Question

Ann has 850 Rs. If she spent a

a.a shirt 360Rs and k trousers

b.m for medicine and 250 for fruits. How much amount remaining she

a.a shirt 360Rs and k trousers

b.m for medicine and 250 for fruits. How much amount remaining she

Dear Sir/Mam,

Please tell me that can we issue Excise invoice to the purchaser who applied for Excise No.?

1. If yes, how we show it in our excise return?

2. How the dealer claim for input?

3. At the time of making invoice, we write Excise no as APPLIEDFOR or Provisional no

Accounts Tax GST

Feb. 3, 2017, 5:01 p.m.

Answer

Feb. 3, 2017, 5:01 p.m.

Answer

Dear sir,

As you mentioned above entry in unsecured loan, you have debited interest account twice, once at the time of interest due and another one at the time of payment..

I am not a teacher, i am learner only like your other students

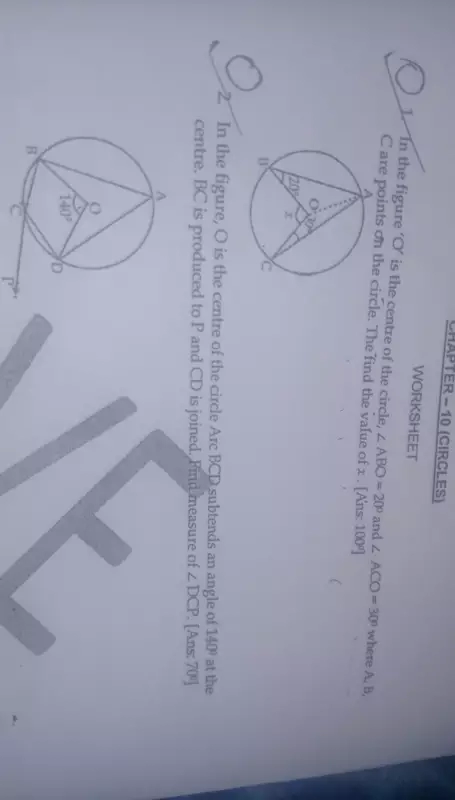

In the given figure 'o' is the center of the circle prove angle a = angle b+angle c

Write contrapositive of the following statement:

If u r born in India then u r the citizen of India