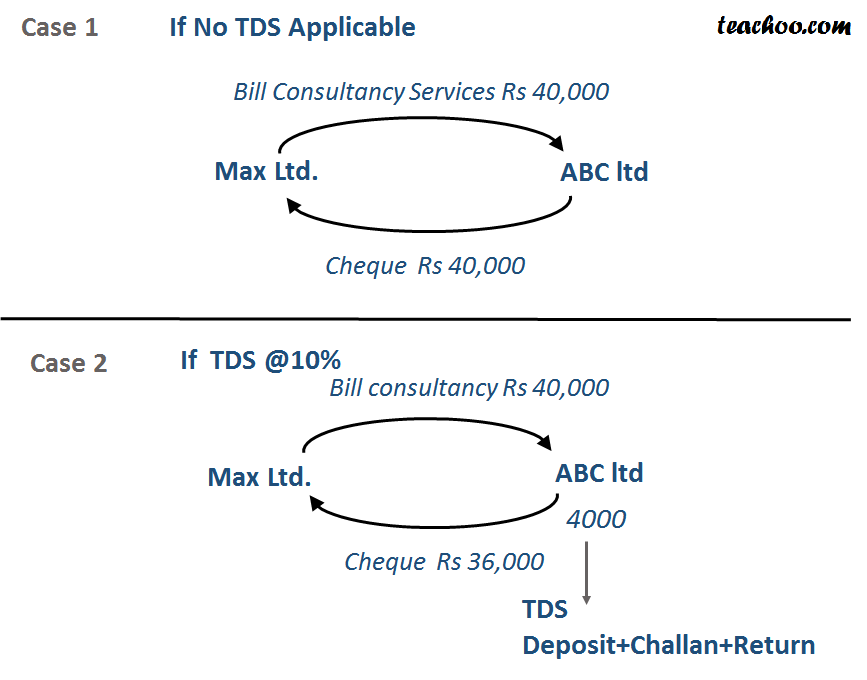

TDS means Tax Deducted at Source.

It is a tax which is to be deducted on some expenses and payments

As per Income Tax Act, persons responsible for making payments are required to deduct TDS at different rates.

Important Sections TDS Chart (From 1st June 2016)

|

Section no |

Description |

Cutoff |

Rate of TDS |

Examples |

|

194I |

Rent of |

180000 p.a |

10% |

Office rent /godown rent/guesthouse rent |

|

Land and Building or Furniture |

||||

|

Others like Plant and Machinery |

2% |

Generator rent, machinery hire charges |

||

|

194J |

Professional Service/Technical/Royalty/Non Compete fees |

30000 p.a |

10% |

Audit fees/Bills of professionals like CA/CWA/CS, or technical service providers or consultancies covered. Employees on contract which are white collared covered here |

|

194H |

Commission/Brokerage |

5000 p.a 15000 p.a |

10% 5% |

Commission to broker/sales agent etc |

|

194J(1)(b)(a) |

Payment to directors other than salary |

0 |

10% |

Sitting fees to director/any payment other than salary |

|

194A |

Interest paid by Banks on FD/RD |

10000 p.a |

10% |

Savings bank interest not covered, only interest on fixed deposits and recurring deposits covered |

|

194 A |

Interest paid by Others on Loan etc |

5000 p.a |

10% |

Interest on loan taken from banks or financial institutions not covered, only interest on loan from friends/relatives/related companies covered |

|

194 IA |

Purchase of Immovable property |

4999999 |

1% |

On purchase of property more than 50 lacs, buyer has to deduct 1% and pay balance to party |

|

194C |

Payment to Contractors |

30000 Single Contract or 75000 100000 annual |

1% for Individual and HUF (2% For Others like Partnership, Company) |

All other services like payment to Security guard/courier/maintenance agency/cab service/advertisement/employees on contract which do blue collared or manual work like peon/driver etc |

|

192A |

Withdrawal of Pf before 5 Years |

30000 50000 p.a |

10% |

If we withdraw our PF for before 5 years, then Pf department deduct 10% TDS. |

Total Rent paid during year =15000*12=180000

No TDS to be deducted as Total rent paid during year is not more than 180000

TDS Certificate is of 2 types

- Form 16A for TDS NON SALARY

(to be given quarterly 15 days of due date of TDS Return) - Form 16 for TDS SALARY

(to be given annually by 31 May of next year)

TDS Return Basically Contains following types of Details

1.Deductor Details

(Details of Our Company who is filling TDS Return)

2, Challan Details

(Details of Monthly TDS Challans which we have filed)

3. Deductee Details Challan vise

(Details of Different Parties whose TDS we have deducted in one challlan)

Note:-

It is normally done through some TDS Return Software

Some of these softwares are Paid while Government also provides a free software called RPU (Return Preparation Utility)

https://www.teachoo.com/955/369/Procedure-for-TDS-Return/category/Return-Procedure/

(7th of Next Month except March)

| Month | Challan 281 |

| Jan | 07-Feb |

| Feb | 07-Mar |

| March | 30-Apr |

| April | 07-May |

(31 Days from end of quarter except March)

| TDS Returrn | FORM 26Q/27Q | FORM 24Q | |

| TDS Non Salary | TDS Salary | ||

| Q1 | Apr-June | 31-Jul | 31-Jul |

| Q3 | Jul-Sep | 31-Oct | 31-Oct |

| Q3 | Oct-Dec | 30-Nov | 30-Nov |

| Q4 | Jan-Mar | 31-May | 31-May |

(15 Days from Return Filing Date)

| FORM 16A | FORM 16 | ||

| TDS Non Salary | TDS Salary | ||

| Q1 | Apr-June | 15-Aug | 15-Jun |

| Q3 | Jul-Sep | 15-Nov | |

| Q3 | Oct-Dec | 15-Dec | |

| Q4 | Jan-Mar | 15-Jun |

| TDS | TCS |

| It is deducted on various expenses | It is collected on various income |

| Example:- Rent, professional services , contract payment etc. | Example:- Sale of scraps, sale of jewellery etc |

| )Return form is form 24Q salary, 26Q for non salary and 27Q for non resident (non salary | Return form is 27EQ |

| TDS certificate is form 16 for salary and 16A for non salary | TCS certificate is form 27D |

Banks have to deduct TDS when interest income is more than Rs.10,000 in a year

In case we want bank not to deduct TDS, we can submit 15G form

| 15 G | 15H |

| 15 G Form is for individual less than 60 years | 15 H is for senior citizen |

| Total interest Income is less than exemption limit for that year which is Rs. 250000 | N/A |

| Tax calculation on total income is Nil | Tax calculation on total income is Nil |

Procedure

When Foreign Invoice is to be Paid,bill is first sent to Chartered Accountant

|

TDS in Income Tax |

TDS in GST |

|

Rate of TDS Under 194C Payment to Individual /HUF 1% Payment to Others 2% |

Rate of TDS Tds Rate is 1% in all cases

|

|

Applicable only If Deductor is Covered in Tax Audit (Individual/HUF/Partnership having turnover>1 Cr Or Company )

|

Applicable in Case of

|

|

Cut off limit 30000 Single Payment Or 100000 Annual |

Cut off limit 250,000 Single Contract

|

|

Challan payment Due date is 7th of next month However, for March, it is 30 April |

Challan payment

Due date is 10th of next month (Even for March, it is same) |

|

TDS Return It is to be file quarterly one month from end of quarter Except last quarter April-June->31 July July-Sep->31 Oct Oct-Dec->31 Jan Jan-March->31 May

Form No Prescribed is Form 26Q |

TDS Return It is to be file monthly by 10th of next quarter Form No Prescribed is GSTR 7

|

|

TDS Certificate It is to be issued quarterly 15 days of filing TDS Return In case of late payment, Penalty applicable is 100 per day

|

TDS Certificate It is to be issued Monthly 5 days of filing TDS Challan In case of late payment, Penalty applicable is 100 per day Upto max 5000 |

Written on Jan. 22, 2019, 2:15 p.m.