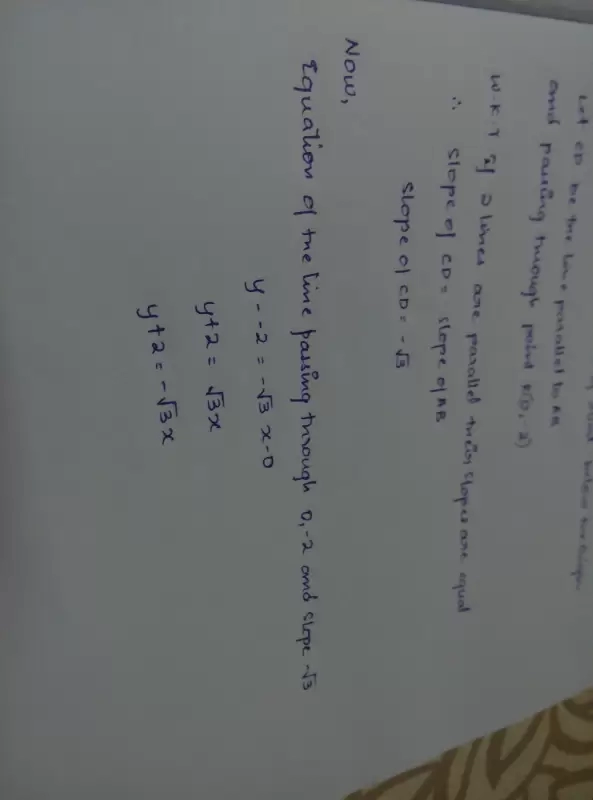

How -✓3

How -✓3

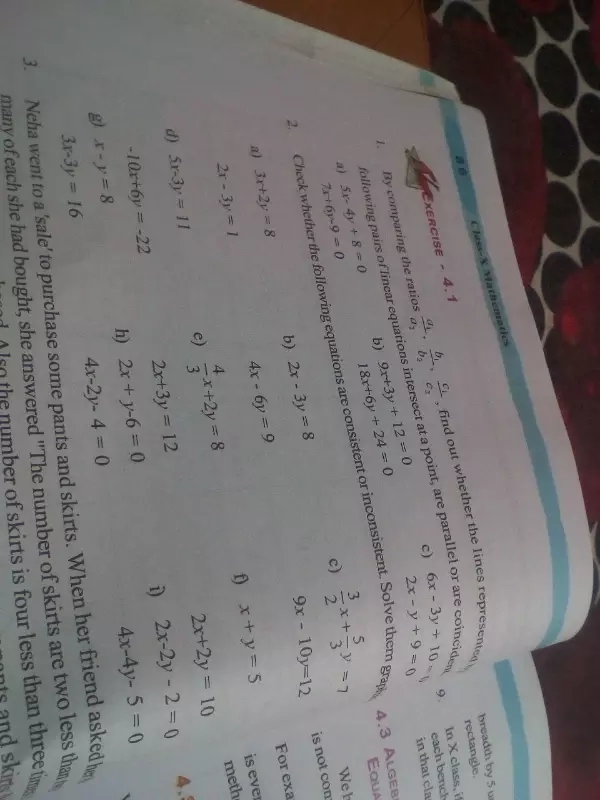

Question

Maths

Nov. 24, 2017, 8 p.m.

Answer

Nov. 24, 2017, 8 p.m.

Answer

Draw a graph of the given polynomial and find the zeros . justify your answer

p(x)=x² - x - 12

p(x)=x² - x - 12

Accounts Tax GST

Nov. 24, 2017, 11:06 a.m.

Answer

Nov. 24, 2017, 11:06 a.m.

Answer

Will you please upload some practical assignment related to AP Process. It can be helpful.

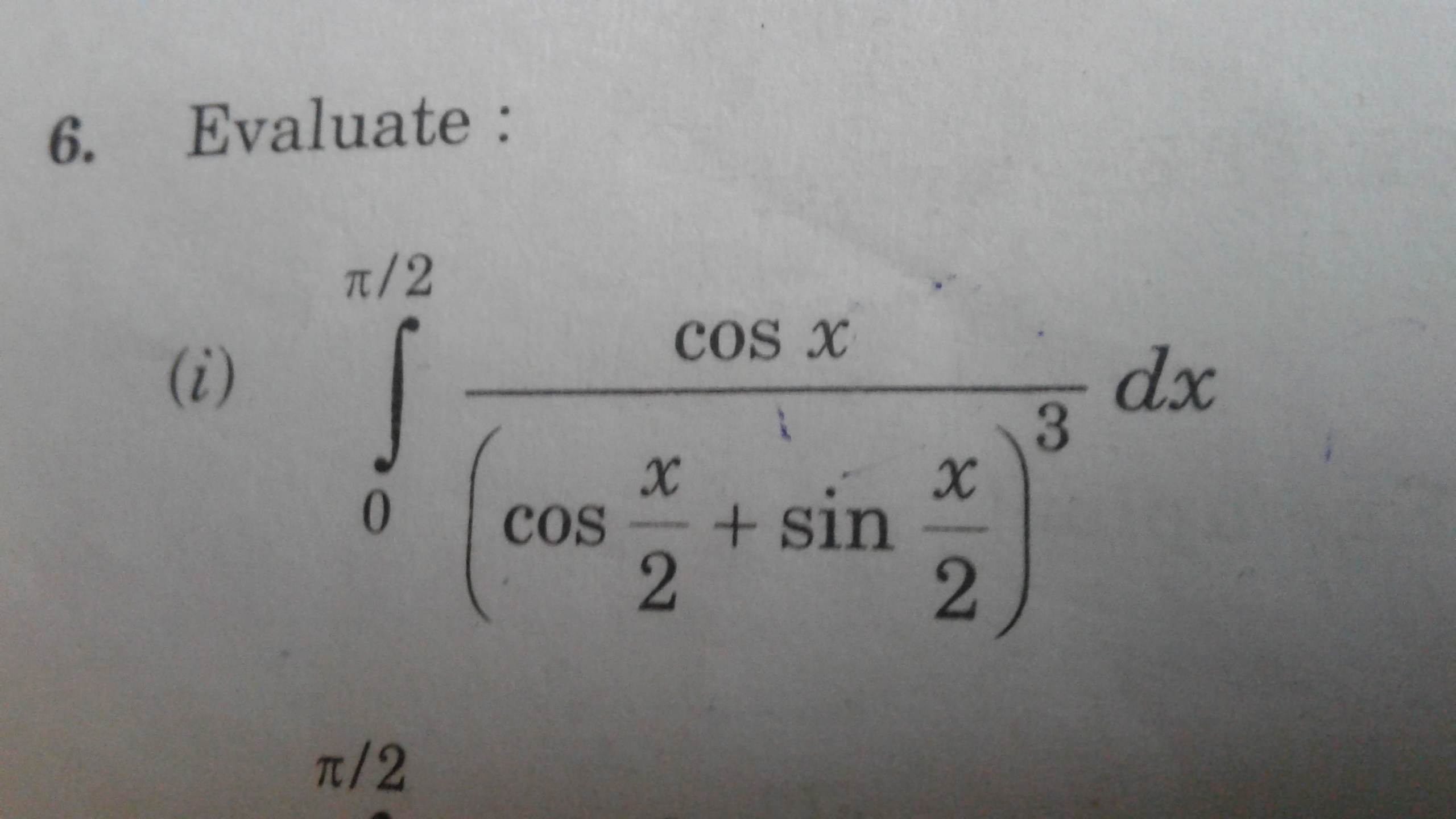

Integrate cos x / (cos x/2 + sin x/3)^3 0 to pi/2

Ques 6 part i

Elements of maths

indefinite integral 6

6

If D is the mid .point of side of side BC of a ΔABC, P and Q are two points lying respectively on the sides AB and BC such that DP is parallel to QA. Prove that ar(ΔCQP) = 1/2 ar(ΔABC).

Maths

Nov. 24, 2017, 12:13 a.m.

Answer

Nov. 24, 2017, 12:13 a.m.

Answer

In 11th ncert book ,ex. 10.3 , 3 q. That is y=0 what is the coeffocient of x and constant c

-

A solid right circular cone of diameter 14 can and height 8 cm is melted to form a hollow sphere.If the external diameter of sphere is 10 cm then find it's internal diameter

Is it necessary to do reference books like Rd sharma for exams of class 9th?

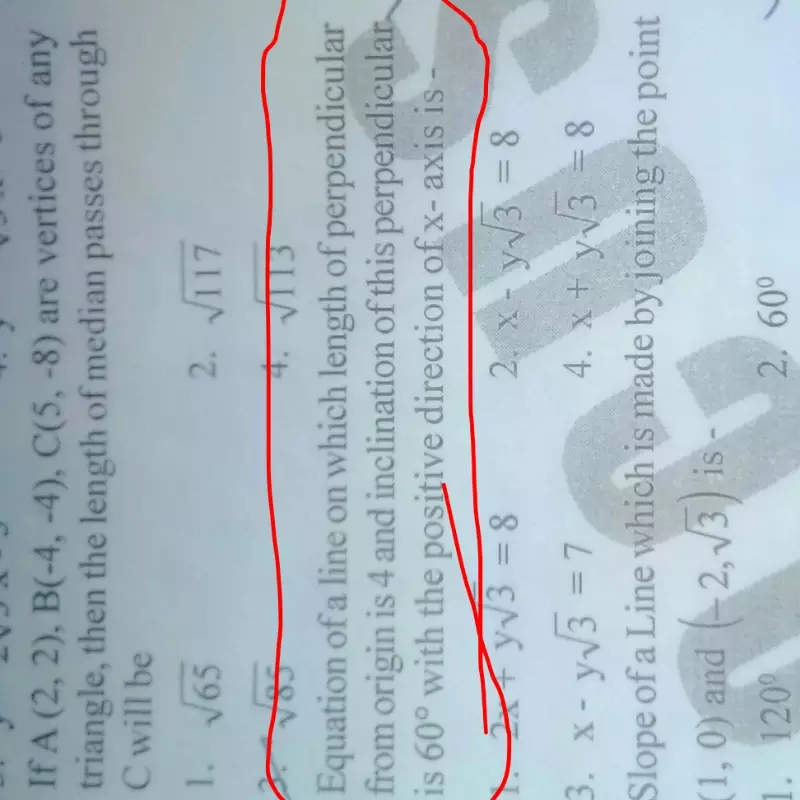

solve this underline question please

solve this underline question please