See what others have taught

Dec. 16, 2024, 2 p.m.

Please explain Excess provision account and under which head??It is indirect incomeExplnanationWhen we make provision,we book an expense as followsExpense DrTo Provision for expWhen we Reverse excess Provision,we Book Inocme as followsProv for ExpTo Excess Provision Written off(Income)

Dec. 16, 2024, 1:59 p.m.

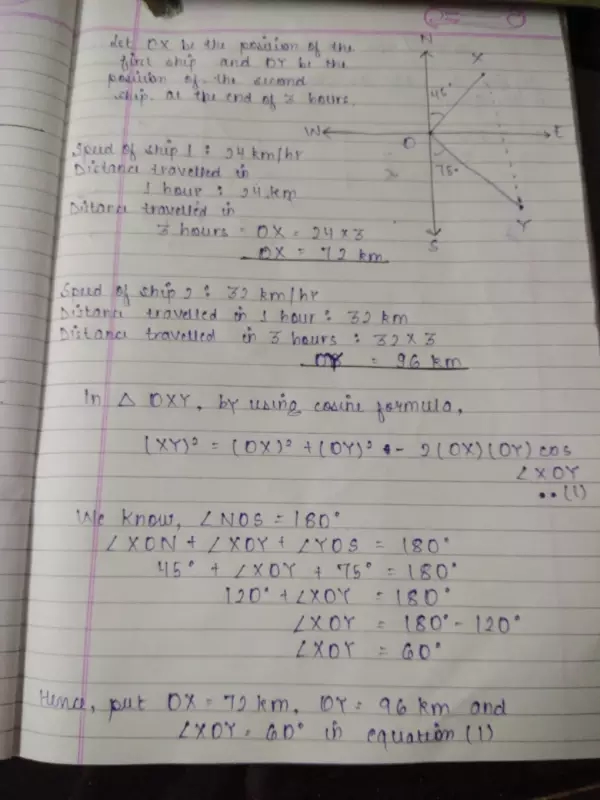

Two ships leave a port at the same time. One goes 24km/hr in the direction N45°E and the other travels 32km/hr in the direction S75°E. Find the distance between the ships at the end of 3 hours.AnswerText version of the answer isLet Ox be the position of the first ship and dy be the position of the

Dec. 16, 2024, 1:58 p.m.

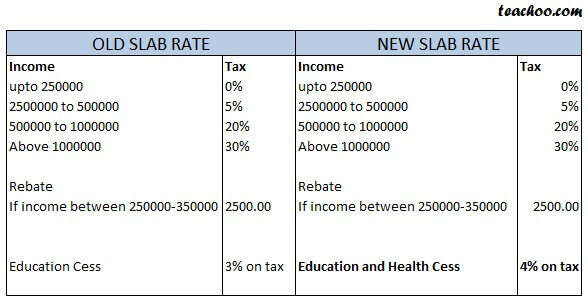

Here we will learn in easy language about Income Tax for Financial Year 2017-18 (Assessment Year 2018-19) likeWhat is income TaxTypes of incomes Under Income TaxConcept of Previous Year and Assessment YearWho is AssesseeWhat is Income tax ChallanIncome Tax Return (ITR)Changes in Finance Act. (Budget

Dec. 16, 2024, 1:58 p.m.

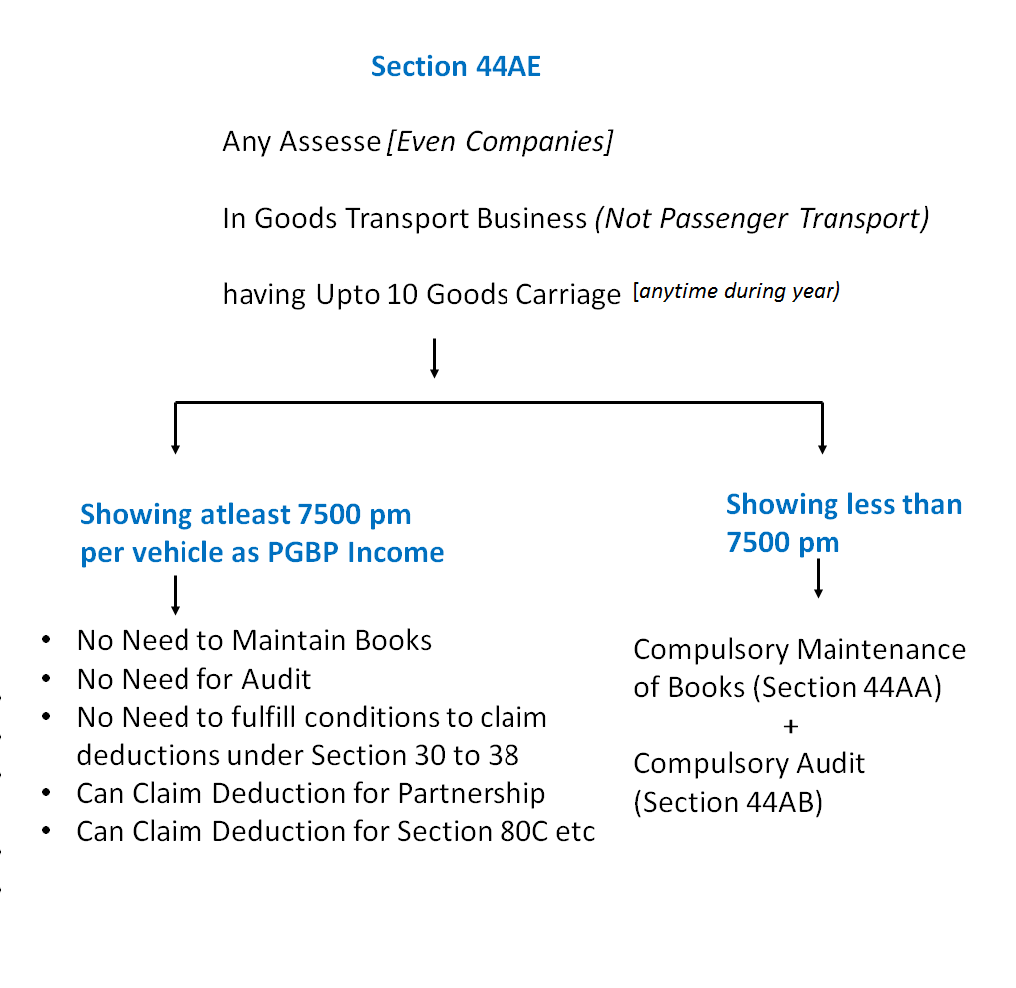

There are 3 schemesFor ProfessionalsFor BusinessFor Goods Transport AgencyFor ProfessionalsPresumptive Income of ProfessionalsApplicable for Financial Year 2016-17 (AY 2017-18)IF Gross Receipts upto 50 lacs50% of Receipts will be ProfitNo need for AuditNo need to maintain books of accountsIf Profess