u have bcom maths

pls i want

Dear sir,

I want to that

How to calculation under sec.142 under GST. kindly help

.

.

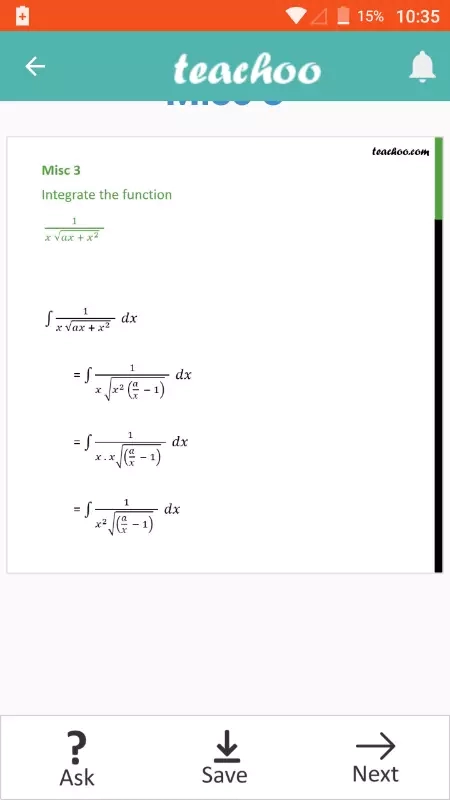

Sir I have dough in step 3 .. when we take common x^2 in root then ( a/x -1) . How ... I can't understand .

Can GSTR 3B return will be filed through off line performa as per GSTR1