Answers!

Difference between Challan and Return

Challan

Return

It is a one page form used to pay tax

It contains details of tax paid (more than one page)

It is done first

It is done later

Challan is deposited with Bank along with cash/cheque/net banking

(either offline or online)

Return is deposited with concerned Tax Dept.

(either offline or online)

Note:-

While depositing any return, it should be ensured that tax payable is 0.

(i.e. all tax which is due has been paid in challan) In return details of challan are also mentioned.

Form No

Challan 281

Due Date

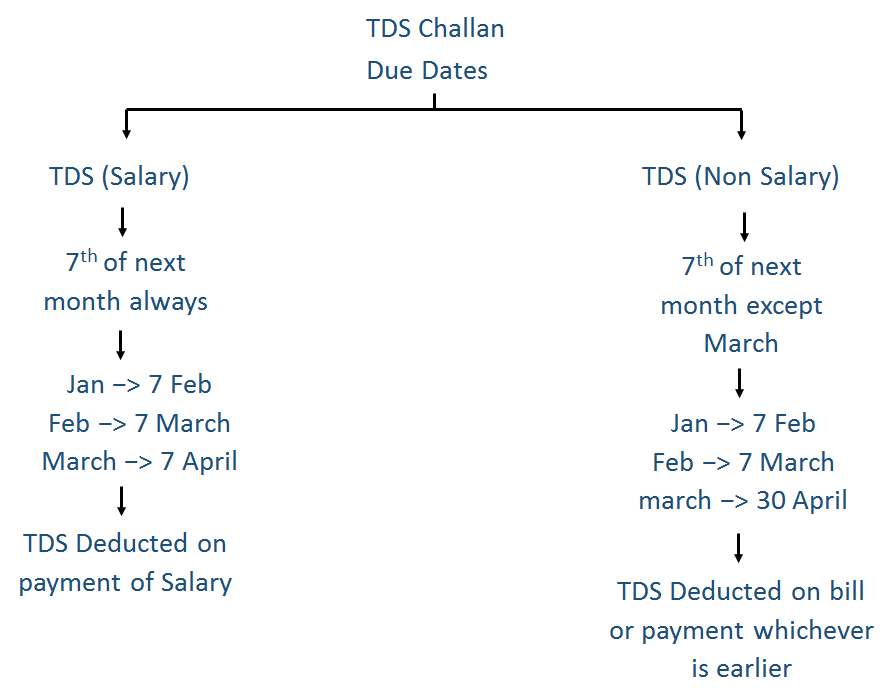

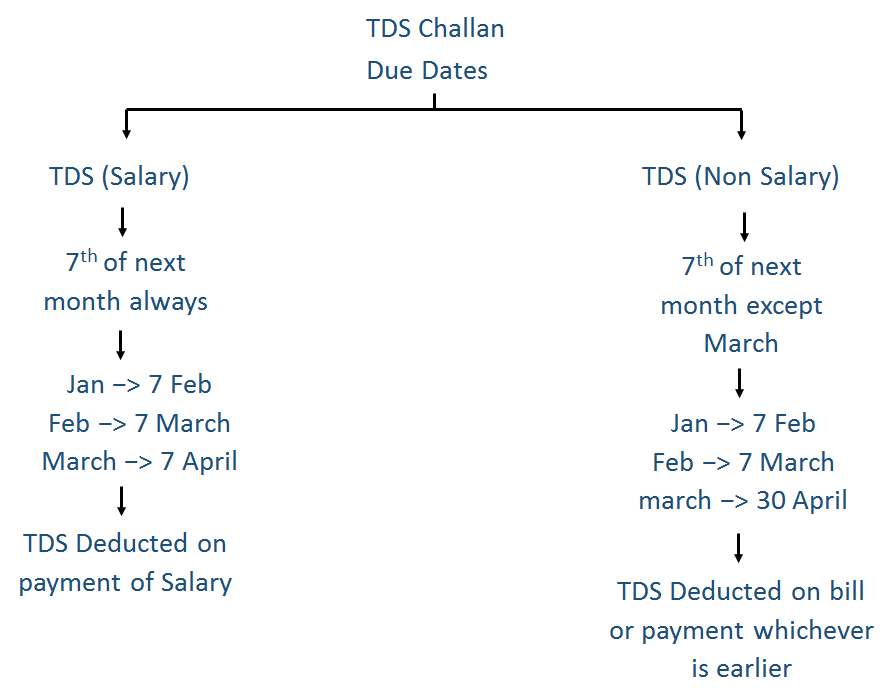

It is normally 7th of next month of Tax Deducted

However for March,it is 30th April in case of TDS Non Salary

For TDS Salary-it is 7 April

Procedure for TDS Challan

It can be paid both

- Online (Through Netbanking)

- Offline (Through Cash or Cheque)

Form No for TDS Returns

Type of TDS

TDS Due Dates

TDS Salary

Form 24Q

TDS Non Salary

Form 26Q (if TDS Deducted of Residents)

Form 27Q (if TDS Deducted of Non Residents)

Due Date for TDS Returns

Period

Due Date

April-June

31 July

July-Sept

31 October

Oct-Dec

31 January

Jan-March

31 May

Same due dates for Form 24Q / 26Q /27Q

Comment

Answer the question...

Difference between Challan and Return

|

Challan |

Return |

|

It is a one page form used to pay tax |

It contains details of tax paid (more than one page) |

|

It is done first |

It is done later |

|

Challan is deposited with Bank along with cash/cheque/net banking (either offline or online) |

Return is deposited with concerned Tax Dept. (either offline or online) |

Note:-

While depositing any return, it should be ensured that tax payable is 0.

(i.e. all tax which is due has been paid in challan) In return details of challan are also mentioned.

Form No

Challan 281

Due Date

It is normally 7th of next month of Tax Deducted

However for March,it is 30th April in case of TDS Non Salary

For TDS Salary-it is 7 April

Procedure for TDS Challan

It can be paid both

- Online (Through Netbanking)

- Offline (Through Cash or Cheque)

Form No for TDS Returns

| Type of TDS | TDS Due Dates |

| TDS Salary | Form 24Q |

| TDS Non Salary |

Form 26Q (if TDS Deducted of Residents) Form 27Q (if TDS Deducted of Non Residents) |

Due Date for TDS Returns

| Period | Due Date |

| April-June | 31 July |

| July-Sept | 31 October |

| Oct-Dec | 31 January |

| Jan-March | 31 May |

Same due dates for Form 24Q / 26Q /27Q