Answers!

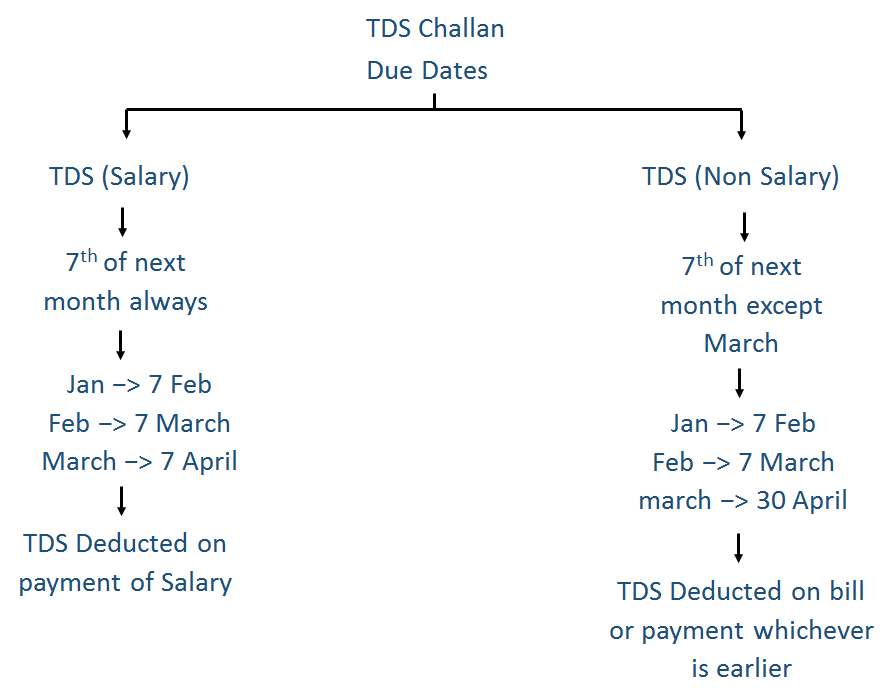

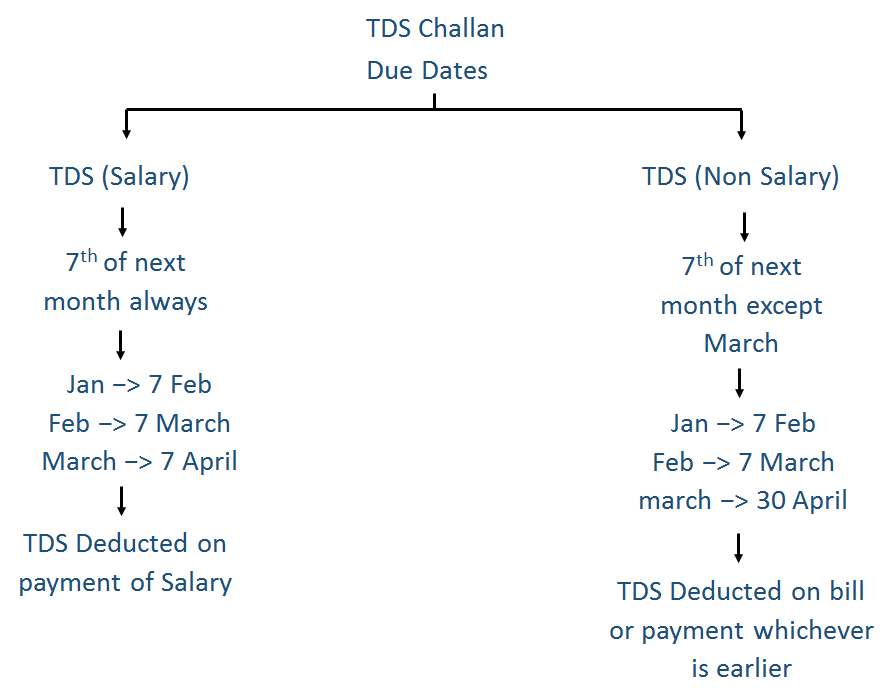

We know that Due date for TDS is 7th of next month

However for March,TDS Due date is 30 April

(in case of Non Salary only)

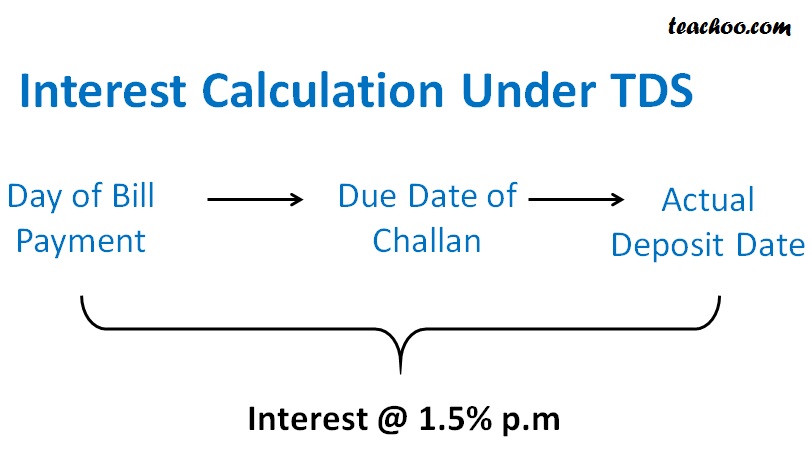

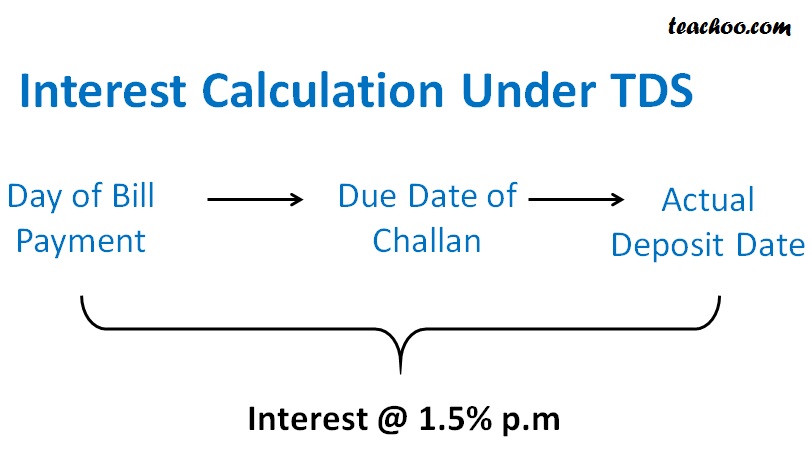

If deposited late,we have to pay interest @ 1.5%

If TDS is deposited late

Interest is payable from

Date of Deduction (and not Last Date of Challan)

to

Actual Date of Deposit

@ 1.5%

TDS Interest if Wrong Date of Deduction in TDS Return

We know that

TDS is to be deducted at Invoice Received

or

Payment Made, whichever is earlier

If we mention wrong date of deduction,then 1% interest is payable from

Last Date of Deduction to Actual Date of Deduction

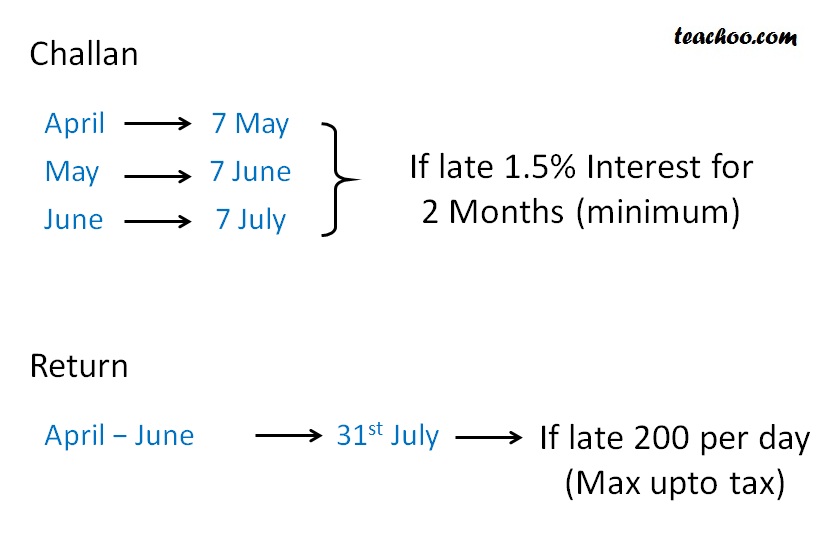

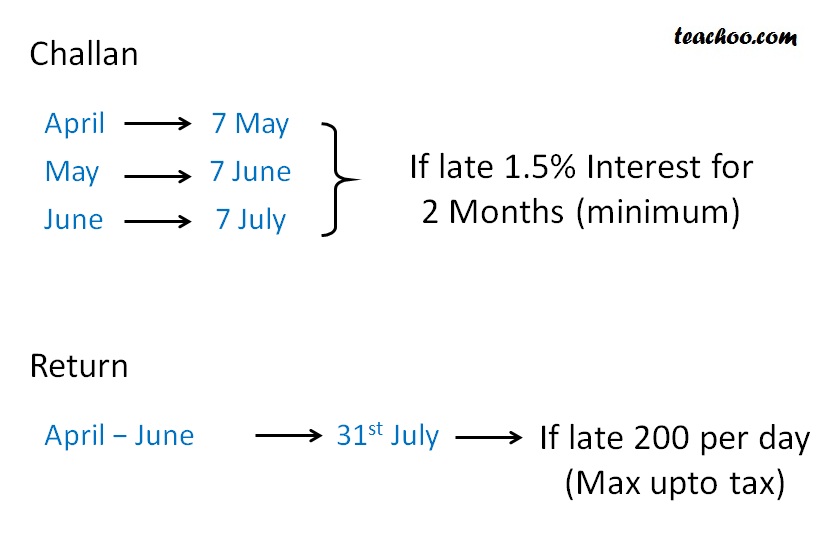

We know that TDS Return are to be filled as follows

Period

Due Date

April-June

31 July

July-Sept

31 October

Oct-Dec

31 January

Jan-March

31 May

Sometimes TDS Return is filed late

In this case Penalty of 200 per day is imposed

Penalty for TDS Return (April - June)

Penalty for TDS Return (July - Aug)

.jpg)

Penalty for TDS Return (Oct -Dec)

.jpg)

Penalty for TDS Return (Jan -Mar)

.jpg)

Note :-

This penalty cannot be more than tax involved

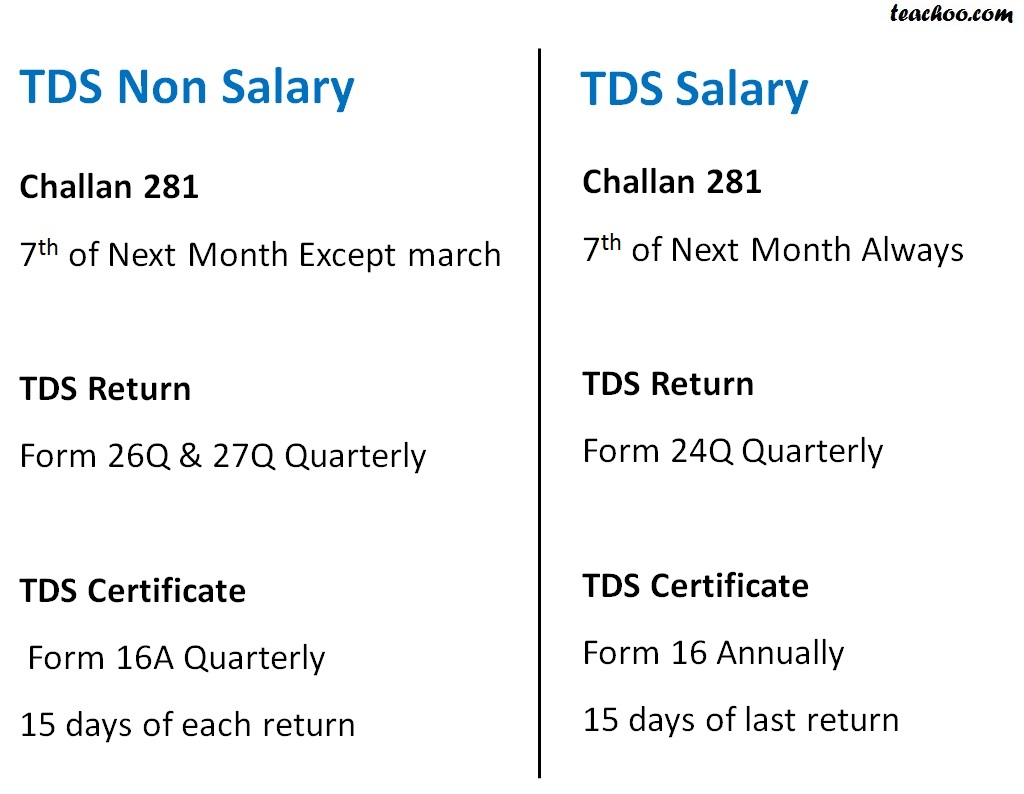

TDS Certificate is to be downloaded within 15 Days of TDS Return

This is quarterly in case of TDS Non Salary

However for TDS Salary,Return is Quarterly but certificate is to be downloaded Annually

If not downloaded,there is penalty of 100 per day

TDS Non Salary

We know that TDS Return 26Q is to be filed Quarterly

In this case TDS Certificate Form 16A is to be issued within 15 days of Return Quarterly

Example

For April-June,TDS Return is to be filed by 31 July

Certificate is to be downloaded Quarterly by 15 days of 31 July i..e 15 August

TDS Salary

We know that TDS Return 24Q is to be filed Quarterly

In this case TDS Certificate Form 16 is to be issued once in a year

Due date is 31 May of Next Year

Example

For April-June,TDS Return is to be filed by 31 May

Certificate is to be downloaded Quarterly by 15 days of 31 May i..e 15 June

What is Penalty for Late Download of TDS Certificate

In this case,Penalty is to be imposed @ 100 per day

.jpg)

Summary

Comment

Answer the question...

We know that Due date for TDS is 7th of next month

However for March,TDS Due date is 30 April

(in case of Non Salary only)

If deposited late,we have to pay interest @ 1.5%

If TDS is deposited late

Interest is payable from

Date of Deduction (and not Last Date of Challan)

to

Actual Date of Deposit

@ 1.5%

TDS Interest if Wrong Date of Deduction in TDS Return

We know that

TDS is to be deducted at Invoice Received

or

Payment Made, whichever is earlier

If we mention wrong date of deduction,then 1% interest is payable from

Last Date of Deduction to Actual Date of Deduction

We know that TDS Return are to be filled as follows

| Period | Due Date |

| April-June | 31 July |

| July-Sept | 31 October |

| Oct-Dec | 31 January |

| Jan-March | 31 May |

Sometimes TDS Return is filed late

In this case Penalty of 200 per day is imposed

Penalty for TDS Return (April - June)

Penalty for TDS Return (July - Aug)

.jpg)

Penalty for TDS Return (Oct -Dec)

.jpg)

Penalty for TDS Return (Jan -Mar)

.jpg)

Note :-

This penalty cannot be more than tax involved

TDS Certificate is to be downloaded within 15 Days of TDS Return

This is quarterly in case of TDS Non Salary

However for TDS Salary,Return is Quarterly but certificate is to be downloaded Annually

If not downloaded,there is penalty of 100 per day

TDS Non Salary

We know that TDS Return 26Q is to be filed Quarterly

In this case TDS Certificate Form 16A is to be issued within 15 days of Return Quarterly

Example

For April-June,TDS Return is to be filed by 31 July

Certificate is to be downloaded Quarterly by 15 days of 31 July i..e 15 August

TDS Salary

We know that TDS Return 24Q is to be filed Quarterly

In this case TDS Certificate Form 16 is to be issued once in a year

Due date is 31 May of Next Year

Example

For April-June,TDS Return is to be filed by 31 May

Certificate is to be downloaded Quarterly by 15 days of 31 May i..e 15 June

What is Penalty for Late Download of TDS Certificate

In this case,Penalty is to be imposed @ 100 per day

Summary