What is E-Way bill?

E-Way bill means Electronic Way Bill

It is an online form which is to be filled in case of movement of goods

It is mandatory from 1 Apr 2018

Example 1

A Ltd, Delhi makes sales to B Ltd of Mumbai

It sends goods from Delhi to Mumbai through truck operator T

In this case, Truck operator has to carry a copy of invoice + copy of E-Way bill

During the transport of Goods

Is E -Way Bill is for Sale of Goods or Service?

It is required in case of Movement of goods

Hence,it is not applicable in case of Services

Is E Way bill required for Movement by hand or Rickshaw

It is required in case of Movement by motorized Vehicle only

When is E Way Bill Compulsory?

It is required in case of

Movement of goods of more than 50000 including GST

This movement may be in case of

- Supply of goods (Sale of goods, branch transfer etc)

- Other than Supply (Sales Return etc)

- Inward Supply form Unregistered Person (Purchase from Unregistered Dealer)

All Type of Sales Covered whether B2B,B2C,Export,Import

Different Rules for Intrastate Sales (Local Sales)

Example

In Delhi,E Way bill is Required in case of Sale of Goods more than 1 lacs

Also E-Way bill is required only in case of B2B Sales (not B2C)

When is E-Way bill Not Required

- If value of goods is less than 50000

- In case of non-motorized transport of goods

-

No E-way bill for Certain Specified Goods

- Liquefied petroleum gas for supply to household and non-domestic exempted category customers

- Kerosene oil sold under PDS

- Postal baggage transported by Department of Posts

- Natural or cultured pearls and precious or semi-precious stones; precious metals and metals clad with precious metal

- Jewellery, goldsmiths’ and silversmiths’ wares and other articles

- Currency

- Used personal and household effects

- Unworked and worked coral

- Goods being transported are alcoholic liquor for human consumption, petroleum crude, high-speed diesel, petrol, natural gas or aviation turbine fuel.

- Goods being transported are not treated as supply under Schedule III of the Act (Schedule III consists of activities that would neither be supply of goods nor service like service of an employee to an employer in the course of his employment, functions performed by MP, MLA etc.)

- Goods transported are empty cargo containers

- Goods, other than de-oiled cake, being transported are specified in notification No. 2/2017 – Central tax (Rate) dated the 28th June, 2017. Few of the goods that are included in the above notification are as follows:

- Curd, lassi, buttermilk

- Fresh milk and pasteurized milk not containing added sugar or other sweetening matter

- Vegetables

- Fruits

- Unprocessed tea leaves and unroasted coffee beans

- Live animals, plants and trees

- Meat

- Cereals

- Unbranded rice and wheat flour

- Salt

- Items of educational importance (books, maps, periodicals)

E-way Bill on Import of Goods

E-Way bill is generated for period from Port to Customer Premises

However if Goods are transported from Port to ICD and then from ICD to customer Premises

No E way bill for first transaction,only for Second transaction

E-way Bill on Export of Goods

E-Way bill is required to be issued from Customer Premises to Place where goods are leaving country

This distance to be mentioned and not distance upto Foreign Country

Exemption-

Export of Goods to Nepal and Bhutan has been exempted by Govt

Transport from Port, Airport or Land Custom Station to ICD (Inland Container Depot) or CFS (Container Freight Station)

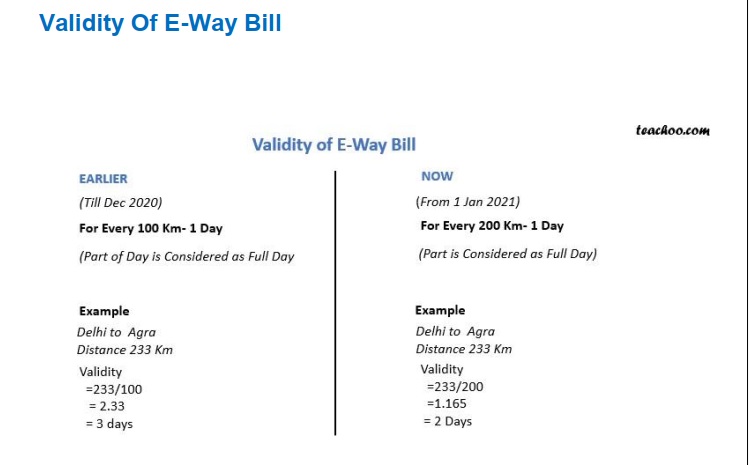

Validity Of E-Way Bill

How to Generate E-Way Bill

it can be Generated direct online from www.ewaybill.nic.in as well as from Tally

Who shall Generate E-way bill?

It is to be generated by

Consignor

or

Consigneee

or

Transporter

If a registered person purchases from unregistered,in this case registered person has to Generate E-way bill

What is Website for E-way bill?

Procedure to Generate E-Way bill

1.Go to E-Way Bill website

2. Click E-Way Bill Registrations

3. Enter GSTIN No. and Code then click Go Button

4. Enter Details and click Send OTP then enter OTP Then click Verify OTP

5. Enter Details Then click Submit Button

6. Enter Login details then click login button

7. Click E-way Bill

8.Click Generate New

9. Fill all details then click button button

10. It shows E- way bill slip

Part A and Part B of E-Way Bill

DIFFERENT SUB-TYPES OF E WAY BILLS

OUTWARD

SUB-TYPES

| NAME | MEANING |

| SUPPLY | NORMAL SALES LOCAL OR INTERSTATE |

| EXPORT | EXPORT SALES BOND OR NO BOND |

| JOB WORK | GOODS SENT OUTSIDE FACTORY FOR MANUFACTURING/WELDING/DYEING |

| SKD/CKD/LOTS | GOODS SENT IN PARTS(COMPLETELY KNOCKED DOWN/SEMI KNOCKED DOWN) |

| FOR OWN USE | BRANCH TRANSFER WITHIN STATE BY DELIVERY CHALLAN |

| LINE SALES | GOODS SENT FROM ONE PRODUCTION LINE TO OTHER PRODUCTION LINE(MY ONE FACTORY TO OTHER FACTORY) |

| RECIEPENTS NOT KNOWN | (A CARRIES GOOD TO B SHOP DISPLAYS IT AND THEN WHEN B AGREES TO BUY IT HANDOVER GOOD TO B) |

| EXIBITIONS OR FAIRS | GOODS SENT TO TRADE FAIR |

| OTHER | ALL OTHERS (GOODS SENT) |

INWARD SUBTYPES

| NAME | MEANING |

| SUPPLY | NORMAL PURCHASE LOCAL OR INTERSTATE |

| IMPORT | IMPORT PURCHASE |

| SKD/CKD/LOTS | GOODS RECEIVED IN PARTS(COMPLETELY KNOCKED DOWN/SEMI KNOCKED DOWN) |

| JOB WORK RETURN | GOODS RECEIVED OUTSIDE FACTORY FOR MANUFACTURING/WELDING/DYEING |

| SALE RETURN | GOOD RETURN BY BUYERS |

| FOR OWN USE | BRANCH TRANSFER WITHIN STATE BY DELIVERY CHALLAN |

| EXIBITIONS OR FAIRS | GOODS SENT TO TRADE FAIR |

| OTHER | ALL OTHERS (GOODS RECEIVED) |

Till 31 st Jan 2018

E Way bill was applicable only in UP and procedure was different

-v-

-

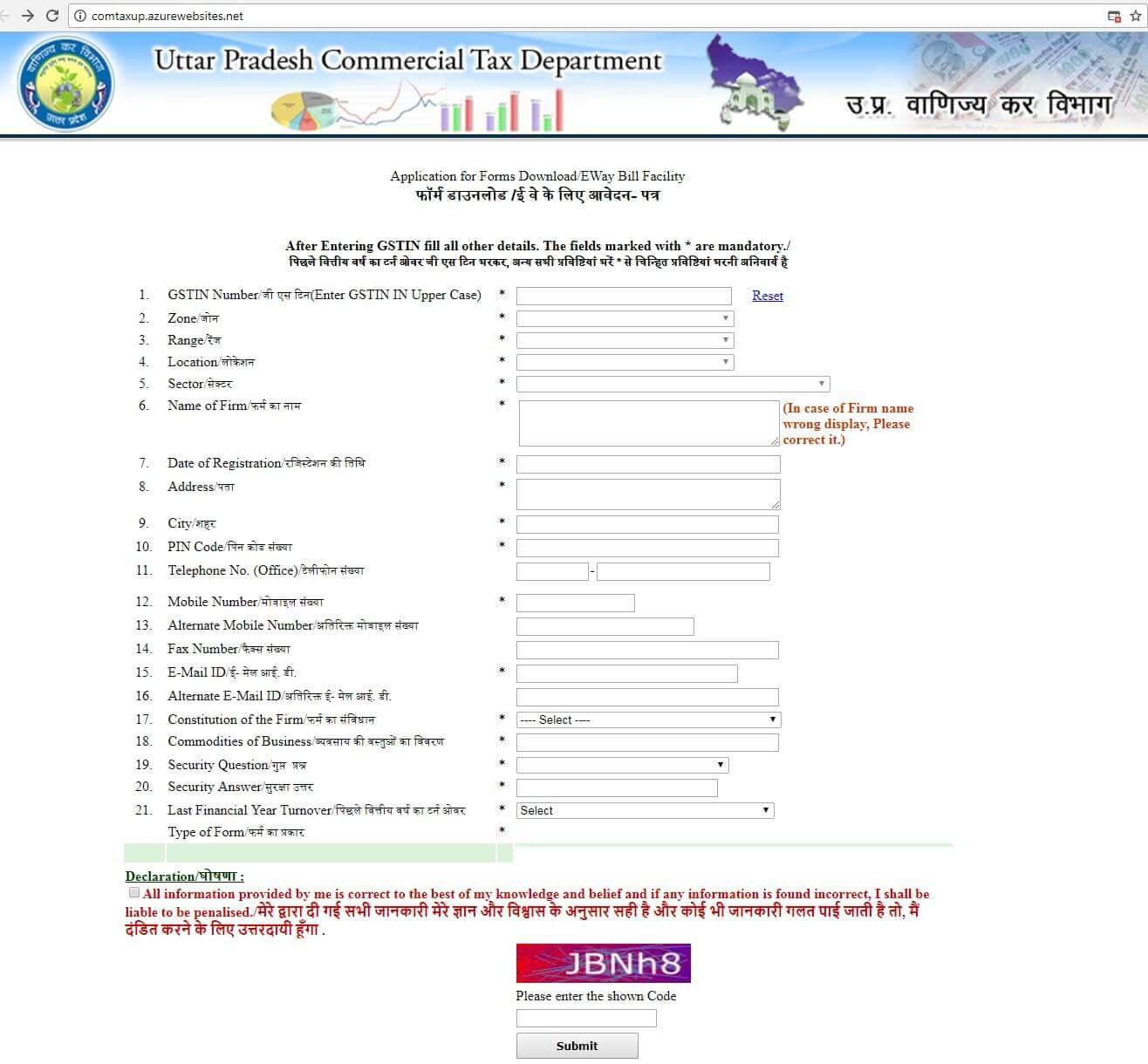

- Do registration at website of up commercial tax( http://comtax.up.nic.in ).. User ID n Password will be sent at email ID and mobile

- Enter login detail. Go to E-way bill. Generate token number. After that go to download eway bill and fill detail and click on preview button. E-way bill will be generated

Different e-way bills have been prescribed under different circumstances as under:

|

Name of Firm |

Use For |

|

Transit System (TDF / Bahti) |

Goods Movement from Other State to Other State, pass vehicle from Uttar Pradesh. |

|

E-Way Bill – 01 |

Goods Movement from other State to Uttar Pradesh |

|

E-Way Bill – 02 |

Goods Movement from City to City within Uttar Pradesh |

|

E-Way Bill – 03 |

E-Commerce Company within Uttar Pradesh. |

All types of the above mentioned e-way bills have to be downloaded from UP GST/Commercial Tax website ( http://comtax.up.nic.in ).

How to fill Transit System (TDF / Bahti) ?

-a-

Go to http://comtaxup.azurewebsites.net/

Click Transit System (TDF-Bahti) then Submit

-then-submit.jpg)

Fill Details

-ea-

How to fill E-Way Bill – 01?

-a-

Go to http://comtaxup.azurewebsites.net/

E-Way Bill (01, 02, 03)

.jpg)

Fill Details

-ea-

How to fill E-WayBill Registration For GST Goods?

-a-

Go to http://comtaxup.azurewebsites.net/

E-WayBill Registration For GST Goods

Fill Details

-ea-

How to fill E-WayBill Registration For Non GST Goods?

-a-

Go to http://comtaxup.azurewebsites.net/

E-WayBill Registration For Non GST Goods

Fill Details

-ea-

How to fill E-Way Bill Registration For Unregistered Dealer?

-a-

Go to http://comtaxup.azurewebsites.net/

E-Way Bill Registration For Unregistered Dealer

Fill Details

-ea-

E-WAY BILL

Concept of E-Way Bill to be Introduced in Staggered Manner starting from 1 Jan 2018

There will be different dates for its launch in different states

In Whole of India,it will be launched by 1 April 2018

-ev-