What is CGST?

It means Central GST(Central Goods and Service Tax)

It is charged on local sales

What is SGST?

It means State GST(State Goods and Service Tax)

It is charged on local sales (sales within state)

What is IGST?

It means Intergrated GST

It is charged on interstate sales(sales outside state)

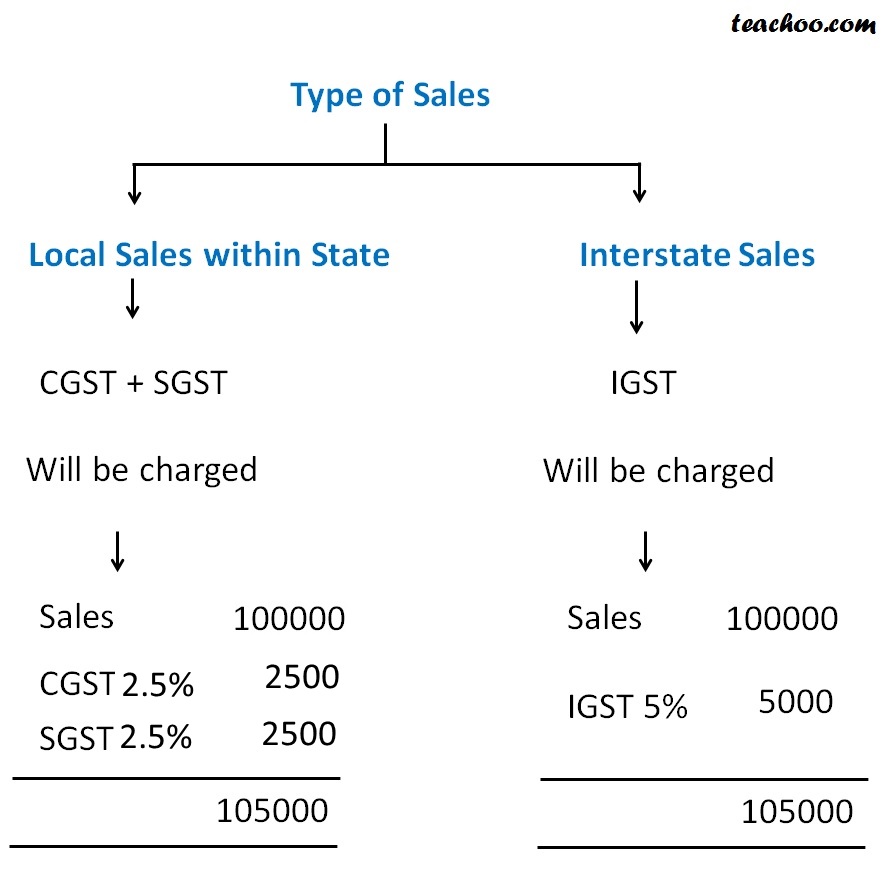

Which Type of GST on Which Sales?

| TYPE OF SALES | TAX CHARGED |

|

LOCAL SALE WITHIN STATE |

CGST+ SGST |

| CENTRAL SALE OUTSIDE STATE | IGST |

What will be Rate of CGST, SST AND IGST?

Suppose government has declared Rate of ITEM as 5%

If we sale within state,we willl charge

CGST 2.5% and SGST 2.5%

If we sale outside state,we will charge

IGST = 5%

Hence

TAX RATE ON IGST

=TAX RATE ON CGST+TAX RATE ON SGST

Example 1

Sales Amount=20000

Suppose Rate of tax on goods as per CGST is 9% and SGST is 9%

Make Bill assuming it is Local Sales within State

View Answer| SALES | 20000 | |

| CGST | 9% | 1800 |

| SGST | 9% | 1800 |

| TOTAL | 23600 |

Example 2

Solve last question assuming it was Interstate Sales

View AnswerIn this case,IGST Will be charged

| SALES | 20000 | |

| IGST | 18% | 3600 |

| TOTAL | 23600 |

Difference between CGST,SGST AND IGST

| CGST | SGST | IGST |

| Its full form is | Its full form is | Its full form is |

| Central Goods and Service Tax | State Goods and Service Tax | Integrated Goods and Service Tax |

| It is charged on local sales (Sales within State) | It is also charged on local sales (Sales within State) | It is charged on Interstate sales (Sales Outside State) .It is also charged on Imports |

| This tax is levied and administered by Central Govt | This tax is levied and administered by State Govt | This tax is levied and administered by Central Govt |

| It is the Revenue of Central Govt | It is the Revenue of State Govt | Its Revenue is shared between Central and State Govt |

| It has replaced taxes like Central Excise and Service tax | It has replaced taxes like VAT, Luxury tax and Entertainment tax | It has replaced taxes like CST(Central Sales Tax) |