Question

Dear sir I'm confused about scenario goal seek video num. 6 please explain how to know

Maths

Feb. 22, 2017, 2:29 p.m.

Answer

Feb. 22, 2017, 2:29 p.m.

Answer

can you please list out some important questions or parts in the sa-2 portion of mathematics grade9

ABCD is a square E and F are midpoint of BC and CD . If R is the midpoint of EF prove that ar AER=ar AFR

ABCD is a square E and F are midpoint of BC and CD . If R is the midpoint of EF prove that ar AER=ar AFR

difference between deemed assessee and assessee in default in table form

Thkss so much teachoo team for updating teachoo

It is so helpfull not for me but for all.....

But it is taking so much processing time and updated data not able to open

It is so helpfull not for me but for all.....

But it is taking so much processing time and updated data not able to open

Parallelograms on the same base and between the same parallels are equal in areas

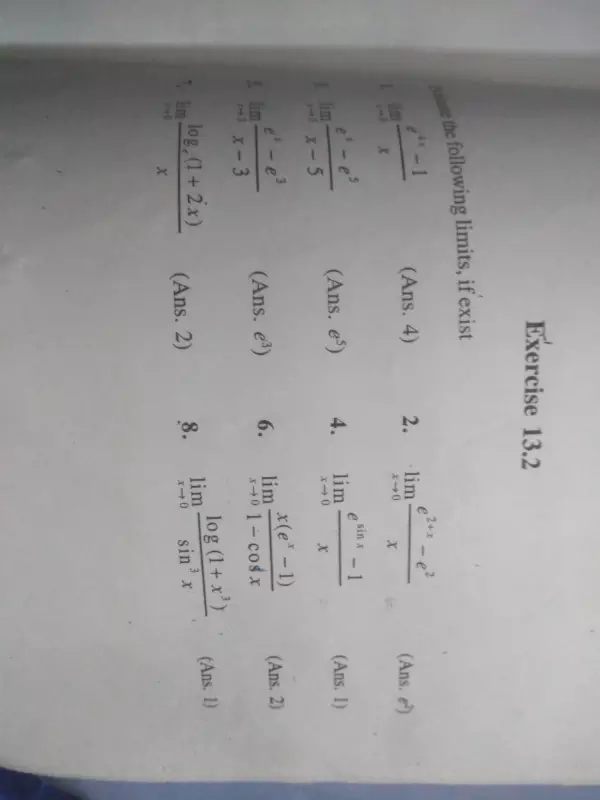

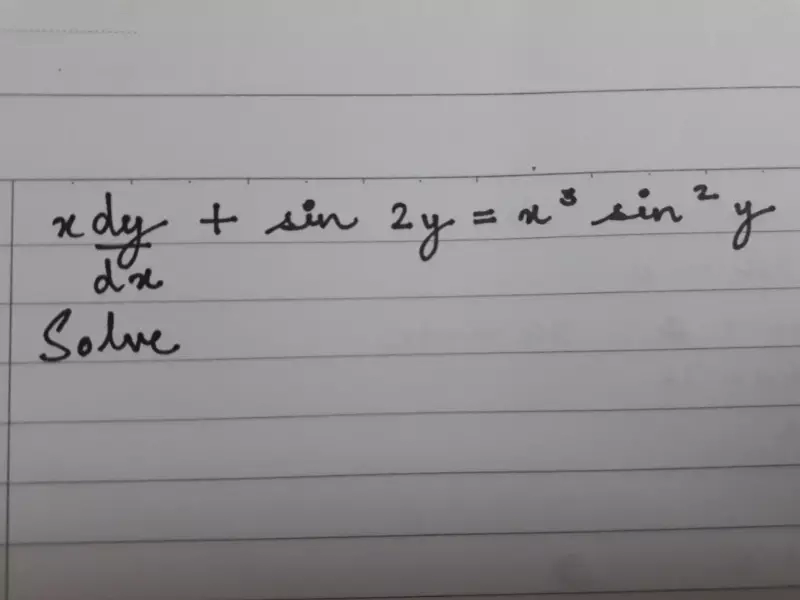

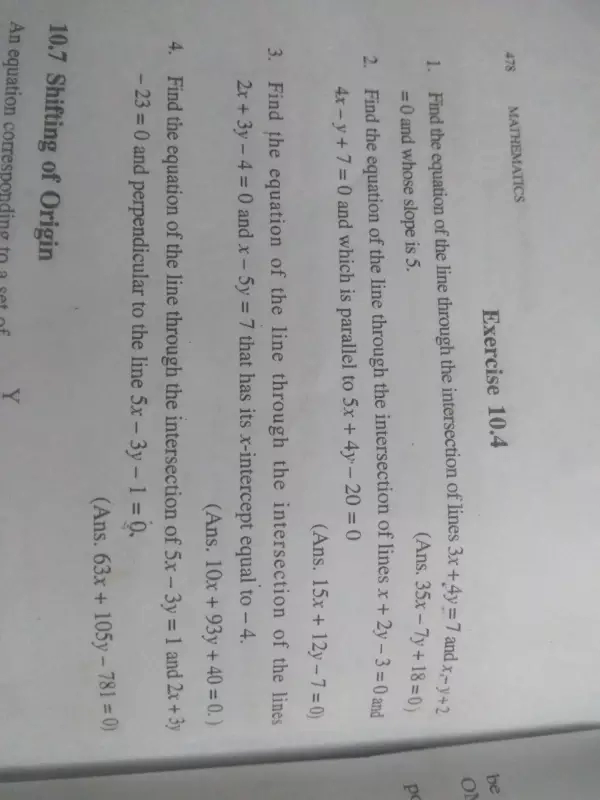

step wise solutions of these questions are urgently required please help

step wise solutions of these questions are urgently required please help

answer these questions please this is urgently required

answer these questions please this is urgently required