Why a-3b/2b is irrational

Question

visualize 4.26 on the number line upto 4 decimal places using succssive magnification

can Electricity Bill on the Name of Mother be used as a Proof regarding Principle Place of Business.......?????

Maths

Sept. 22, 2017, 5:37 p.m.

Answer

Sept. 22, 2017, 5:37 p.m.

Answer

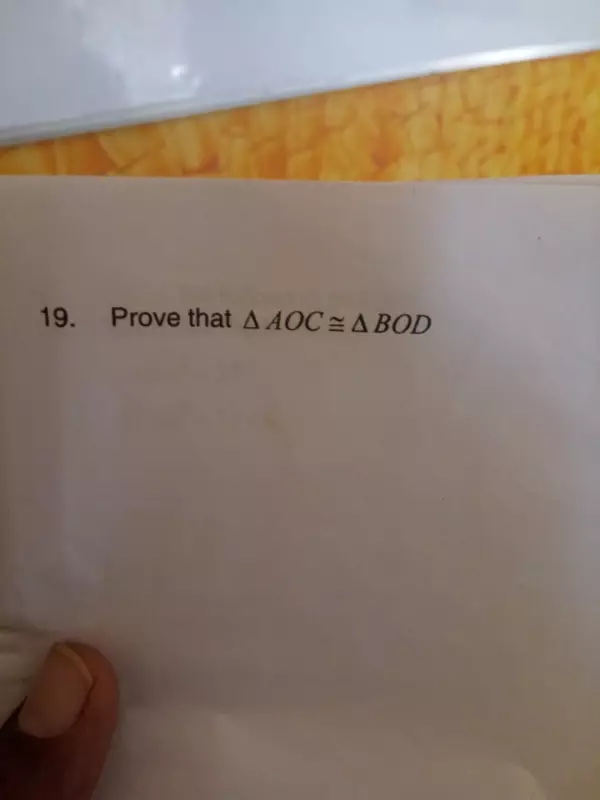

Prove that equal chords of congruent circles subtended equal angles at their centres

?

?

Maths

Sept. 22, 2017, 4:39 p.m.

Answer

Sept. 22, 2017, 4:39 p.m.

Answer

In this question of exercise 6.3, number 8, can we say that angle BFC = angle ABE?

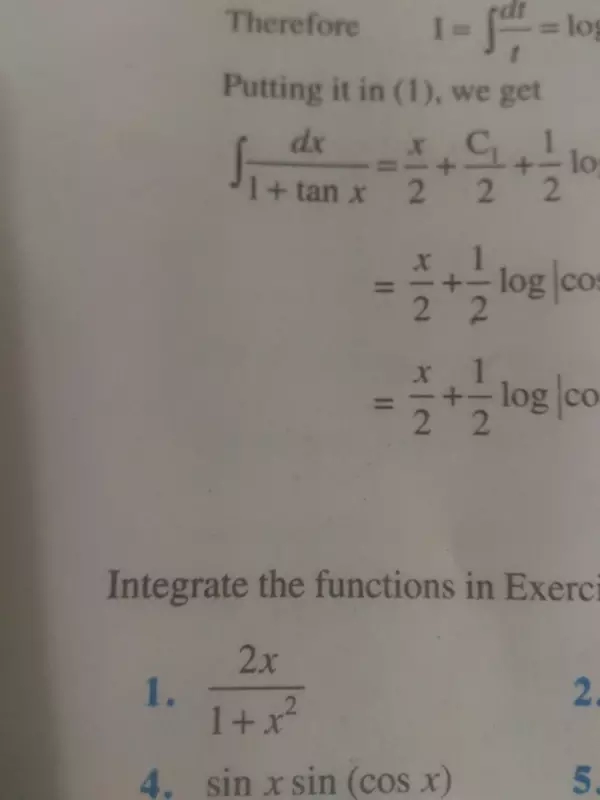

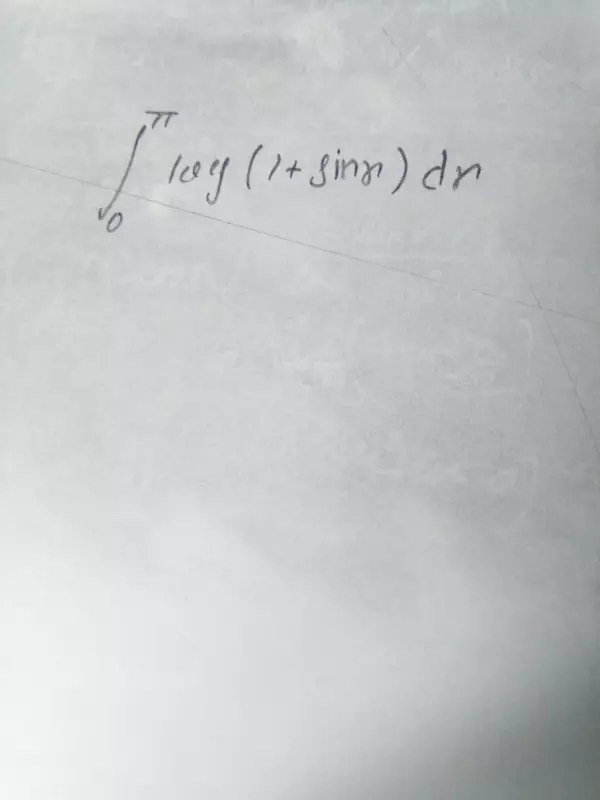

question 1

question 1 integrated it

integrated it