Question

How to enter petty expenses in tally in which under groups and how to enter amount?

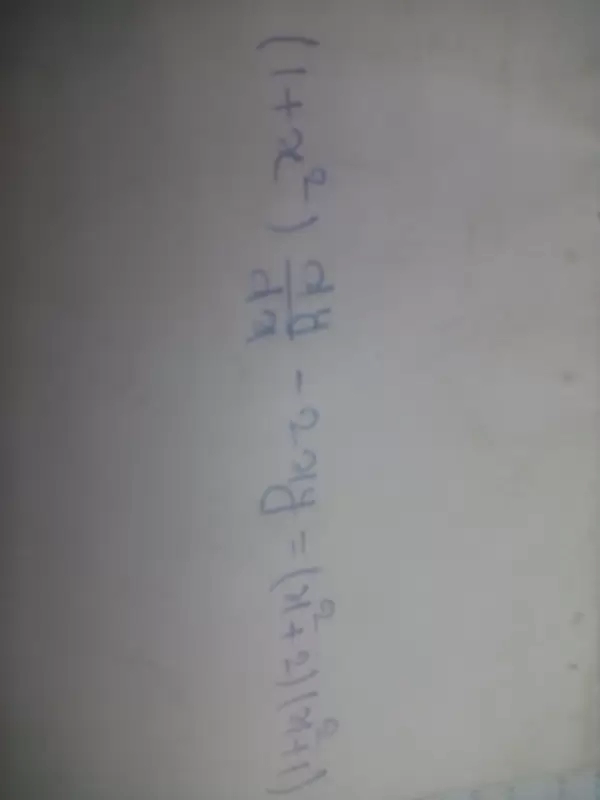

If AM and GM of two postive numbers a and b are 10 and 8 respectively find the numbers

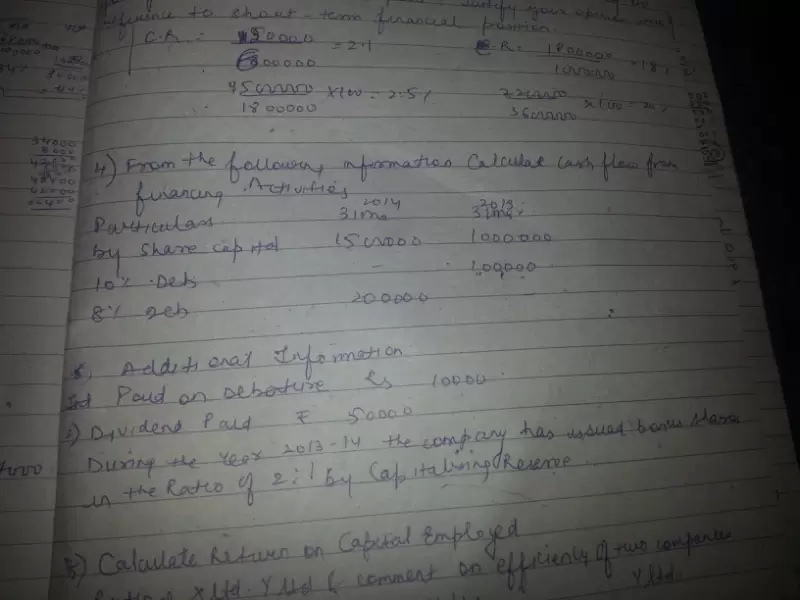

Accounts Tax GST

Feb. 5, 2017, 9:09 a.m.

Answer

Feb. 5, 2017, 9:09 a.m.

Answer

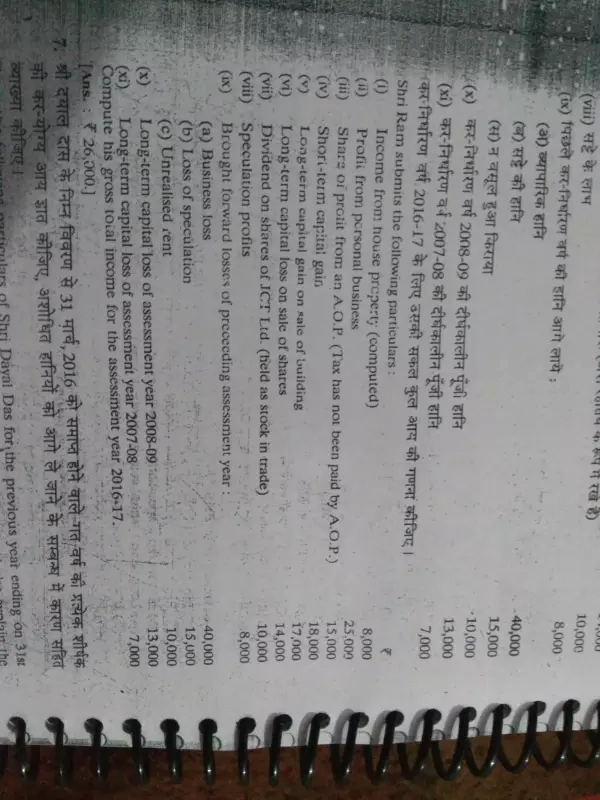

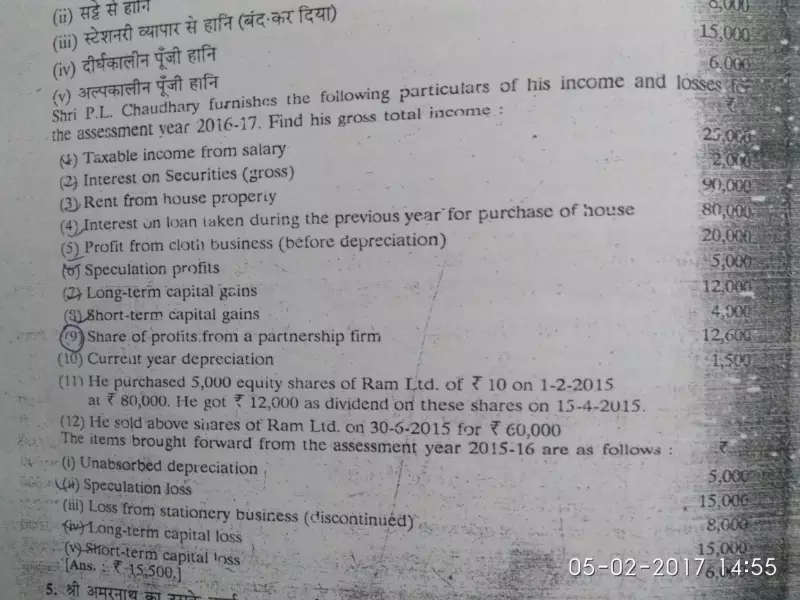

I am not understand Treatment of Unabsorbed Depreciation please elaborate this with example .one example given your application but I think that was wrong pls help me

Accounts Tax GST

Feb. 4, 2017, 6:32 p.m.

Answer

Feb. 4, 2017, 6:32 p.m.

Answer

Can you please state the procedure for filing tds e-return or provide some material on e-return of tds

Accounts Tax GST

Feb. 4, 2017, 5:25 p.m.

Answer

Feb. 4, 2017, 5:25 p.m.

Answer

If quarterly return filing receipt & user id & password lost of tds return so how can we confirm up to what duration we have send return.

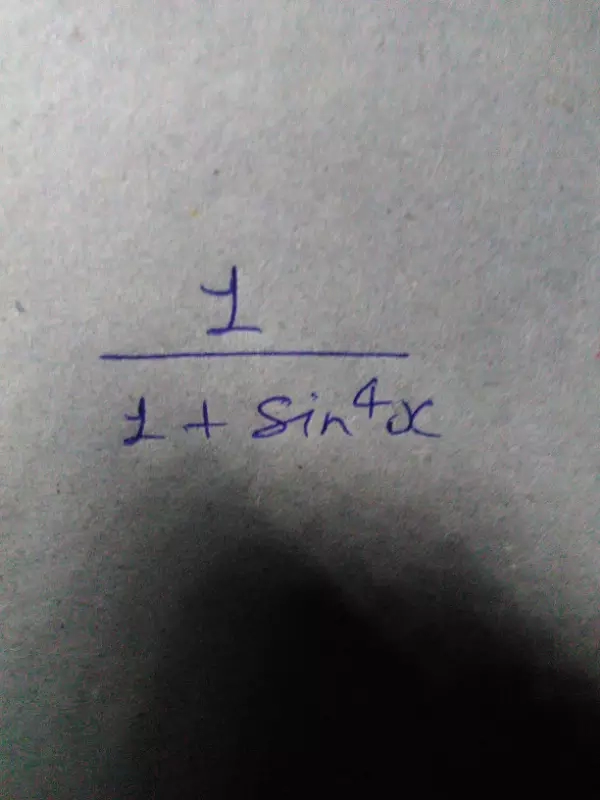

Find integration of ex cost 3x dx

I want it's answer from you teachoo

I want it's answer from you teachoo