Term Loan refers to Loan taken for limited period of time.

Whole amount including Interest is repaid either together at once or in instalments (EMI)

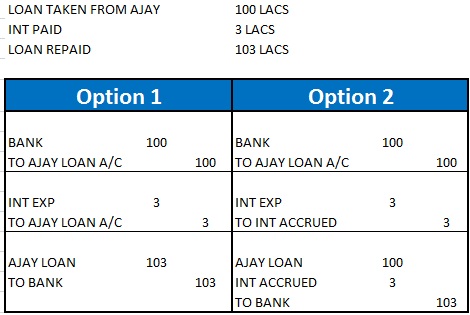

Entry for Loan Taken

Bank A/c Dr

to Loan A/c

Entries for Interest

Interest A/c Dr

To Loan A/c Dr

Entry for Loan Repaid

Loan A/c Dr

To Bank A/c

LOAN ENTRIES ASSIGNMENT

Pass Entry for Loan taken, Interest and Principal Repayment.

Unsecured Loan

Unsecured Loan taken from Akash & Co Rs 50000 @ 12% p.a.

Amount received by cheque.

It was repaid after 6 months together with Interest

View AnswerAt the time loan was taken:

Bank A/c Dr 50000

To Akash and Co (12%) Loan A/c 50000

( Being amount of loan received)

Interest Expense A/c Dr 3000

To Akash and Co (12%) Loan A/c 3000

( Being interest on loan charged)

At the time of repayment of loan :

Akash and Co (12%) Loan A/c Dr 53000

To Bank A/c 53000

(Being loan amount repaid.)

Secured Loan EMI

Term Loan was taken from PNB Bank 100000.

It was to be repaid in 4 monthly EMI of Rs 25628 as follows

Principal and Interest repayment chart (as given by Bank)

|

Month |

Op Balance of Loan |

EMI Repaid |

Interest Component |

Principal Component |

Closing Balance of loan |

|

1 |

100000 |

25628 |

1000 |

24628 |

75372 |

|

2 |

75372 |

25628 |

754 |

24874 |

50498 |

|

3 |

50498 |

25628 |

505 |

25123 |

25374 |

|

4 |

25374 |

25628 |

254 |

25374 |

0 |

|

|

Total |

102512 |

2512 |

100000 |

|

View Answer

At the time loan was taken:

Bank A/c Dr 100000

To PNB Loan A/c 100000

( Being amount of loan received)

End of month 1:

Interest Expense A/c Dr 1000

To PNB Loan A/c 1000

(Being interest expense booked)

PNB Loan A/c Dr 25628

To Bank A/c 25628

(Being loan repaid)

End of month 2:

Interest Expense A/c Dr 754

To PNB Loan A/c 754

(Being interest expense booked)

PNB Loan A/c Dr 25628

To Bank A/c 25628

(Being loan repaid)

End of month 3:

Interest Expense A/c Dr 505

To PNB Loan A/c 505

(Being interest expense booked)

PNB Loan A/c Dr 25628

To Bank A/c 25628

(Being loan repaid)

End of month 4:

Interest Expense A/c Dr 254

To PNB Loan A/c 254

(Being interest expense booked)

PNB Loan A/c Dr 25628

To Bank A/c 25628

(Being loan repaid)

Term Loan for Asset Purchase

Building purchased for 100 lacs.from Ajay Properties on 1 July 2016

Amount spent on further construction =20 lacs

Total Project Cost=120 lacs

ICICI Bank gave loan at 75% of project cost @ 10% p.a

(120 lacs*75%=90 lacs)

Whoie amount repaid after 6 months including interest

Construction was complete by 31 Aug 2016

Pass Entries for Asset Purchased,Loan Taken,EMi and Interest Repaid

View AnswerOn 1 st july:

Building WIP Dr 10000000

To Ajay Properties A/c 10000000

(Being building purchased.)

Loan from ICICI bank:

Bank A/c Dr 9000000

To ICICI 10% Loan A/c 9000000

( Being loan amount received.)

Building WIP Dr 2000000

To Bank A/c 2000000

(Building construction charges)

Interest on loan from ICICI bank (1 st july to 31 st August 2016)

Building WIP A/c Dr 150000

To ICICI 10% Loan A/c 150000

(Being interest on loan during construction is capitalized.)

Interest on loan from ICICI bank ( 31 st August 2016 to 31 st December 2016)

Interest On Loan A/c Dr 300000

To ICICI 10% Loan A/c 300000

(Being interest on loan charged after Construction Completed booked as expense)

Building Dr 13500000

To Building WIP Dr 13500000

(Being construction of building finally completed.)

Repayment of loan:

ICICI 10% Loan A/c Dr 9450000

To Bank A/c 9450000

( Being loan repaid.)

Term Loan for Asset Purchase +EMI

Resolve last question assuming EmI for Loan is 1544053 for 6 months as

| Month | Op Balance of Loan | EMI Repaid | Interest Component | Principal Component | Closing Balance of Loan |

| July | 9000000 | 1544053 | 75000 | 1469053 | 7530947 |

| Aug | 7530947 | 1544053 | 62758 | 1481295 | 6049652 |

| Sept | 6049652 | 1544053 | 50414 | 1493639 | 4556013 |

| Oct | 4556013 | 1544053 | 37967 | 1506086 | 3049926 |

| Nov | 3049926 | 1544053 | 25416 | 1518637 | 1531289 |

| Dec | 1531289 | 1544053 | 12761 | 1531292 | 0 |

Pass Entry for Loan taken, Interest and Principal Repayment.

View AnswerOn 1 st july:

Building WIP Dr 10000000

To Ajay Properties A/c 10000000

(Being building purchased.)

Loan from ICICI bank:

Bank A/c Dr 9000000

To ICICI 10% Loan A/c 9000000

( Being loan amount received.)

Building WIP Dr 2000000

To Bank A/c 2000000

(Building construction charges)

At End of July:

Building WIP A/c Dr 75000

To ICICI 10% Loan A/c 75000

(Being interest expense capitalized)

ICICI 10% Loan A/c Dr 1544053

To Bank A/c 1544053

(Being loan repaid)

At End of August:

Building WIP A/c Dr 62758

To ICICI 10% Loan A/c 62758

(Being interest expense capitalized)

ICICI 10% Loan A/c Dr 1544053

To Bank A/c 1544053

(Being loan repaid)

At End of September:

Interest Expense A/c Dr 50414

To ICICI 10% Loan A/c 50414

(Being interest expense charged)

ICICI 10% Loan A/c Dr 1544053

To Bank A/c 1544053

(Being loan repaid)

At End of October:

Interest Expense A/c Dr 37967

To ICICI 10% Loan A/c 37967

(Being interest expense charged)

ICICI 10% Loan A/c Dr 1544053

To Bank A/c 1544053

(Being loan repaid)

At End of November:

Interest Expense A/c Dr 25416

To ICICI 10% Loan A/c 25416

(Being interest expense charged)

ICICI 10% Loan A/c Dr 1544053

To Bank A/c 1544053

(Being loan repaid)

At End of December:

Interest Expense A/c Dr 12761

To ICICI 10% Loan A/c 12761

(Being interest expense charged)

ICICI 10% Loan A/c Dr 1544053

To Bank A/c 1544053

(Being loan repaid)