gursant singh Singh

Answers!

Davneet Singh

Oct. 12, 2016, 9:11 p.m.

HI Gurusant

According to us,the answer is 70700 and not 85200 as calculated below

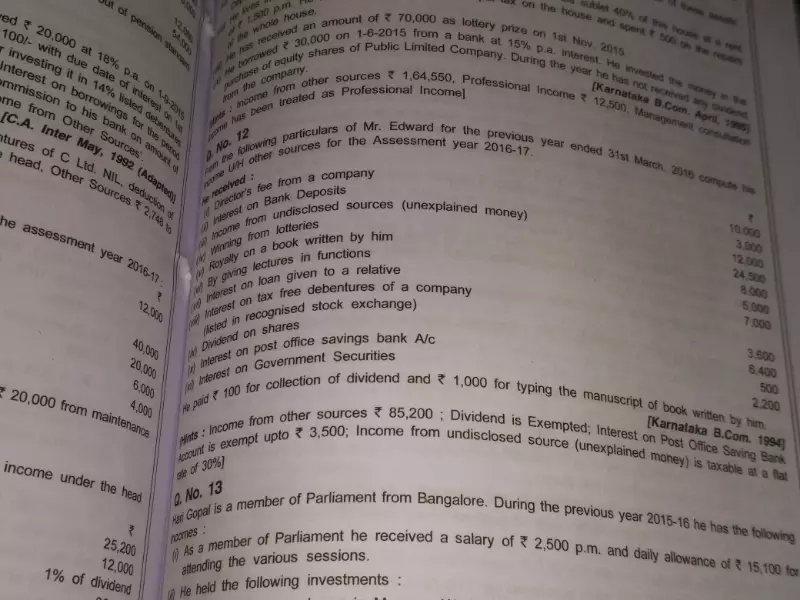

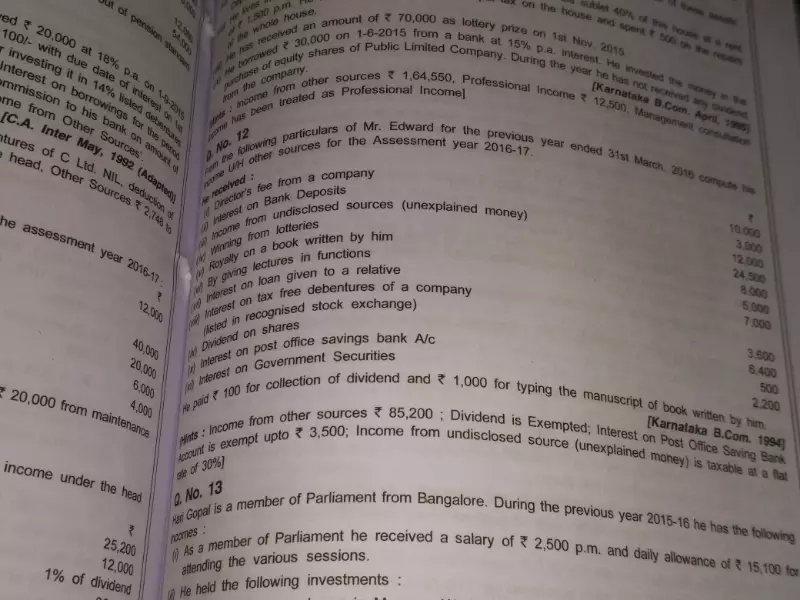

PARTICULARS

Taxable

Amt

Director Fee from Company

10000

Interest on Bank Deposit

3000

Income form Undisclosed Sources

12000

Winning from Lotteries

24500

Royalty on Book

8000

Less Allowed Expenses

1000

Net amt taxable

7000

Lectures in function

5000

Interest on loan to relative

7000

Interest on tax free debentures

0

Dividend on shares

0

Interest on Post office savings bank

0

Interest on Govt Securities

2200

TOTAL INCOME FROM OTHER SOURCES

70700

Comment

Answer the question...

Davneet Singh

HI Gurusant

According to us,the answer is 70700 and not 85200 as calculated below

| PARTICULARS |

Taxable Amt |

|

| Director Fee from Company | 10000 | |

| Interest on Bank Deposit | 3000 | |

| Income form Undisclosed Sources | 12000 | |

| Winning from Lotteries | 24500 | |

| Royalty on Book | 8000 | |

| Less Allowed Expenses | 1000 | |

| Net amt taxable | 7000 | |

| Lectures in function | 5000 | |

| Interest on loan to relative | 7000 | |

| Interest on tax free debentures | 0 | |

| Dividend on shares | 0 | |

| Interest on Post office savings bank | 0 | |

| Interest on Govt Securities | 2200 | |

| TOTAL INCOME FROM OTHER SOURCES | 70700 |

Comment

Hi, it looks like you're using AdBlock :(

Displaying ads are our only source of revenue. To help Teachoo create more content, and view the ad-free version of Teachooo... please purchase Teachoo Black subscription.

Please login to view more pages. It's free :)

Teachoo gives you a better experience when you're logged in. Please login :)

Solve all your doubts with Teachoo Black!

Teachoo answers all your questions if you are a Black user!