Changes in Income Tax Rebate

Income Tax Rebate increased from 2500 to 12500 if Income between 250000-500000

Earlier

Income Tax Rebate was earlier available of max 2500 if Income between 250000-350000

Now

Income Tax Rebate is now available of max 12500 if Income between 250000-500000

| OLD SLAB RATE | NEW SLAB RATE | ||

| Income | Tax | Income | Tax |

| upto 250000 | 0% | upto 250000 | 0% |

| 250001 to 500000 | 5% | 250001 to 500000 | 5% |

| 500001 to 1000000 | 20% | 500001 to 1000000 | 20% |

| Above 1000000 | 30% | Above 1000000 | 30% |

| Rebate | Rebate | ||

| If income between 250000-350000 | 2500 | If income between 250000-500000 | 12500 |

| Education Cess | 4% on tax | Education and Health Cess | 4% on tax |

** No changes in Income tax slab rate for F.Y 2019 -20 in this budget. Only rebate has been increased from 2500 to 12500 u/s 87A, if net total income is less then or up to Rs 500000

Example

Income Tax Rebate was earlier available of max 2500 if Income between 250000-350000

| OLD SLAB RATE | |||

| Particulars | Case 1 | Case 2 | Case 3 |

| Income | 350000 | 500000 | 600000 |

| Tax | 5000 | 12500 | 32500 |

| Rebate | 2500 | 0 | 0 |

| Net Tax | 2500 | 12500 | 32500 |

| Education and Health Cess 4% | 100 | 500 | 1300 |

| Tax + Cess | 2600 | 13000 | 33800 |

Now

Income Tax Rebate is now available of max 12500 if Income between 250000-500000

| NEW SLAB RATE | |||

| Particulars | Case 1 | Case 2 | Case 3 |

| Income | 350000 | 500000 | 600000 |

| Tax | 5000 | 12500 | 32500 |

| Rebate | 5000 | 12500 | 0 |

| Net Tax | 0 | 0 | 32500 |

| Education and Health Cess 4% | 0 | 0 | 1300 |

| Tax + Cess | 0 | 0 | 33800 |

Standard Deduction Now 50000 for Salaried Employees (Earlier it was 40000)

Standard Deduction has been increased from 40,000 to 50,000 now

| EARLIER | NOW | ||

| Monthly Salary | 30000 | Monthly Salary | 30000 |

| Annual Salary | 360000 | Annual Salary | 360000 |

| Less Standard Deduction | 40000 | Less Standard Deduction | 50000 |

| Income From Salary | 320000 | Income From Salary | 310000 |

EARLIER

Standard Deduction of 40000 was available

| EARLIER | ||||||

| Particular | Case 1 | Case 2 | Case 3 | Case 4 | Case 5 | Case 6 |

| Monthly Salary | 10000 | 20000 | 30000 | 45833.33 | 50000 | 1000000 |

| Annual Salary | 120000 | 240000 | 360000 | 550000 | 600000 | 12000000 |

| Less: Standard Deduction | 40000 | 40000 | 40000 | 40000 | 40000 | 40000 |

| Net Total Income | 80000 | 200000 | 320000 | 510000 | 560000 | 11960000 |

| Tax | 0 | 0 | 3500 | 14500 | 24500 | 3400500 |

| Rebate | 0 | 0 | 2500 | 0 | 0 | 0 |

| Net Tax | 0 | 0 | 1000 | 14500 | 24500 | 3400500 |

| Cess 4% | 0 | 0 | 40 | 580 | 980 | 136020 |

| Tax+Cess | 0 | 0 | 1040 | 15080 | 25480 | 3536520 |

| NOW | ||||||

| Particular | Case 1 | Case 2 | Case 3 | Case 4 | Case 5 | Case 6 |

| Monthly Salary | 10000 | 20000 | 30000 | 45833.33 | 50000 | 1000000 |

| Annual Salary | 120000 | 240000 | 360000 | 550000 | 600000 | 12000000 |

| Less: Statndard Deduction | 50000 | 50000 | 50000 | 50000 | 50000 | 50000 |

| Net Total Income | 70000 | 190000 | 310000 | 500000 | 550000 | 11950000 |

| Tax | 0 | 0 | 3000 | 12500 | 22500 | 3397500 |

| Rebate | 0 | 0 | 3000 | 12500 | 0 | 0 |

| Net Tax | 0 | 0 | 0 | 0 | 22500 | 3397500 |

| Cess 4% | 0 | 0 | 0 | 0 | 900 | 135900 |

| Tax+Cess | 0 | 0 | 0 | 0 | 23400 | 3533400 |

| Particular | Case 1 | Case 2 | Case 3 | Case 4 | Case 5 | Case 6 |

| Old Tax | 0 | 0 | 1040 | 15080 | 25480 | 3536520 |

| New Tax | 0 | 0 | 0 | 0 | 23400 | 3533400 |

| Savings | 0 | 0 | 1040 | 15080 | 2080 | 3120 |

No Tax for Salaried Tax Payers Claiming 80C If Income Up to 700000

| Salaried | |

| Particular | Amount |

| Annual Salary | 700000 |

| Less: Standard Deduction | 50000 |

| Income From Salary | 650000 |

| Less: Deduction | |

| 80 C | 150000 |

| Net Total Income | 500000 |

| Tax | 12500 |

| Rebate | 12500 |

| Net Tax | 0 |

| Cess 4% | 0 |

| Tax + Cess | 0 |

(For Businessman, Limit Is 650000)

| Business | |

| Particular | Amount |

| Annual Income | 650000 |

| Less: Standard Deduction | 0 (**No Standard deduction allow for Business.) |

| Income From Salary | 650000 |

| Less: Deduction | |

| 80 C | 150000 |

| Net Total Income | 500000 |

| Tax | 12500 |

| Rebate | 12500 |

| Net Tax | 0 |

| Cess 4% | 0 |

| Tax + Cess | 0 |

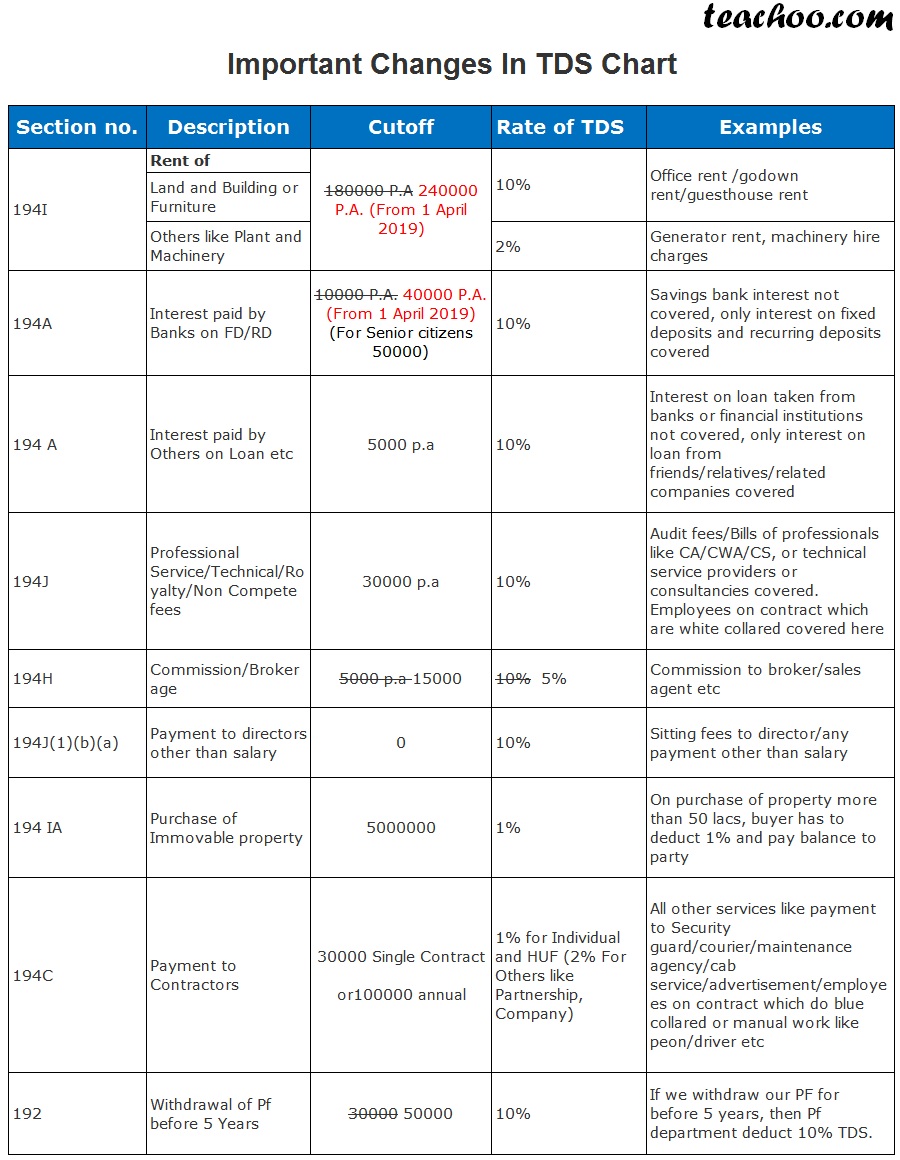

Change in TDS Cutoff

- Section 194I Limit increased from 180000 to 240000

- Section 194A Limit increased from 10000 to 40000

Section 194A TDS limit increased

Earlier

If Interest is upto 10000,No TDS.

Now

if Interest on FD is upto 40000,No TDS

(However for Interest on FD is upto 50000,then No TDS

TDS on Interest on FD/RD (Section 194A)

| OLD | NEW | ||

| Particulars | RATE | Particulars | RATE |

| Senior Citizens | Senior Citizens | ||

| Interest income more than 50000 | 10% | Interest income more than 50000 | 10% |

| Normal Citizens (Less than 60) | Normal Citizens (Less than 60) | ||

| Interest income more than 10000 | 10% | Interest income more than 40000 | 10% |

Section 194I TDS limit increased for Rent (Land and Building)

| OLD | NEW | ||

| Particulars | RATE | Particulars | RATE |

| Cut off | 180000 p.a | Cut off | 240000 p.a |

| Rate off TDS | 10% | Rate off TDS | 10% |

Income From House Property Will be 0 for Two (Earlier it was One) Self Occupied property

EARLIER

Suppose I Have 2 Houses Which Are Self-Occupied Gross Annual Value Of Only One House Can Be Nil For Second House ,We Will Calculate Income From House Property Taking Market Rent

Now

Suppose I Have 2 Houses Which Are Self-Occupied Gross Annual Value of both will Be Nil

Example 1

Suppose i have 2 houses whose market rent is 10000 and 20000 pm

Both houses are self-occupied(it is not given on rent, I am staying in it)

To Claim Section 54 Deduction, Earlier we used to claim

| Earlier | ||

| Particular | House 1 | House 2 |

| Market Rent | 10000 | 20000 |

| Annual Rent | 120000 | 240000 |

| Gross Annual Value | 120000 | 0 |

| Less Standard Deduction 30% | 36000 | 0 |

| Less Municipal Taxes | 0 | 0 |

| Net Annual Value | 36000 | 0 |

| Less Int On Loan | 0 | 0 |

| Income From House Property | 36000 | 0 |

| Now | ||

| Particular | House 1 | House 2 |

| Market Rent | 10000 | 20000 |

| Annual Rent | 120000 | 240000 |

| Gross Annual Value | 0 | 0 |

| Less Standard Deduction 30% | 0 | 0 |

| Less Municipal Taxes | 0 | 0 |

| Net Annual Value | 0 | 0 |

| Less Int On Loan | 0 | 0 |

| Income From House Property | 0 | 0 |

Section 54 Exemption can be used for Purchase of 2 House Property

(Earlier it was 1 house Properties)

Section 54 exemption now available on the second house property, provided the capital gains is less than or equal to Rs. 2 crores – to be availed only once in a lifetime.

Example 1

| Amount | |

| Suppose I Sell A Property For 40 Lacs | 40 Lacs |

| Its Cost(After Indexation) Is | 30 Lacs |

| Long Term Capital Gain | 10 Lacs |

This 10 Lacs I Have To Invest In Purchasing Property

If I Purchase This Property For 8 Lacs,I Used To Get Deduction Under Section 54 Of 8 Lacs

| Amount | |

| Suppose I Sell A Property For 40 Lacs | 40 Lacs |

| Its Cost(After Indexation) Is | 30 Lacs |

| Long Term Capital Gain | 10 Lacs |

| Less Section 54 Deduction | 8 Lacs |

| Net Income From Capital Gain | 2 Lacs |

If I Purchased 2 Properties Of 6 Lacs And 2 Lacs,I Will Deduction For Only One Property

I will take deduction for property having higher value

| Amount | |

| Suppose I Sell A Property For | 40 Lacs |

| Its Cost(After Indexation) Is | 30 Lacs |

| Long Term Capital Gain | 10 Lacs |

| Less Section 54 Deduction | 6 Lacs |

| Net Income From Capital Gain | 4 Lacs |

But From F.Y 2019-20 Onward,I Can Get Deduction For Both House Property Purchases Of 6 Lacs And 2 Lacs

| Case 4 | Amount |

| Suppose I Sell A Property For | 40 Lacs |

| Its Cost(After Indexation) Is | 30 Lacs |

| Long Term Capital Gain | 10 Lacs |

| Less Section 54 Deduction (6 lac + 2 lac) | 8 Lacs |

| Net Income From Capital Gain | 2 Lacs |

Note

This Is Applicable Only If Amount Of Capital Gain Is Upto 2 Crore Rupees

Example 2

| Amount | |

| Suppose I Sell A Property For | 700 Lacs |

| Its Cost(After Indexation) Is | 400 Lacs |

| Long Term Capital Gain | 300 Lacs |

I Purchase 2 Properties For 220 And 50 Lacs

Since capital gain is more than 200 lac, i take deduction for only one property

I Take Deduction To Either 220 Or 50 Lac

We Can Take Deduction Under Sec 54 For The Amount 220 Lac .

| Amount | |

| Suppose I Sell A Property For | 700 Lacs |

| Its Cost(After Indexation) Is | 400 Lacs |

| Long Term Capital Gain | 300 Lacs |

| Less Deduction | 220 Lacs |

| Net Income From Capital Gain | 80 Lacs |

Download in PDF