I can't understand how calculate Tax Rs 48000=23000?

Question

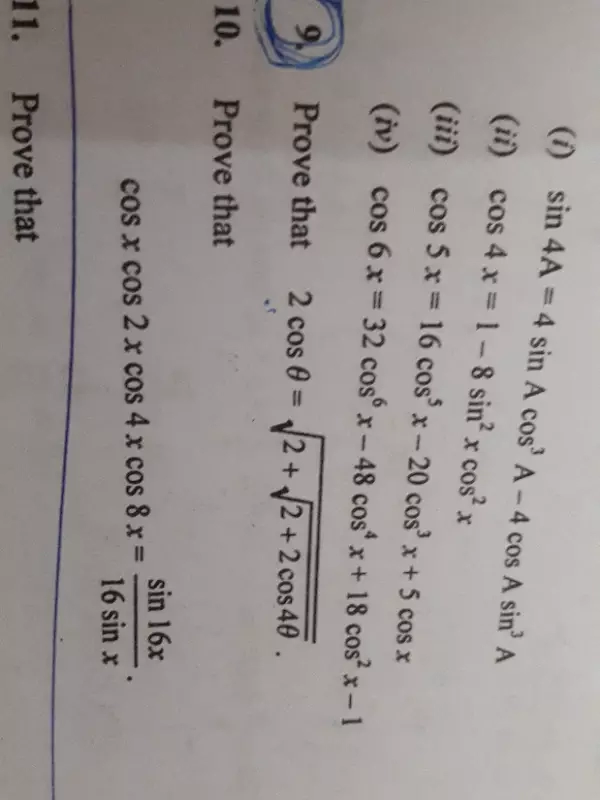

Two angle of a triangle are 72°53' 51" and 41°22'50' respectively. Find the third angles in radians

Sir I can file itr for FY 15-16 & 16-17

What type of itr if proprietary business having salary income

What type of itr if proprietary business having salary income

How I believe your software your software teach Wrongly become the Role is debit the Receiver. And credit the giver you Enter in software Wrongly...... Check One's and Curect

if the middle term in the expansion of (x^2 1/x)^n is 924 x^6 ,then n?

Class 9

Nov. 14, 2017, 8:27 p.m.

Answer

Nov. 14, 2017, 8:27 p.m.

Answer

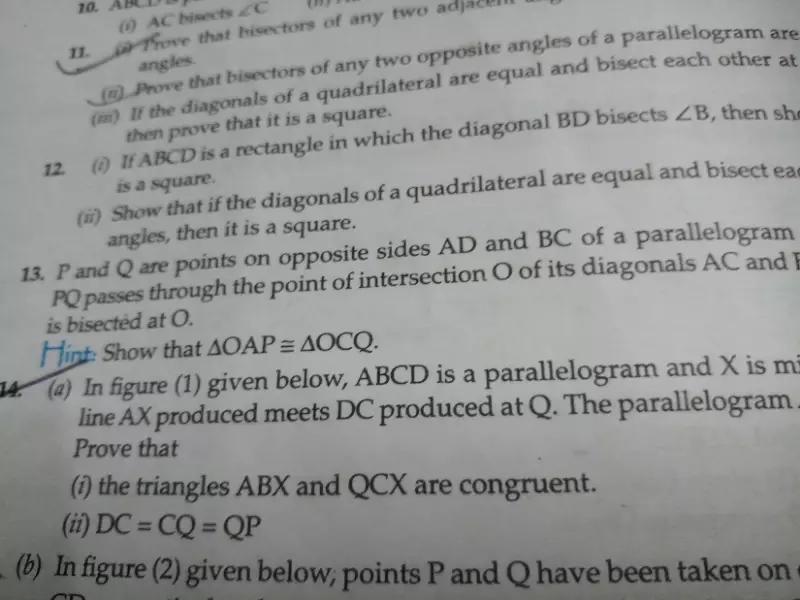

If the diagonal of a quadrilateral bisect each other, then it is a parallelogram

Maths

Nov. 14, 2017, 6:57 p.m.

Answer

Nov. 14, 2017, 6:57 p.m.

Answer

from the top of a lighthouse the angle of depression of two ships on opposite side of it they are observed to be 30 angle and 90 angle if the hight of the lighthouse is h meters and the line joining the ships passes through the foot of the lighthouse show that the distance between the ships is 4 upon root 3h metres

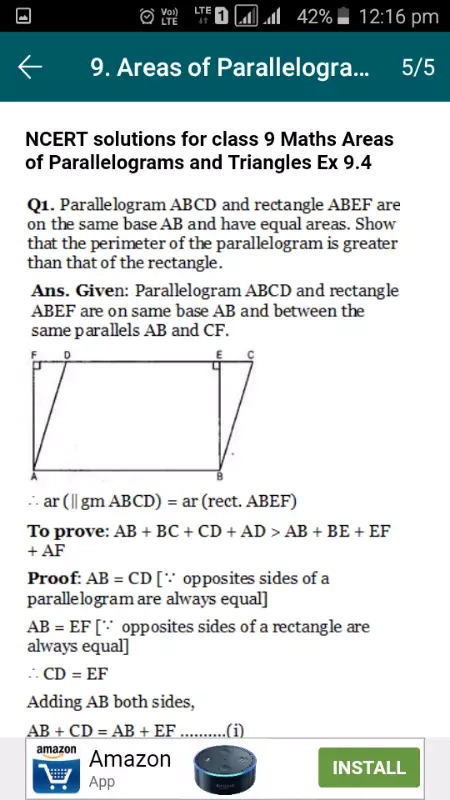

Prove that the area of two Triangles are equal if they are on the same base and between the same pair of parallel lines.

please answer this question

please answer this question