Henna Khan

Answers!

Form No for TDS Returns

Type of TDS

TDS Due Dates

TDS Salary

Form 24Q

TDS Non Salary

Form 26Q (if TDS Deducted of Residents)

Form 27Q (if TDS Deducted of Non Residents)

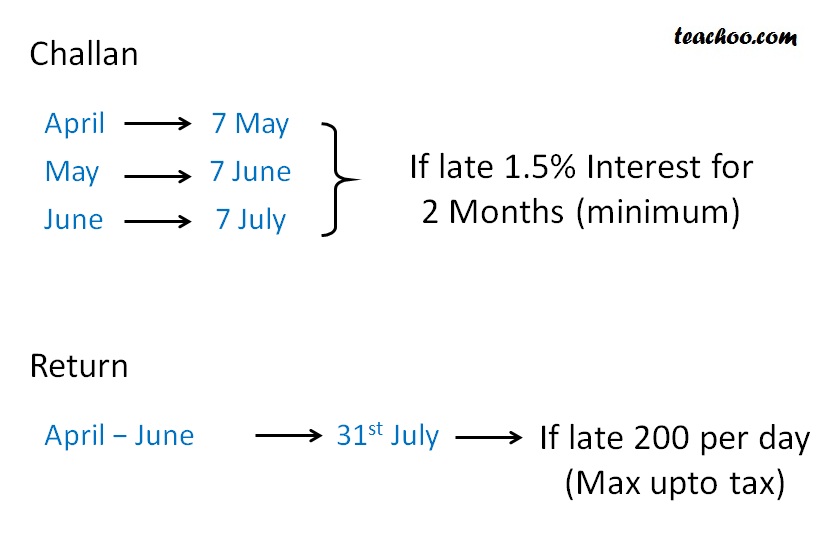

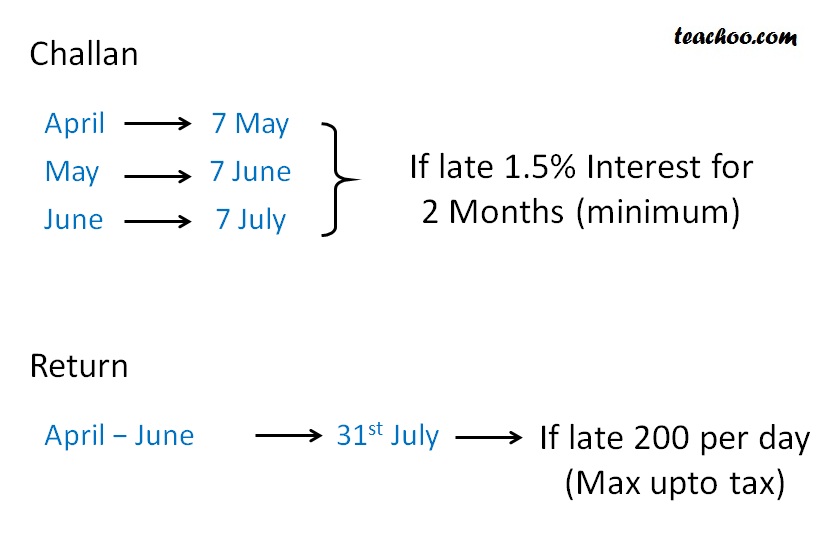

Due Date for TDS Returns

Period

Due Date

April-June

31 July

July-Sept

31 October

Oct-Dec

31 January

Jan-March

31 May

Same due dates for Form 24Q / 26Q /27Q

We know that TDS Return are to be filled as follows

Period

Due Date

April-June

31 July

July-Sept

31 October

Oct-Dec

31 January

Jan-March

31 May

Sometimes TDS Return is filed late

In this case Penalty of 200 per day is imposed

Penalty for TDS Return (April - June)

Penalty for TDS Return (July - Aug)

.jpg)

Penalty for TDS Return (Oct -Dec)

.jpg)

Penalty for TDS Return (Jan -Mar)

.jpg)

Note :-

This penalty cannot be more than tax involved

Comment

Answer the question...

Form No for TDS Returns

| Type of TDS | TDS Due Dates |

| TDS Salary | Form 24Q |

| TDS Non Salary |

Form 26Q (if TDS Deducted of Residents) Form 27Q (if TDS Deducted of Non Residents) |

Due Date for TDS Returns

| Period | Due Date |

| April-June | 31 July |

| July-Sept | 31 October |

| Oct-Dec | 31 January |

| Jan-March | 31 May |

Same due dates for Form 24Q / 26Q /27Q

We know that TDS Return are to be filled as follows

| Period | Due Date |

| April-June | 31 July |

| July-Sept | 31 October |

| Oct-Dec | 31 January |

| Jan-March | 31 May |

Sometimes TDS Return is filed late

In this case Penalty of 200 per day is imposed

Penalty for TDS Return (April - June)

Penalty for TDS Return (July - Aug)

.jpg)

Penalty for TDS Return (Oct -Dec)

.jpg)

Penalty for TDS Return (Jan -Mar)

.jpg)

Note :-

This penalty cannot be more than tax involved

Comment

Hi, it looks like you're using AdBlock :(

Displaying ads are our only source of revenue. To help Teachoo create more content, and view the ad-free version of Teachooo... please purchase Teachoo Black subscription.

Please login to view more pages. It's free :)

Teachoo gives you a better experience when you're logged in. Please login :)

Solve all your doubts with Teachoo Black!

Teachoo answers all your questions if you are a Black user!