Answers!

Maninder

Feb. 15, 2018, 11:58 a.m.

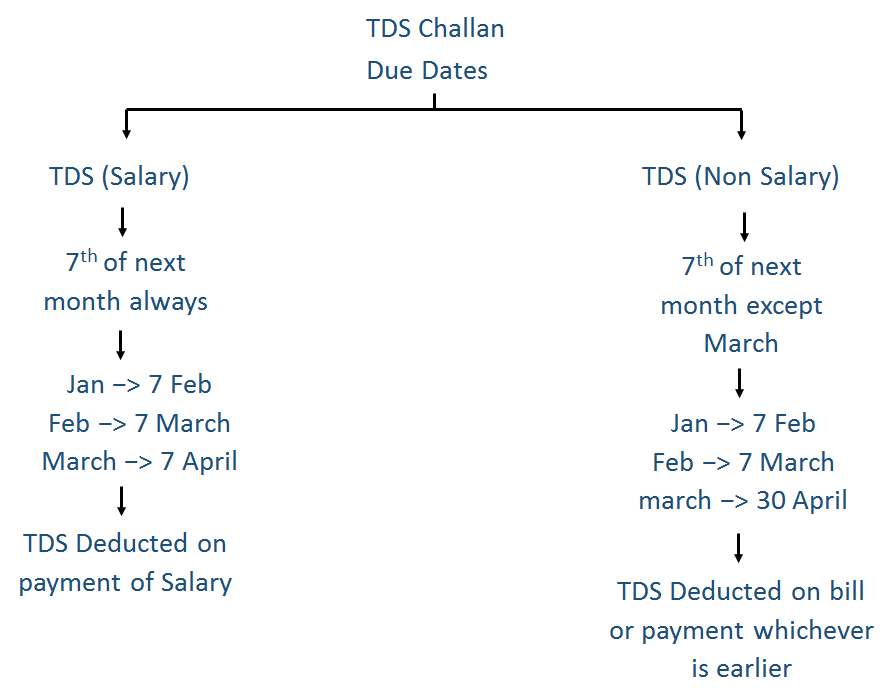

Due Date and Form No of TDS Challan

Form No

Challan 281

Due Date

It is normally 7th of next month of Tax Deducted

However for March,it is 30th April in case of TDS Non Salary

For TDS Salary-it is 7 April

Procedure for TDS Challan

It can be paid both

- Online (Through Netbanking)

- Offline (Through Cash or Cheque)

Lets study both one by one

------------------------------------------------------------------------------------------------------------------------------------------------------

Direct Online TDS Payment Procedure by Net Banking

We should have Net banking to use this feature

Net Banking may be of any person (It is not necessary that it should be of person whose TDS we are paying)

How to Pay through Net Banking

- Click https://onlineservices.tin.egov-nsdl.com/etaxnew/tdsnontds.jsp

- Select Challan 281

- Fill Challan

- Select Bank whose Net Banking we are using

- Click Submit to Bank

- Click Confirm

- Bank Website Opens

- Make Payment by net banking

- Challan Generated

- Save Challan or take printout

------------------------------------------------------------------------------------------------------------------------------------------------------

Manual Offline Procedure for TDS Challan in Bank

In this case, we have to go to bank to Deposit TDS

Procedure

- Download TDS Challan in Excel format

- Enable Editing

- Enable Content

- Fill Challan

- Take Printout (1 Copy)

- Go To Bank

- Submit Printout of Challan 281+ Cash/Cheque

- Bank will give Counterfoil/Receipt Back Stamped

To Practically learn how to make TDS computation and pay challan, attend CA Maninder Singh Practical Training Classes

------------------------------------------------------------------------------------------------------------------------------------------------------

Procedure after paying challan in GST

When we use deposited challan we get a receipt. On this receipt following details are mention

- Date of challan

- BSR Code

- Challan

What is BSR Code?

- It means Branch Serial no.

- It is seven Digit No.

- It common for every Challan of one branch

What is Challan No.?

- It is unique No. of challan

- It is of five digit and unique for every challan

We have to update these details in our TDS Computation and TDS Return.

.jpg)

Comment

Answer the question...

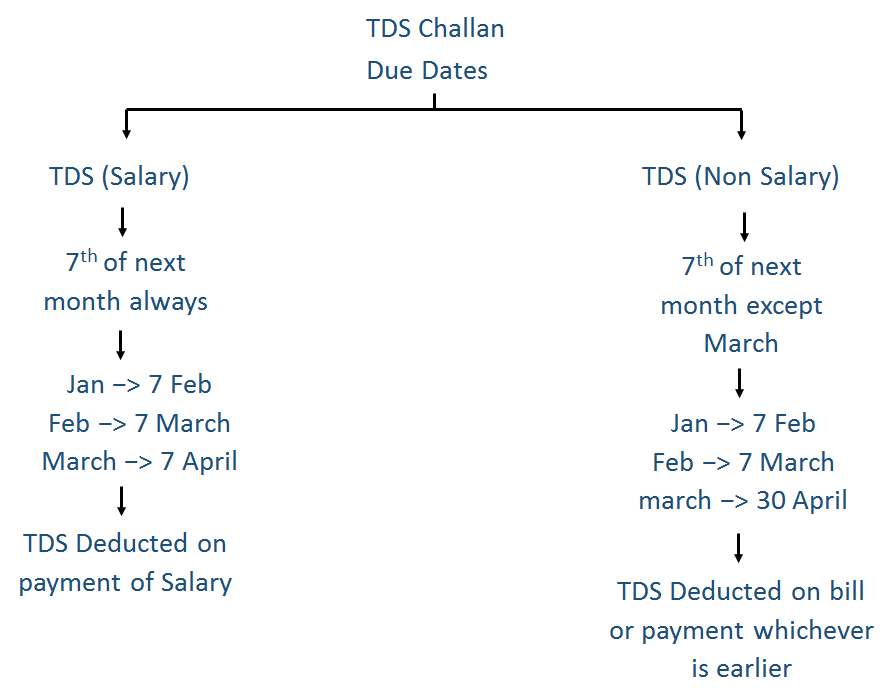

Due Date and Form No of TDS Challan

Form No

Challan 281

Due Date

It is normally 7th of next month of Tax Deducted

However for March,it is 30th April in case of TDS Non Salary

For TDS Salary-it is 7 April

Procedure for TDS Challan

It can be paid both

- Online (Through Netbanking)

- Offline (Through Cash or Cheque)

Lets study both one by one

------------------------------------------------------------------------------------------------------------------------------------------------------

Direct Online TDS Payment Procedure by Net Banking

We should have Net banking to use this feature

Net Banking may be of any person (It is not necessary that it should be of person whose TDS we are paying)

How to Pay through Net Banking

- Click https://onlineservices.tin.egov-nsdl.com/etaxnew/tdsnontds.jsp

- Select Challan 281

- Fill Challan

- Select Bank whose Net Banking we are using

- Click Submit to Bank

- Click Confirm

- Bank Website Opens

- Make Payment by net banking

- Challan Generated

- Save Challan or take printout

------------------------------------------------------------------------------------------------------------------------------------------------------

Manual Offline Procedure for TDS Challan in Bank

In this case, we have to go to bank to Deposit TDS

Procedure

- Download TDS Challan in Excel format

- Enable Editing

- Enable Content

- Fill Challan

- Take Printout (1 Copy)

- Go To Bank

- Submit Printout of Challan 281+ Cash/Cheque

- Bank will give Counterfoil/Receipt Back Stamped

To Practically learn how to make TDS computation and pay challan, attend CA Maninder Singh Practical Training Classes

------------------------------------------------------------------------------------------------------------------------------------------------------

Procedure after paying challan in GST

When we use deposited challan we get a receipt. On this receipt following details are mention

- Date of challan

- BSR Code

- Challan

What is BSR Code?

- It means Branch Serial no.

- It is seven Digit No.

- It common for every Challan of one branch

What is Challan No.?

- It is unique No. of challan

- It is of five digit and unique for every challan

We have to update these details in our TDS Computation and TDS Return.

.jpg)