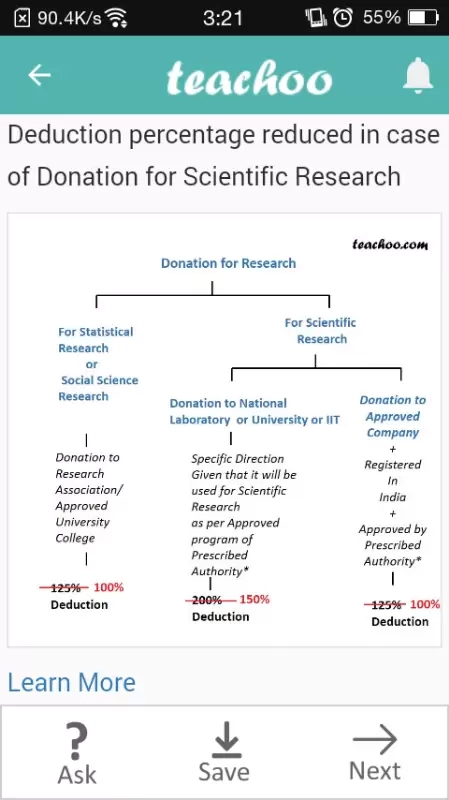

5 and 6

Whether u konw that limit is not applicable for CA IPCC MAY 2017

Whether u konw that limit is not applicable for CA IPCC MAY 2017

And your notes sayit is for may 2017

It is wrong for us

can I pay VAT Invoice in cash to Vendor..??

The Bill Amt id Rs,681/- (Incl 13.5% VAT)

Pls advice.

Can we solve the question 10 of straight line ex 13.1 by using Formula of angle between two lines. If yes then plzzzzz solve