Write a letter to the concerned authority about atrocities on women

Write a letter to the concerned authority about atrocities on women

Write a letter to the concerned authority about atrocities on women

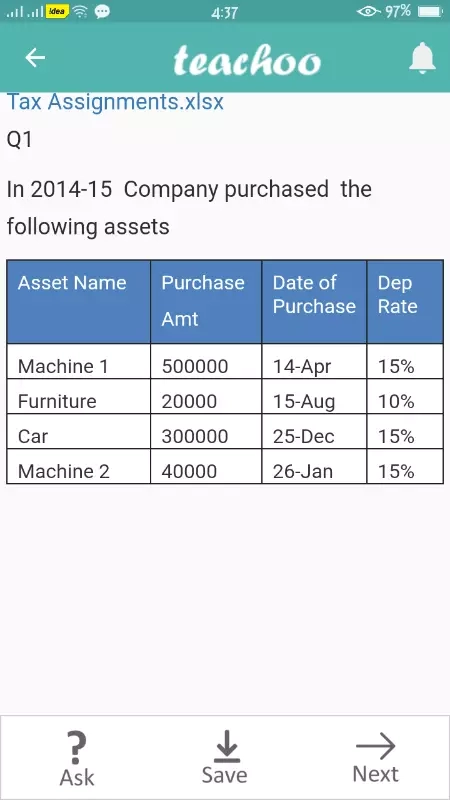

The ans is that there are 3 blocks but how? machinery and car have same rate and are from the same class of assets therefore they constitute one block and furniture is the second block

Dear Sir,

If GST not paid. what will be interest & Penalty Charge in monthly basis rates.

Hi,

I leave in a housing society where each member monthly maintenance is less than 5000/- and turnover is more than 20 lacs. I would like to know the following -

1. Should our housing society get registered for GST?

2. Should every member of the housing society pay 18% GST, though his maintenance is less than 5000/-

regards

Swapnil Nikhar