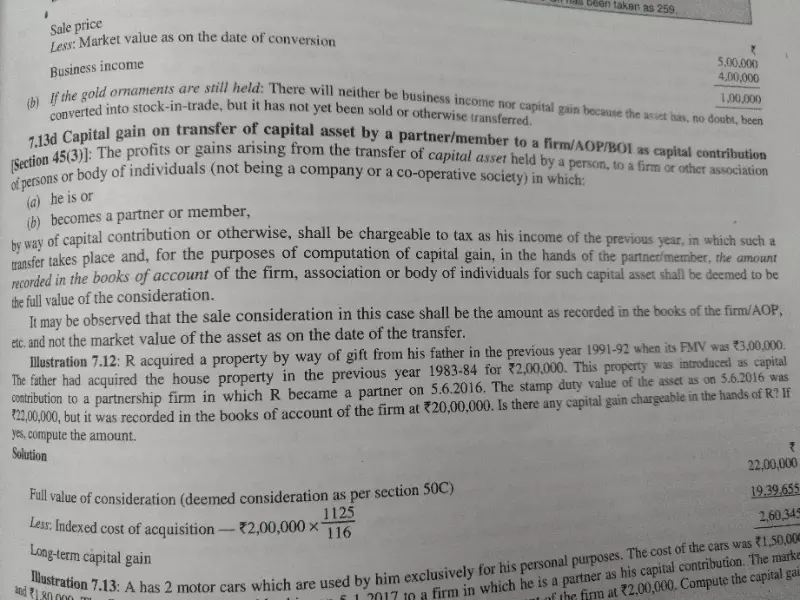

It is given in the special case of chapter capital gain that if a partner transfers his capital assets to the firm then the amount recorded in the book is taken as the full value of consideration and not the actual market value on the day of transfer but in this question the stamp duty value is taken as the full value of consideration andnot the amount recorded in the books of firm. Why?

Rashi Bhartia

Answer the question...

Hi, it looks like you're using AdBlock :(

Displaying ads are our only source of revenue. To help Teachoo create more content, and view the ad-free version of Teachooo... please purchase Teachoo Black subscription.

Please login to view more pages. It's free :)

Teachoo gives you a better experience when you're logged in. Please login :)