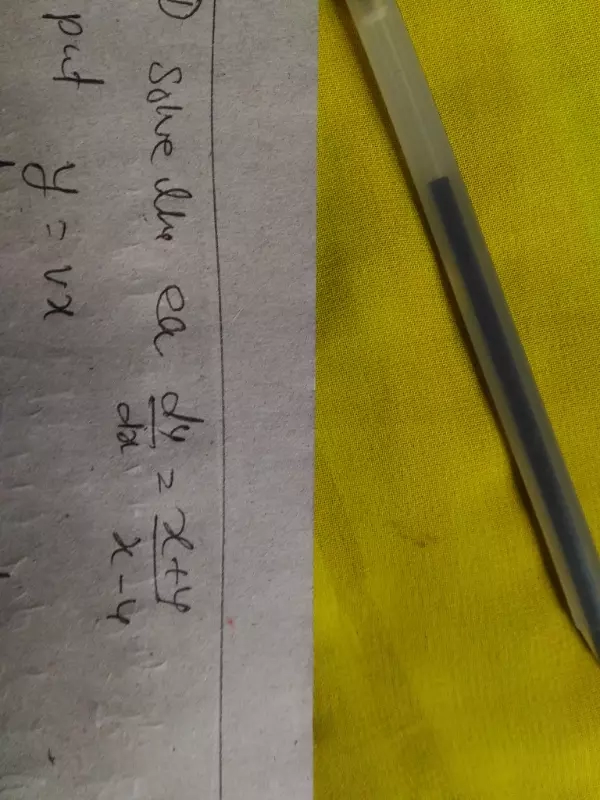

Integration of /1divided by (1+x)2

Question

Sir

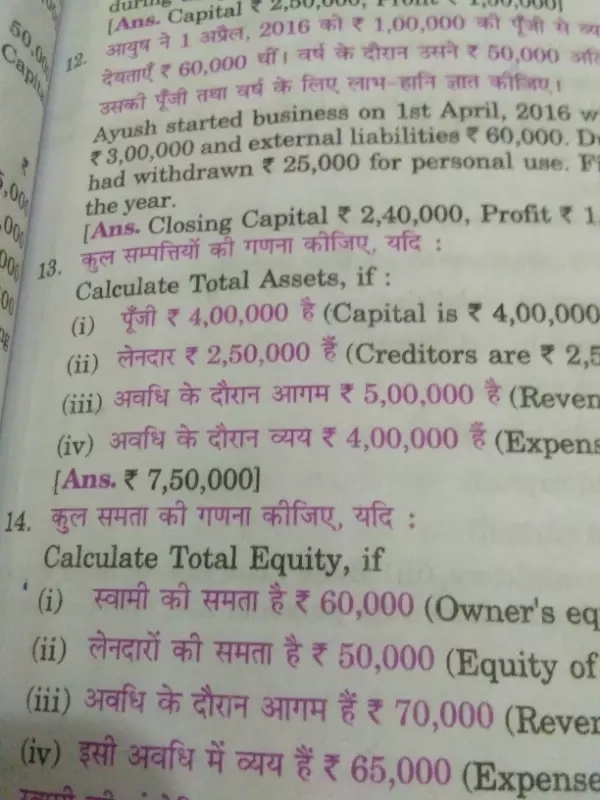

Sir June month sales @ 5 % of sales to interstates and now they have payment this month of Bill's but they are concerned to cst 2% so diff tax amt I asking question our is SALES @5 % and they are cst @2 % sir they given to vat - cst = amt Tax amt less so how to entry to tally

Sir June month sales @ 5 % of sales to interstates and now they have payment this month of Bill's but they are concerned to cst 2% so diff tax amt I asking question our is SALES @5 % and they are cst @2 % sir they given to vat - cst = amt Tax amt less so how to entry to tally

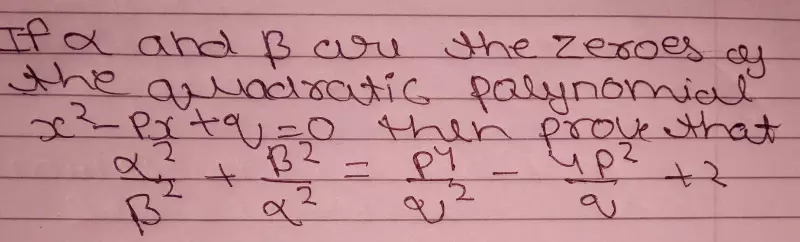

If alpha and beta are the zeroes of the quadratic polynomial f(x) = x2 - px q, prove that alpha2/beta2 beta2/alpha2 = p4/q2 - 4p2/q 2.

Find the perimeter of the triangle of 1 whose ABC's side is 4 centimeters and the BC side is 3 centimeter.

If p (n) is the statement2 3n-1

Is an integral multiple of 7 nd p (n)is true PT

P (n 1) is true

Is an integral multiple of 7 nd p (n)is true PT

P (n 1) is true