What A is representing in the reversal entry of tax liability

Question

From pack of 52 cards two are drawn one by one without replacement find the probability that both them of them are king

thank you for your answer ................

if i take the bill URD ..............for tempo hire charges 4400

labour charges 10,000

how to show the entry in tally ??? for GST ??? if any credit

Accounts Tax GST

Aug. 26, 2017, 10:10 a.m.

Answer

Aug. 26, 2017, 10:10 a.m.

Answer

plz give me advice. What is show in my CV relative to GST Form( GSTR-1,GSTR-2,GSTR-3,GST 3B etc With Date Details. I want.

I'll send cv to MNC Company.

Thanks & Regard.

Mohd Babar.

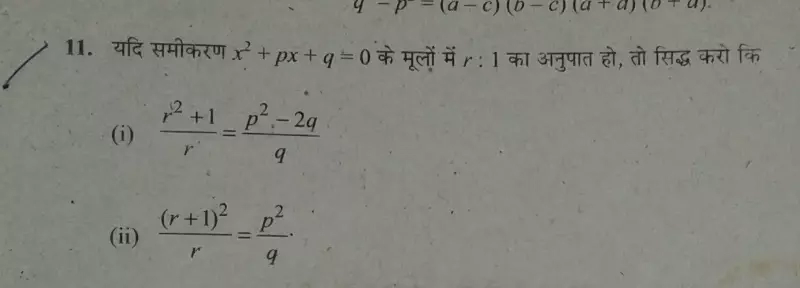

If a b c d are angles of a cyclic quadrilateral prove that Sin A-sinC=sinD-sinB

Sir, we have already generated gst payment challan please mail how to make the payment