find the midpoint of the line segment joining the points (4 .10) and (6 .2)

Question

The sum of digits of a 2 digit no is 8 . if we inyerchange the digits , the new no exceeds 18 by the original number .Find the original number

Your Jamaal answer is correct but the last working is wrong you answered:-

4 by 8 ÷ 4 by 8 = 1 by 2

but the real working is :-

4 by 8 ÷ 4 by 4 = 1 by 2

4 by 8 ÷ 4 by 8 = 1 by 2

but the real working is :-

4 by 8 ÷ 4 by 4 = 1 by 2

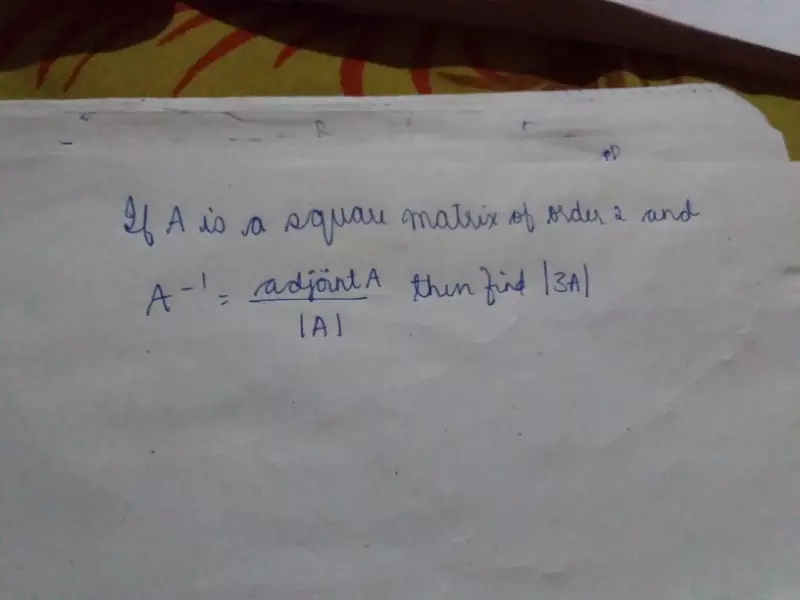

If A is a square matrix of order 2 and A inverse =adjoint A/|A| then find |3A|