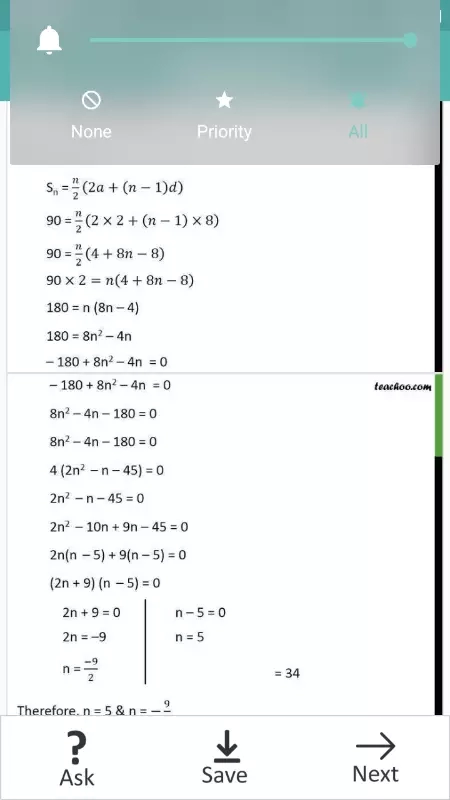

Solve this by sustitution method.

Root7x root13y=9 and root5x root17y=0

Root7x root13y=9 and root5x root17y=0

where did 4 go in12th step

where did 4 go in12th step

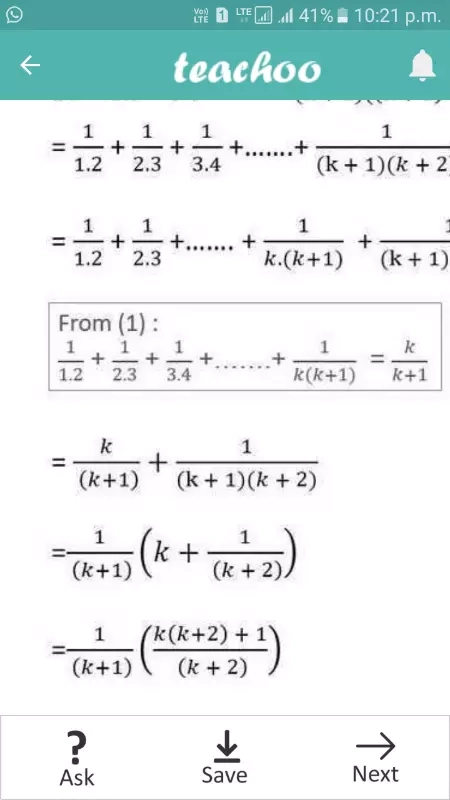

in denominator (k 1)(k 2)has came

in denominator (k 1)(k 2)has came